Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Calculations of 5 ratios for each period as follows: profitability ratio, efficiency ratio, liquidity ratio, gearing ratio and investment ratio. (b) Using the ratios

(a) Calculations of 5 ratios for each period as follows: profitability ratio, efficiency ratio, liquidity ratio, gearing ratio and investment ratio.

(b) Using the ratios calculated in (a) and any other useful/relevant information about the company, comment on (or interpret) its financial performance and position.

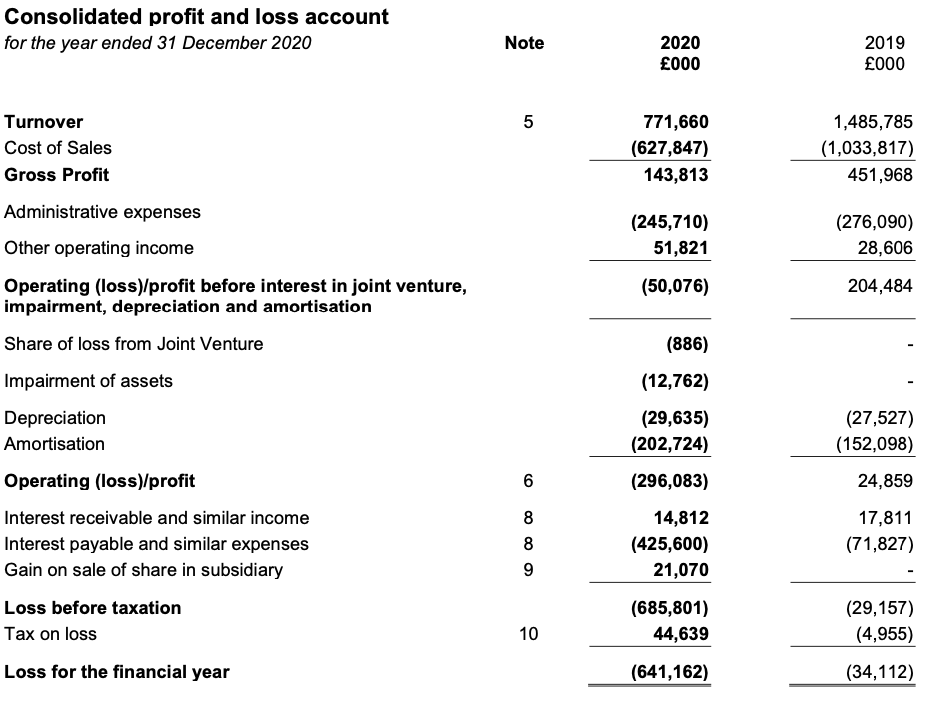

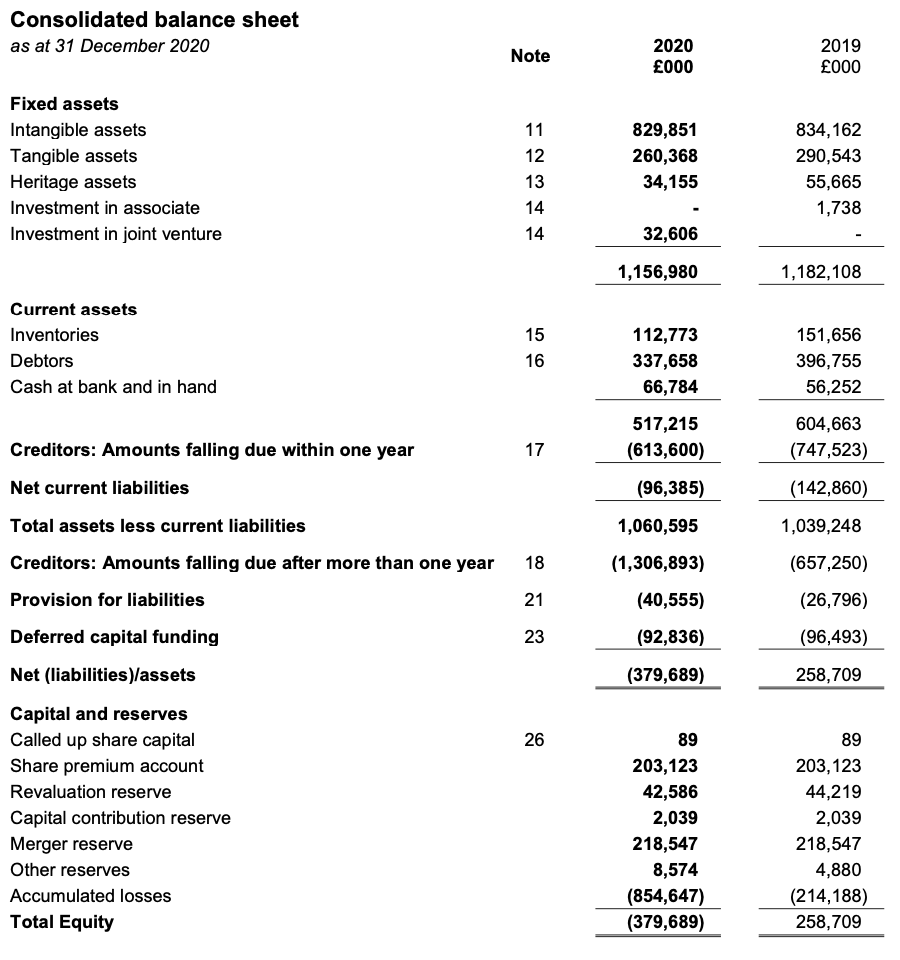

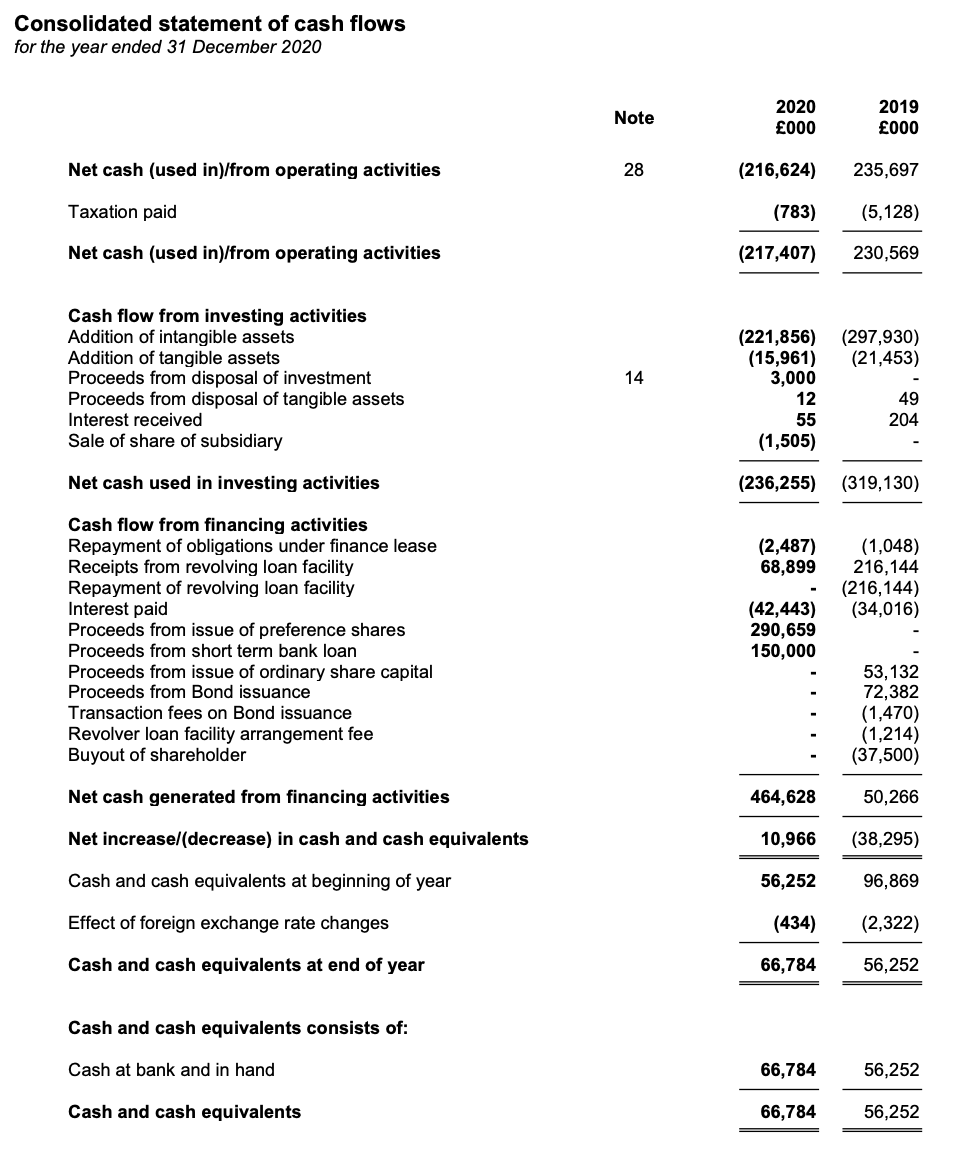

Consolidated profit and loss account for the year ended 31 December 2020 Note 2020 000 2019 000 LO Turnover Cost of Sales Gross Profit Administrative expenses Other operating income 771,660 (627,847) 143,813 1,485,785 (1,033,817) 451,968 (245,710) 51,821 (276,090) 28,606 (50,076) 204,484 (886) Operating (loss)/profit before interest in joint venture, impairment, depreciation and amortisation Share of loss from Joint Venture Impairment of assets Depreciation Amortisation (12,762) (29,635) (202,724) (27,527) (152,098) Operating (loss) profit 6 6 (296,083) 24,859 Interest receivable and similar income Interest payable and similar expenses Gain on sale of share in subsidiary 8 8 9 14,812 (425,600) 21,070 17,811 (71,827) Loss before taxation Tax on loss (685,801) 44,639 (29,157) (4,955) 10 Loss for the financial year (641,162) (34,112) Consolidated balance sheet as at 31 December 2020 Note 2020 000 2019 000 Fixed assets Intangible assets Tangible assets Heritage assets Investment in associate Investment in joint venture 11 12 13 14 14 829,851 260,368 34,155 834,162 290,543 55,665 1,738 32,606 1,156,980 1,182,108 Current assets Inventories Debtors Cash at bank and in hand 15 16 112,773 337,658 66,784 151,656 396,755 56,252 517,215 (613,600) 604,663 (747,523) 17 (96,385) (142,860) 1,060,595 1,039,248 Creditors: Amounts falling due within one year Net current liabilities Total assets less current liabilities Creditors: Amounts falling due after more than one year Provision for liabilities Deferred capital funding 18 (1,306,893) (657,250) 21 (40,555) (26,796) 23 (92,836) (96,493) Net (liabilities)/assets (379,689) 258,709 26 Capital and reserves Called up share capital Share premium account Revaluation reserve Capital contribution reserve Merger reserve Other reserves Accumulated losses Total Equity 89 203,123 42,586 2,039 218,547 8,574 (854,647) (379,689) 89 203,123 44,219 2,039 218,547 4,880 (214,188) 258,709 Consolidated statement of cash flows for the year ended 31 December 2020 Note 2020 000 2019 000 Net cash (used in)/from operating activities 28 (216,624) 235,697 Taxation paid (783) (5,128) Net cash (used in)/from operating activities (217,407) 230,569 (297,930) (21,453) Cash flow from investing activities Addition of intangible assets Addition of tangible assets Proceeds from disposal of investment Proceeds from disposal of tangible assets Interest received Sale of share of subsidiary 14 (221,856) (15,961) 3,000 12 55 (1,505) 49 204 Net cash used in investing activities (236,255) (319,130) (2,487) 68,899 (1,048) 216,144 (216,144) (34,016) Cash flow from financing activities Repayment of obligations under finance lease Receipts from revolving loan facility Repayment of revolving loan facility Interest paid Proceeds from issue of preference shares Proceeds from short term bank loan Proceeds from issue of ordinary share capital Proceeds from Bond issuance Transaction fees on Bond issuance Revolver loan facility arrangement fee Buyout of shareholder (42,443) 290,659 150,000 53, 132 72,382 (1,470) (1,214) (37,500) Net cash generated from financing activities 464,628 50,266 Net increase (decrease) in cash and cash equivalents 10,966 (38,295) Cash and cash equivalents at beginning of year 56,252 96,869 Effect of foreign exchange rate changes (434) (2,322) Cash and cash equivalents at end of year 66,784 56,252 Cash and cash equivalents consists of: Cash at bank and in hand 66,784 56,252 Cash and cash equivalents 66,784 56,252Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started