Answered step by step

Verified Expert Solution

Question

1 Approved Answer

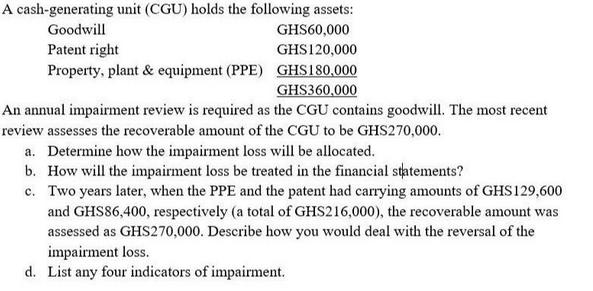

A cash-generating unit (CGU) holds the following assets: Goodwill GHS60,000 Patent right GHS120,000 Property, plant & equipment (PPE) GHS180,000 GHS360,000 An annual impairment review

A cash-generating unit (CGU) holds the following assets: Goodwill GHS60,000 Patent right GHS120,000 Property, plant & equipment (PPE) GHS180,000 GHS360,000 An annual impairment review is required as the CGU contains goodwill. The most recent review assesses the recoverable amount of the CGU to be GHS270,000. a. Determine how the impairment loss will be allocated. b. How will the impairment loss be treated in the financial statements? c. two years later, when the PPE and the patent had carrying amounts of GHS129,600 and GHS86,400, respectively (a total of GHS216,000), the recoverable amount was assessed as GHS270,000. Describe how you would deal with the reversal of the impairment loss. d. List any four indicators of impairment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

I can see the question you have about financial accounting related to impairment of assets within a CashGenerating Unit CGU Lets address each part of the question one by one a Determine how the impair...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started