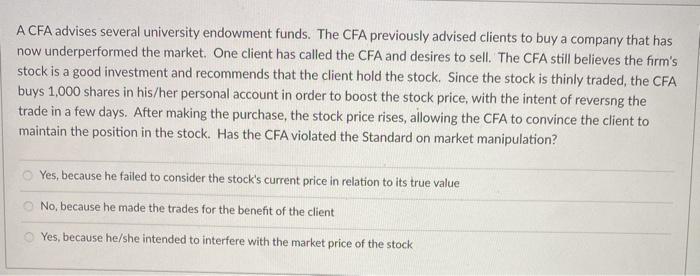

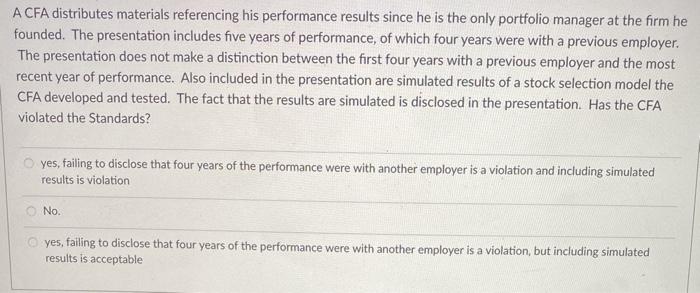

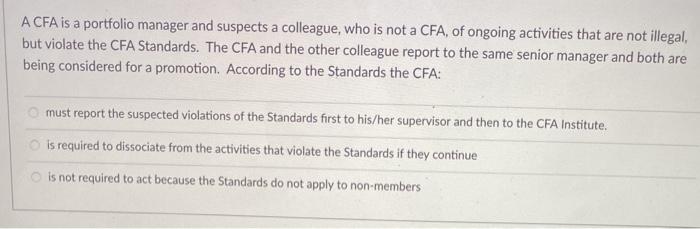

A CFA advises several university endowment funds. The CFA previously advised clients to buy a company that has now underperformed the market. One client has called the CFA and desires to sell. The CFA still believes the firm's stock is a good investment and recommends that the client hold the stock. Since the stock is thinly traded, the CFA buys 1,000 shares in his/her personal account in order to boost the stock price, with the intent of reversng the trade in a few days. After making the purchase, the stock price rises, allowing the CFA to convince the client to maintain the position in the stock. Has the CFA violated the Standard on market manipulation? Yes, because he failed to consider the stock's current price in relation to its true value No, because he made the trades for the benefit of the client Yes, because he/she intended to interfere with the market price of the stock A CFA distributes materials referencing his performance results since he is the only portfolio manager at the firm he founded. The presentation includes five years of performance, of which four years were with a previous employer. The presentation does not make a distinction between the first four years with a previous employer and the most recent year of performance. Also included in the presentation are simulated results of a stock selection model the CFA developed and tested. The fact that the results are simulated is disclosed in the presentation. Has the CFA violated the Standards? yes, failing to disclose that four years of the performance were with another employer is a violation and including simulated results is violation No. yes, failing to disclose that four years of the performance were with another employer is a violation, but including simulated results is acceptable A CFA is a portfolio manager and suspects a colleague, who is not a CFA, of ongoing activities that are not illegal, but violate the CFA Standards. The CFA and the other colleague report to the same senior manager and both are being considered for a promotion. According to the Standards the CFA: must report the suspected violations of the Standards first to his/her supervisor and then to the CFA Institute. is required to dissociate from the activities that violate the Standards if they continue is not required to act because the Standards do not apply to non-members A CFA advises several university endowment funds. The CFA previously advised clients to buy a company that has now underperformed the market. One client has called the CFA and desires to sell. The CFA still believes the firm's stock is a good investment and recommends that the client hold the stock. Since the stock is thinly traded, the CFA buys 1,000 shares in his/her personal account in order to boost the stock price, with the intent of reversng the trade in a few days. After making the purchase, the stock price rises, allowing the CFA to convince the client to maintain the position in the stock. Has the CFA violated the Standard on market manipulation? Yes, because he failed to consider the stock's current price in relation to its true value No, because he made the trades for the benefit of the client Yes, because he/she intended to interfere with the market price of the stock A CFA distributes materials referencing his performance results since he is the only portfolio manager at the firm he founded. The presentation includes five years of performance, of which four years were with a previous employer. The presentation does not make a distinction between the first four years with a previous employer and the most recent year of performance. Also included in the presentation are simulated results of a stock selection model the CFA developed and tested. The fact that the results are simulated is disclosed in the presentation. Has the CFA violated the Standards? yes, failing to disclose that four years of the performance were with another employer is a violation and including simulated results is violation No. yes, failing to disclose that four years of the performance were with another employer is a violation, but including simulated results is acceptable A CFA is a portfolio manager and suspects a colleague, who is not a CFA, of ongoing activities that are not illegal, but violate the CFA Standards. The CFA and the other colleague report to the same senior manager and both are being considered for a promotion. According to the Standards the CFA: must report the suspected violations of the Standards first to his/her supervisor and then to the CFA Institute. is required to dissociate from the activities that violate the Standards if they continue is not required to act because the Standards do not apply to non-members