A CCPC disposes of a building used for business operations with capital cost of $1 million and UCC of $400,000, for $1.25 million. Given

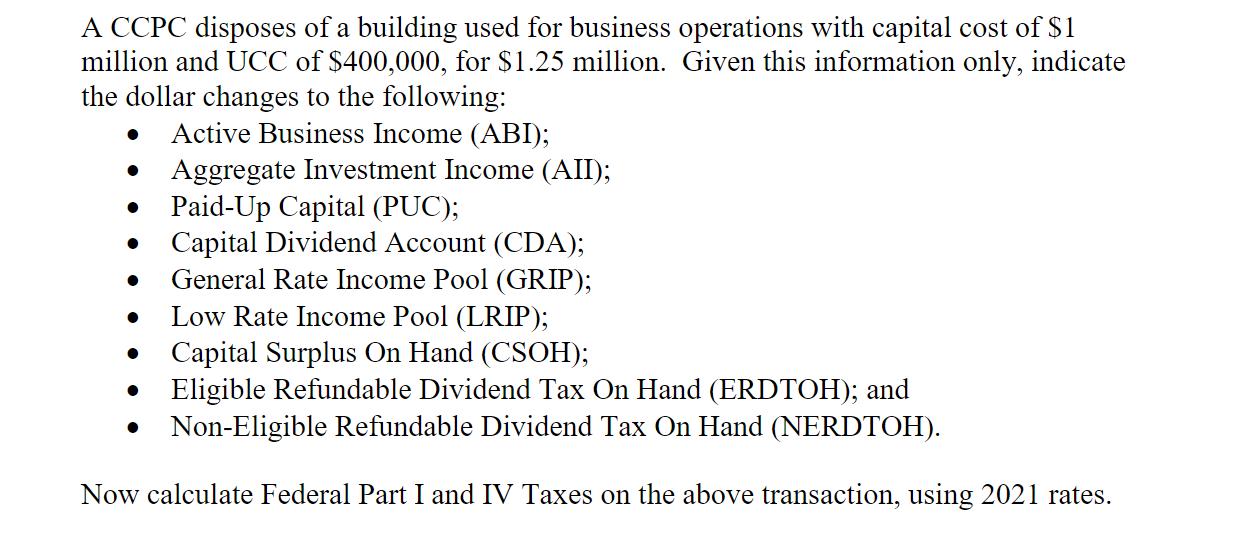

A CCPC disposes of a building used for business operations with capital cost of $1 million and UCC of $400,000, for $1.25 million. Given this information only, indicate the dollar changes to the following: Active Business Income (ABI); Aggregate Investment Income (AII); Paid-Up Capital (PUC); Capital Dividend Account (CDA); General Rate Income Pool (GRIP); Low Rate Income Pool (LRIP); Capital Surplus On Hand (CSOH); Eligible Refundable Dividend Tax On Hand (ERDTOH); and Non-Eligible Refundable Dividend Tax On Hand (NERDTOH). Now calculate Federal Part I and IV Taxes on the above transaction, using 2021 rates.

Step by Step Solution

3.47 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The dollar changes to the following are as follows ABI ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started