Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(a) Celia Co. will receive 10 million Mexican Pesos (MXP) tomorrow as a result of providing consulting services to a Mexican Firm. It wants to

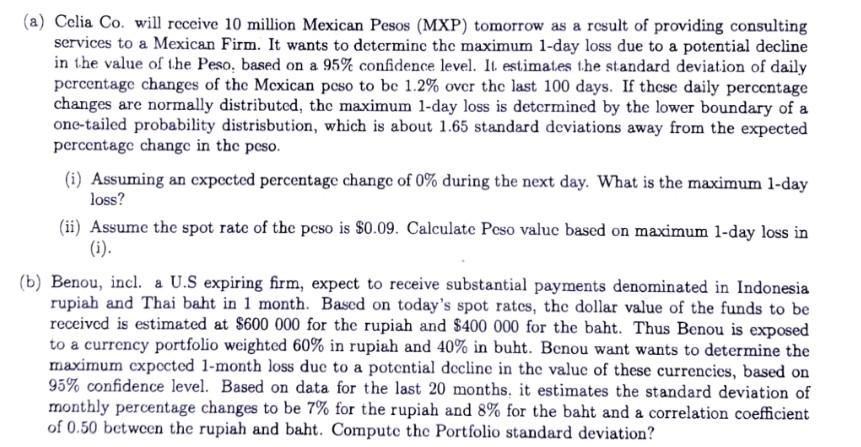

(a) Celia Co. will receive 10 million Mexican Pesos (MXP) tomorrow as a result of providing consulting services to a Mexican Firm. It wants to determine the maximum 1-day loss due to a potential decline in the value of the Peso, based on a 95% confidence level. It estimates the standard deviation of daily percentage changes of the Mexican peso to bc 1.2% over the last 100 days. If these daily percentage changes are normally distributed, the maximum 1-day loss is determined by the lower boundary of a onc-tailed probability distrisbution, which is about 1.65 standard deviations away from the expected percentage change in the peso. (i) Assuming an expected percentage change of 0% during the next day. What is the maximum 1-day loss? (ii) Assume the spot rate of the peso is $0.09. Calculate Peso value based on maximum 1-day loss in (i). (b) Benou, incl. a V.S expiring firm, expect to receive substantial payments denominated in Indonesia rupiah and Thai baht in 1 month. Based on today's spot rates, the dollar value of the funds to be received is estimated at $600 000 for the rupiah and $400 000 for the baht. Thus Benou is exposed to a currency portfolio weighted 60% in rupiah and 40% in buht. Bcnou want wants to determine the maximum expected 1-month loss due to a potential decline in the value of these currencies, based on 95% confidence level. Based on data for the last 20 months, it estimates the standard deviation of monthly percentage changes to be 7% for the rupiah and 8% for the baht and a correlation coefficient of 0.50 between the rupiah and baht. Compute the Portfolio standard deviation? (a) Celia Co. will receive 10 million Mexican Pesos (MXP) tomorrow as a result of providing consulting services to a Mexican Firm. It wants to determine the maximum 1-day loss due to a potential decline in the value of the Peso, based on a 95% confidence level. It estimates the standard deviation of daily percentage changes of the Mexican peso to bc 1.2% over the last 100 days. If these daily percentage changes are normally distributed, the maximum 1-day loss is determined by the lower boundary of a onc-tailed probability distrisbution, which is about 1.65 standard deviations away from the expected percentage change in the peso. (i) Assuming an expected percentage change of 0% during the next day. What is the maximum 1-day loss? (ii) Assume the spot rate of the peso is $0.09. Calculate Peso value based on maximum 1-day loss in (i). (b) Benou, incl. a V.S expiring firm, expect to receive substantial payments denominated in Indonesia rupiah and Thai baht in 1 month. Based on today's spot rates, the dollar value of the funds to be received is estimated at $600 000 for the rupiah and $400 000 for the baht. Thus Benou is exposed to a currency portfolio weighted 60% in rupiah and 40% in buht. Bcnou want wants to determine the maximum expected 1-month loss due to a potential decline in the value of these currencies, based on 95% confidence level. Based on data for the last 20 months, it estimates the standard deviation of monthly percentage changes to be 7% for the rupiah and 8% for the baht and a correlation coefficient of 0.50 between the rupiah and baht. Compute the Portfolio standard deviation

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started