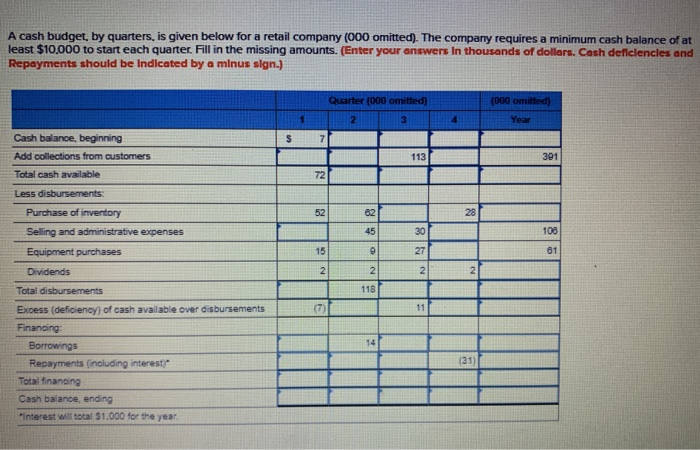

Question: A cash budget, by quarters, is given below for a retail company (000 omitted). The company requires a minimum cash balance of at least $10,000

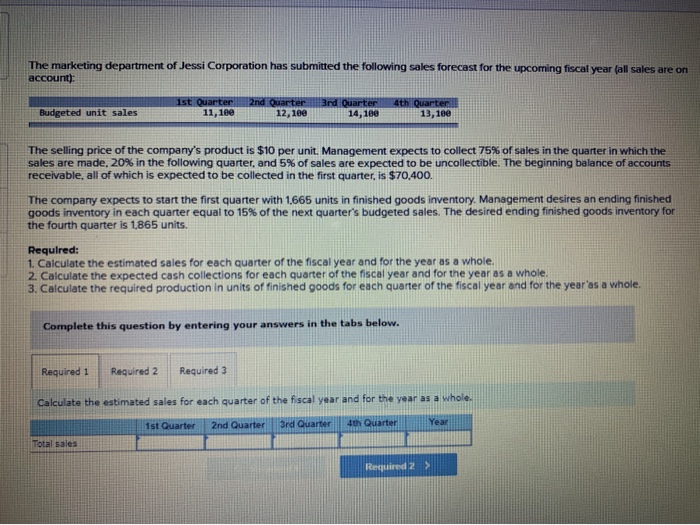

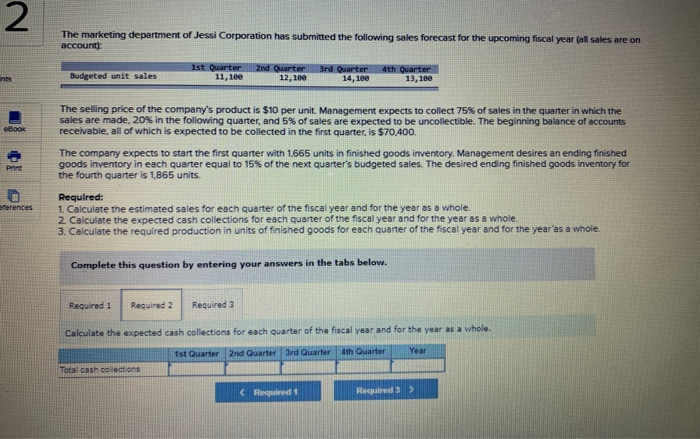

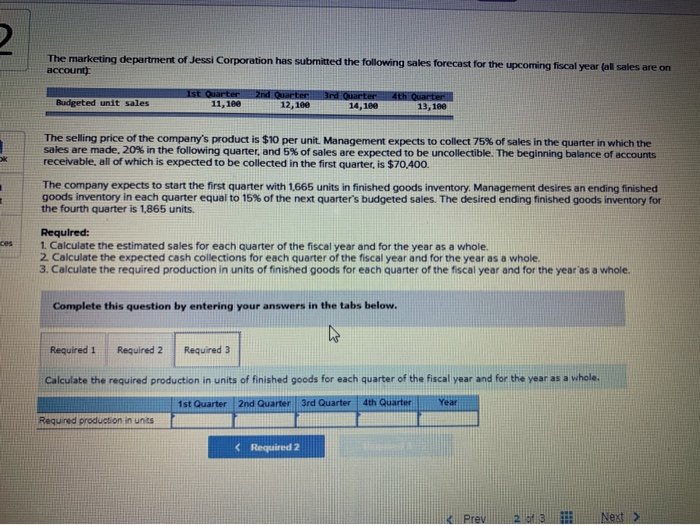

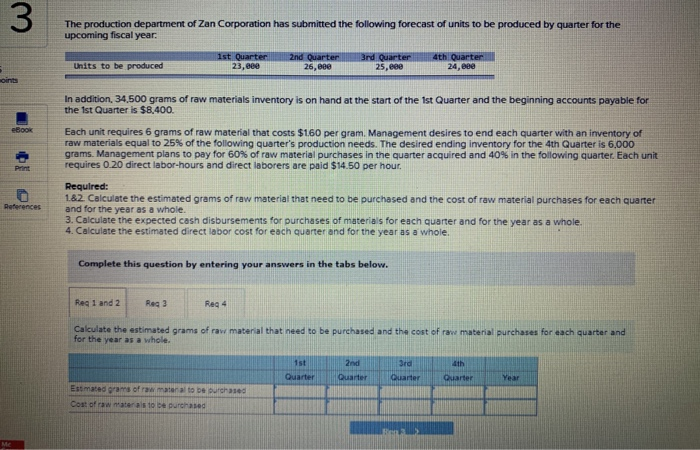

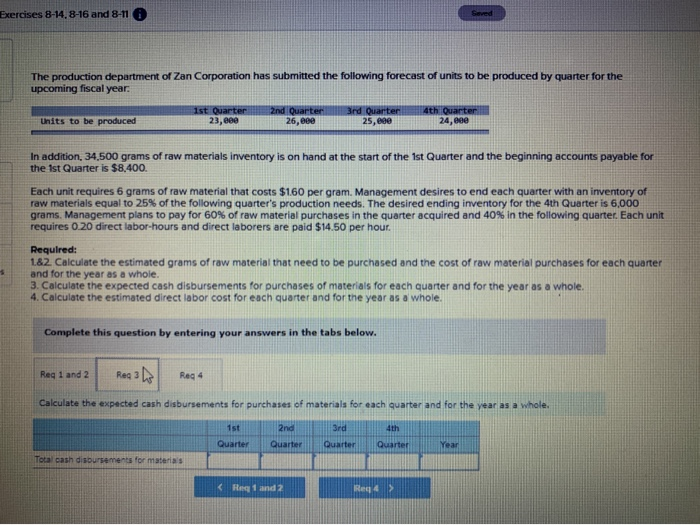

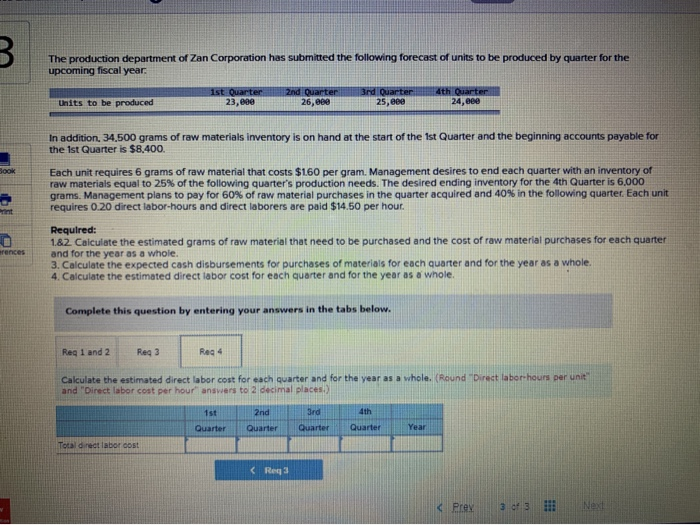

A cash budget, by quarters, is given below for a retail company (000 omitted). The company requires a minimum cash balance of at least $10,000 to start each quarter. Fill in the missing amounts. (Enter your answers in thousands of dollars. Cash deficiencies and Repayments should be indicated by a minus sign.) Quarter 1000 omitted) (000 omitted) Cash balance, beginning Add collections from customers Total cash available Less disbursements: Purchase of inventory Selling and administrative expenses Equipment purchases Dividends Total disbursements Excess (deficiency) of cash available over disbursements Financing Borrowings Repayments (including interest Total financing Cash balance, ending "Interest will total $1.000 for the year. The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account): 2nd Quarter 1st Quarter 11. 10e Budgeted unit sales and Quarter 14. 180 The selling price of the company's product is $10 per unit. Management expects to collect 75% of sales in the quarter in which the sales are made, 20% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $70.400. The company expects to start the first quarter with 1,665 units in finished goods inventory Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1.865 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year'as a whole. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Total sales Required 2 > The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year (all sales are on account 1st Quarter 11.100 Budgeted unit sales 2nd Quarter 12, 1ee 3rd Quarter 14,1ee 4th Quarter 1 3, lee The selling price of the company's product is $10 per unit. Management expects to collect 75% of sales in the quarter in which the sales are made, 20% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $70.400. The company expects to start the first quarter with 1665 units in finished goods inventory. Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1.865 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year'as a whole. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Year Total cash colections The marketing department of Jessi Corporation has submitted the following sales forecast for the upcoming fiscal year lal sales are on account Budgeted unit ist Quarter 11,160 3rd Quarter ales 2nd Quarter 12.10 4th Quarter 13,1 14,100 The selling price of the company's product is $10 per unit. Management expects to collect 75% of sales in the quarter in which the sales are made, 20% in the following quarter, and 5% of sales are expected to be uncollectible. The beginning balance of accounts receivable, all of which is expected to be collected in the first quarter, is $70,400. The company expects to start the first quarter with 1,665 units in finished goods Inventory Management desires an ending finished goods inventory in each quarter equal to 15% of the next quarter's budgeted sales. The desired ending finished goods inventory for the fourth quarter is 1,865 units. Required: 1. Calculate the estimated sales for each quarter of the fiscal year and for the year as a whole. 2. Calculate the expected cash collections for each quarter of the fiscal year and for the year as a whole. 3. Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Calculate the required production in units of finished goods for each quarter of the fiscal year and for the year as a whole. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter Required production in unts The production department of Zan Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year. Units to be produced 1st Quarter 23, 000 2nd Quarter 2 6, 000 3rd Quarter 2 5,88e 4th Quarter 2 4.ee In addition, 34.500 grams of raw materials inventory is on hand at the start of the 1st Quarter and the beginning accounts payable for the 1st Quarter is $8.400. Each unit requires 6 grams of raw material that costs $160 per gram Management desires to end each quarter with an inventory of raw materials equal to 25% of the following quarter's production needs. The desired ending inventory for the 4th Quarter is 6.000 grams. Management plans to pay for 60% of raw material purchases in the quarter acquired and 40% in the following quarter. Each unit requires 0.20 direct labor-hours and direct laborers are paid $14.50 per hour. References Required: 1.82. Calculate the estimated grams of raw material that need to be purchased and the cost of raw material purchases for each quarter and for the year as a whole. 3. Calculate the expected cash disbursements for purchases of materials for each quarter and for the year as a whole. 4. Calculate the estimated direct labor cost for each quarter and for the year as a whole Complete this question by entering your answers in the tabs below. Req 1 and 2 Res 3 Calculate the estimated grams of raw material that need to be purchased and the cost of raw material purchases for each quarter and for the year as a whole. 2nd 3rd th Quarter Quarter Quarter Quarter Estimated as of raw materal to be purchased Cost of raw mater also be purchased Exercises 8-14. 8-16 and 8-11 a The production department of Zan Corporation has submitted the following forecast of units to be produced by quarter for the upcoming fiscal year. 1st Quarter 23,eee 2nd Quarter 26.089 3rd Quarter 2 5.e9e 4 th Quarter 2 4, eee Units to be produced In addition, 34.500 grams of raw materials inventory is on hand at the start of the 1st Quarter and the beginning accounts payable for the 1st Quarter is $8.400. Each unit requires 6 grams of raw material that costs $1.60 per gram. Management desires to end each quarter with an inventory of raw materials equal to 25% of the following quarter's production needs. The desired ending inventory for the 4th Quarter is 6,000 grams, Management plans to pay for 60% of raw material purchases in the quarter acquired and 40% in the following quarter. Each unit requires 0.20 direct labor-hours and direct laborers are paid $14.50 per hour. Required: 1.82. Calculate the estimated grams of raw material that need to be purchased and the cost of raw material purchases for each quarter and for the year as a whole. 3. Calculate the expected cash disbursements for purchases of materials for each quarter and for the year as a whole. 4. Calculate the estimated direct labor cost for each quarter and for the year as a whole. Complete this question by entering your answers in the tabs below. Reg 1 and 2 Rea 3 Reg 4 Calculate the expected cash disbursements for purchases of materials for each quarter and for the year as a whole Quarter Quarter Quarter Quarte Total cash disbursements for materia's

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts