Answered step by step

Verified Expert Solution

Question

1 Approved Answer

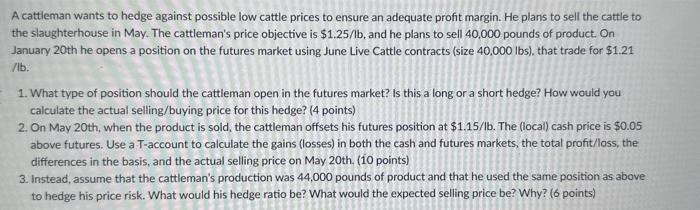

A cattleman wants to hedge against possible low cattle prices to ensure an adequate profit margin. He plans to sell the cattle to the

A cattleman wants to hedge against possible low cattle prices to ensure an adequate profit margin. He plans to sell the cattle to the slaughterhouse in May. The cattleman's price objective is $1.25/lb, and he plans to sell 40,000 pounds of product. On January 20th he opens a position on the futures market using June Live Cattle contracts (size 40,000 lbs), that trade for $1.21 /lb. 1. What type of position should the cattleman open in the futures market? Is this a long or a short hedge? How would you calculate the actual selling/buying price for this hedge? (4 points) 2. On May 20th, when the product is sold, the cattleman offsets his futures position at $1.15/lb. The (local) cash price is $0.05 above futures. Use a T-account to calculate the gains (losses) in both the cash and futures markets, the total profit/loss, the differences in the basis, and the actual selling price on May 20th. (10 points) 3. Instead, assume that the cattleman's production was 44,000 pounds of product and that he used the same position as above to hedge his price risk. What would his hedge ratio be? What would the expected selling price be? Why? (6 points)

Step by Step Solution

★★★★★

3.45 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

1 Type of Position The cattleman should open a short hedge position The actual sellingbuying price i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started