Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A car manufacturer changed its financial reporting inventory method from LIFO to FIFO. The manufacturer explained in a letter to shareholders that other automobile

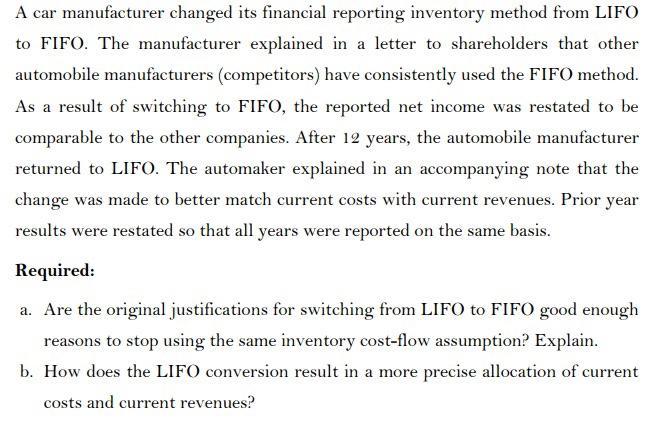

A car manufacturer changed its financial reporting inventory method from LIFO to FIFO. The manufacturer explained in a letter to shareholders that other automobile manufacturers (competitors) have consistently used the FIFO method. As a result of switching to FIFO, the reported net income was restated to be comparable to the other companies. After 12 years, the automobile manufacturer returned to LIFO. The automaker explained in an accompanying note that the change was made to better match current costs with current revenues. Prior year results were restated so that all years were reported on the same basis. Required: a. Are the original justifications for switching from LIFO to FIFO good enough reasons to stop using the same inventory cost-flow assumption? Explain. b. How does the LIFO conversion result in a more precise allocation of current costs and current revenues?

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Are the original justifications for switching from LIFO to FIFO good enough reasons to stop using th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started