Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, a Bakery purchased a Bagel-Making Machine at a cost of $150,000 and incurred an additional $7,000 of customization costs to

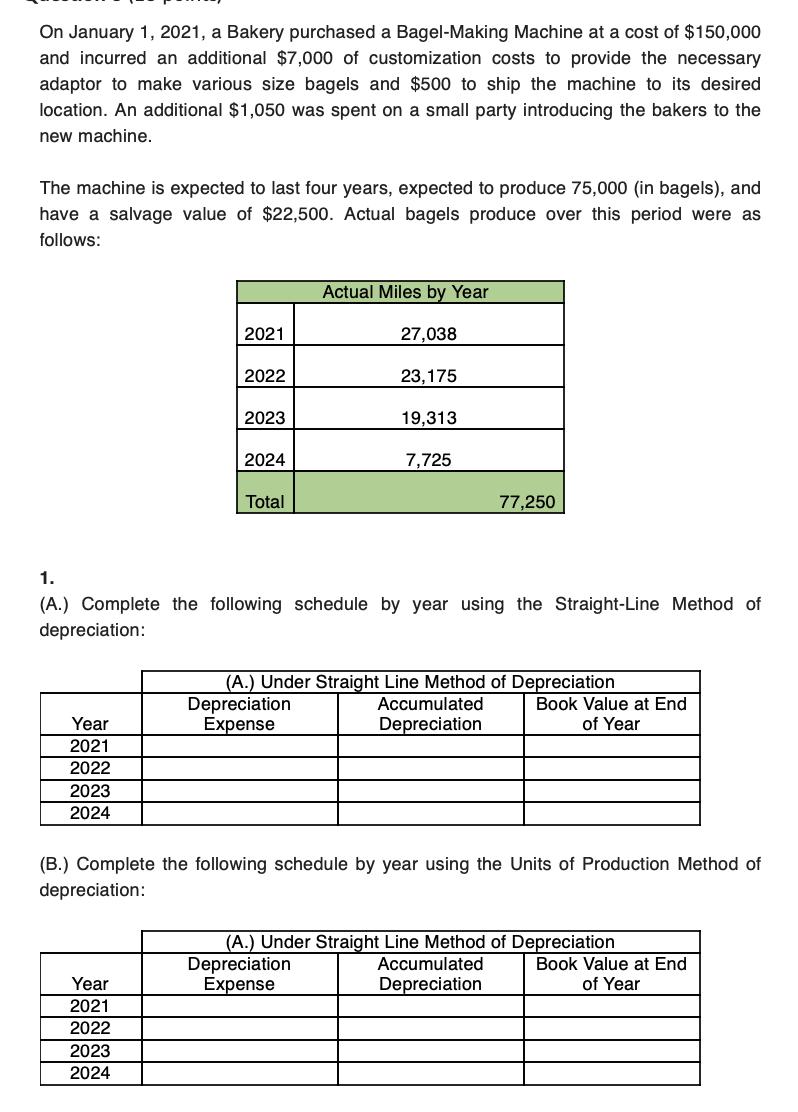

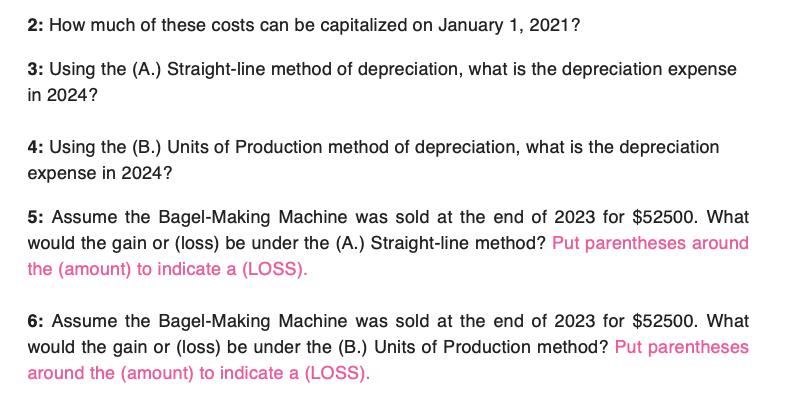

On January 1, 2021, a Bakery purchased a Bagel-Making Machine at a cost of $150,000 and incurred an additional $7,000 of customization costs to provide the necessary adaptor to make various size bagels and $500 to ship the machine to its desired location. An additional $1,050 was spent on a small party introducing the bakers to the new machine. The machine is expected to last four years, expected to produce 75,000 (in bagels), and I have a salvage value of $22,500. Actual bagels produce over this period were as follows: Year 2021 2022 2023 2024 2021 Year 2021 2022 2022 2023 2024 2023 2024 Total Actual Miles by Year 27,038 23,175 1. (A.) Complete the following schedule by year using the Straight-Line Method of depreciation: 19,313 7,725 77,250 (A.) Under Straight Line Method of Depreciation Depreciation Expense Accumulated Depreciation (B.) Complete the following schedule by year using the Units of Production Method of depreciation: Book Value at End of Year Accumulated Depreciation (A.) Under Straight Line Method of Depreciation Depreciation Expense Book Value at End of Year 2: How much of these costs can be capitalized on January 1, 2021? 3: Using the (A.) Straight-line method of depreciation, what is the depreciation expense in 2024? 4: Using the (B.) Units of Production method of depreciation, what is the depreciation expense in 2024? 5: Assume the Bagel-Making Machine was sold at the end of 2023 for $52500. What would the gain or (loss) be under the (A.) Straight-line method? Put parentheses around the (amount) to indicate a (LOSS). 6: Assume the Bagel-Making Machine was sold at the end of 2023 for $52500. What would the gain or (loss) be under the (B.) Units of Production method? Put parentheses around the (amount) to indicate a (LOSS).

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started