Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A cash count was conducted by your staff on January 7, 2018. The petty cash fund of P60,000 maintained by the company on an

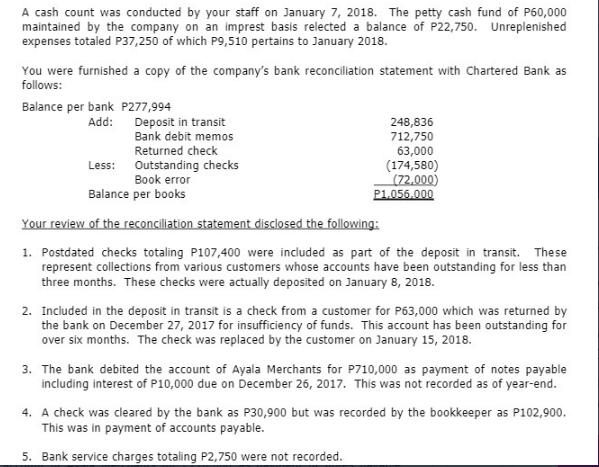

A cash count was conducted by your staff on January 7, 2018. The petty cash fund of P60,000 maintained by the company on an imprest basis relected a balance of P22,750. Unreplenished expenses totaled P37,250 of which P9,510 pertains to January 2018. You were furnished a copy of the company's bank reconciliation statement with Chartered Bank as follows: Balance per bank P277,994 Add: Deposit in transit Bank debit memos Returned check Less: Outstanding checks Book error Balance per books 248,836 712,750 63,000 (174,580) (72,000) P1.056.000 Your review of the reconciliation statement disclosed the following: 1. Postdated checks totaling P107,400 were included as part of the deposit in transit. These represent collections from various customers whose accounts have been outstanding for less than three months. These checks were actually deposited on January 8, 2018. 2. Included in the deposit in transit is a check from a customer for P63,000 which was returned by the bank on December 27, 2017 for insufficiency of funds. This account has been outstanding for over six months. The check was replaced by the customer on January 15, 2018. 3. The bank debited the account of Ayala Merchants for P710,000 as payment of notes payable including interest of P10,000 due on December 26, 2017. This was not recorded as of year-end. 4. A check was cleared by the bank as P30,900 but was recorded by the bookkeeper as P102,900. This was in payment of accounts payable. 5. Bank service charges totaling P2,750 were not recorded.

Step by Step Solution

★★★★★

3.33 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the corrected Petty Cash Fund we need to adjust the current bala...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started