Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Canadian sports specialty item manufacturer, SportA, is attempting a comparison of their financial positions with a certain competitor, SportB. As part of this SportA

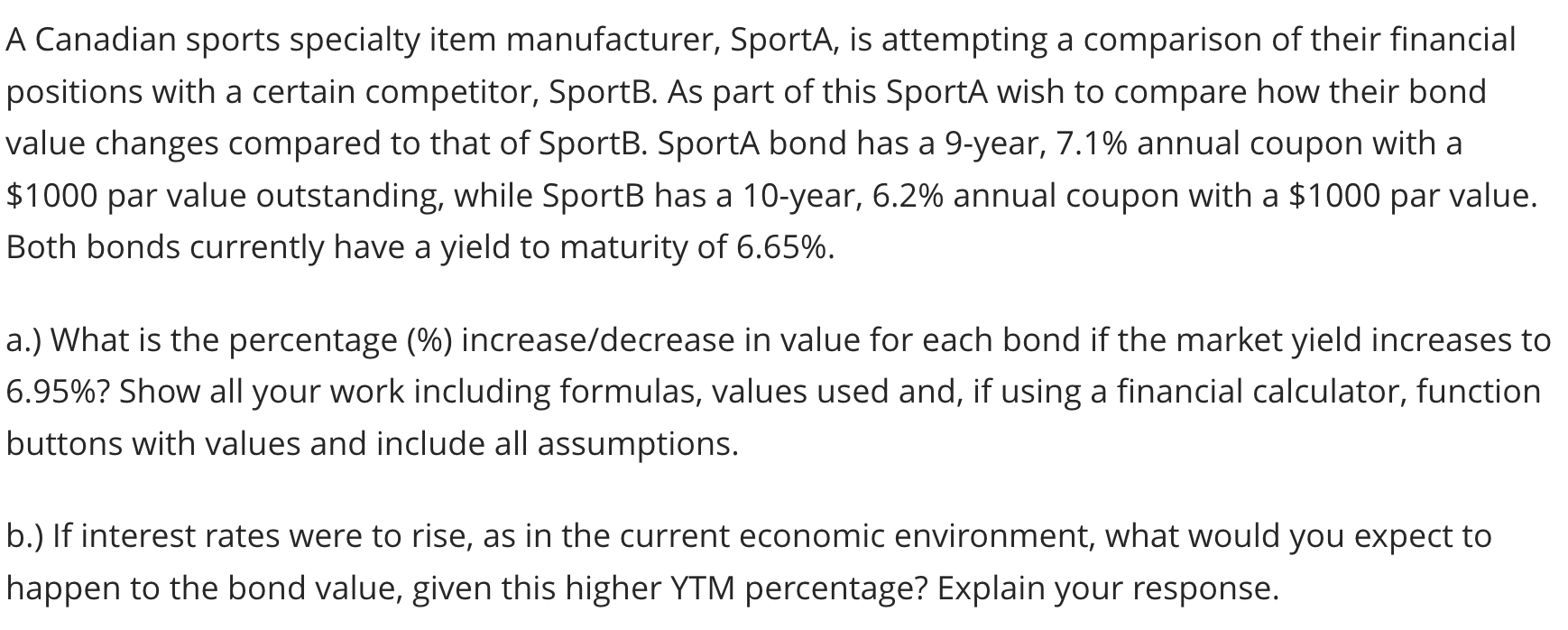

A Canadian sports specialty item manufacturer, SportA, is attempting a comparison of their financial positions with a certain competitor, SportB. As part of this SportA wish to compare how their bond value changes compared to that of SportB. SportA bond has a 9-year, 7.1% annual coupon with a $1000 par value outstanding, while SportB has a 10 -year, 6.2% annual coupon with a $1000 par value. Both bonds currently have a yield to maturity of 6.65%. a.) What is the percentage (\%) increase/decrease in value for each bond if the market yield increases to 6.95% ? Show all your work including formulas, values used and, if using a financial calculator, function buttons with values and include all assumptions. b.) If interest rates were to rise, as in the current economic environment, what would you expect to happen to the bond value, given this higher YTM percentage? Explain your response

A Canadian sports specialty item manufacturer, SportA, is attempting a comparison of their financial positions with a certain competitor, SportB. As part of this SportA wish to compare how their bond value changes compared to that of SportB. SportA bond has a 9-year, 7.1% annual coupon with a $1000 par value outstanding, while SportB has a 10 -year, 6.2% annual coupon with a $1000 par value. Both bonds currently have a yield to maturity of 6.65%. a.) What is the percentage (\%) increase/decrease in value for each bond if the market yield increases to 6.95% ? Show all your work including formulas, values used and, if using a financial calculator, function buttons with values and include all assumptions. b.) If interest rates were to rise, as in the current economic environment, what would you expect to happen to the bond value, given this higher YTM percentage? Explain your response Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started