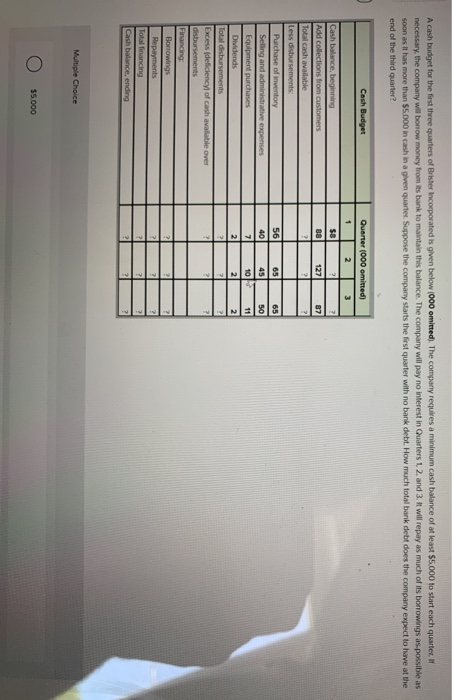

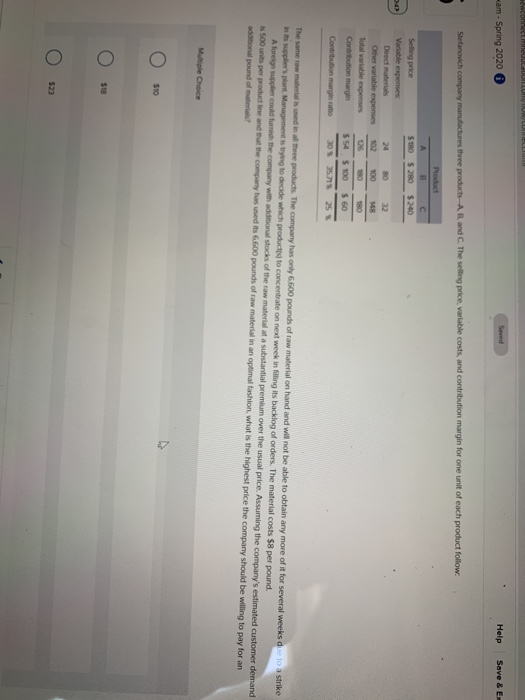

A cash budget for the first three quarters of Brister Incorporated is given below (000 omitted). The company requires a minimum cash balance of at least $5,000 to start each quarter. If necessary, the company wil borrow money from its bank to maintain this balance. The company will pay no interest in Quarters 1. 2. and 3. It will repay as much of its borrowings as possible as soon as it has more than $5,000 in cash in a given quarter Suppose the company starts the first quarter with no bank debt. How much total bank debt does the company expect to have at the end of the third quarter? Cash Budget Quarter (000 omitted) 1 2 3 $8 ? 127 2 87 88 2 ? ? 56 40 65 45 65 50 7 10 11 Cash balance, beginning Add collections from customers Total cash available Less disbursements Purchase of inventory Selling and administrative expenses Equipment purchases Dividends Total disbursements Excess deficiency of cash available over disbursements Financing Borrowings Repayments Total financing Cash balance, ending 2 2 2 2 Multiple Choice $5,000 won LLULLUTUNUL am - Spring 2020 saved Help Save & E Stefanovich company manufactures three products AB and C. The selling price variable costs, and contribution margin for one unit of each product follow Product B C $20 $240 Selling price STRO 24 Direct materials Other variable expenses Total variable expenses Contribution margin 32 148 100 180 $ 60 $ 54 S 100 2055715 Contribution marginal 25 The same raw materials used in all three products. The company has only 6.600 pounds of raw material on hand and will not be able to obtain any more of it for several weeks due to a strike in supplier's plant Management is trying to decide which products to concentrate on next week in filing its backlog of orders. The material costs $8 per pound. A foreign supplier could the company with additional stocks of the raw material at a substantial premium over the usual price. Assuming the company's estimated customer demand 1 500 units per product line and that the company has used is 6.500 pounds of raw material in an optimal fashion, what is the highest price the company should be willing to pay for an additional pound of me? Multiple Choice O 510 $23