A change in method of accounting generally requires an adjustment under IRC 481(a) to prevent duplication or error in income or deductions when the taxpayer computes its taxable income under a method of accounting different from the method used to compute taxable income for the preceding year.

A change in method of accounting generally requires an adjustment under IRC 481(a) to prevent duplication or error in income or deductions when the taxpayer computes its taxable income under a method of accounting different from the method used to compute taxable income for the preceding year.

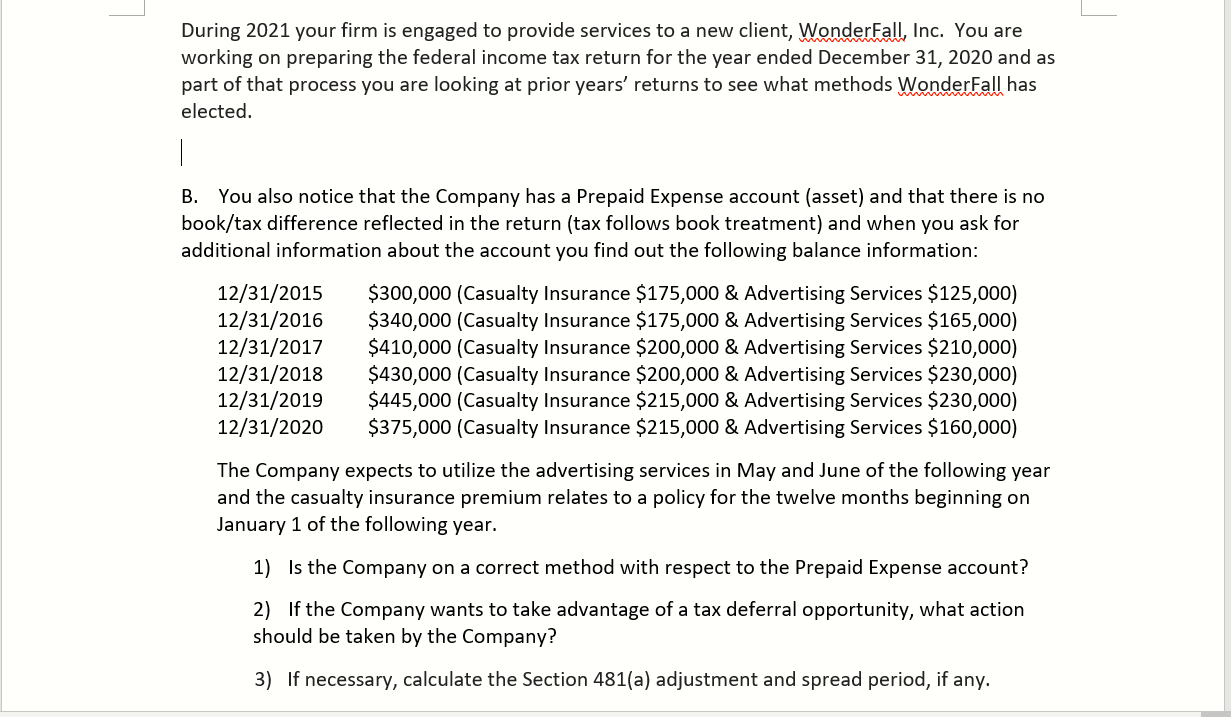

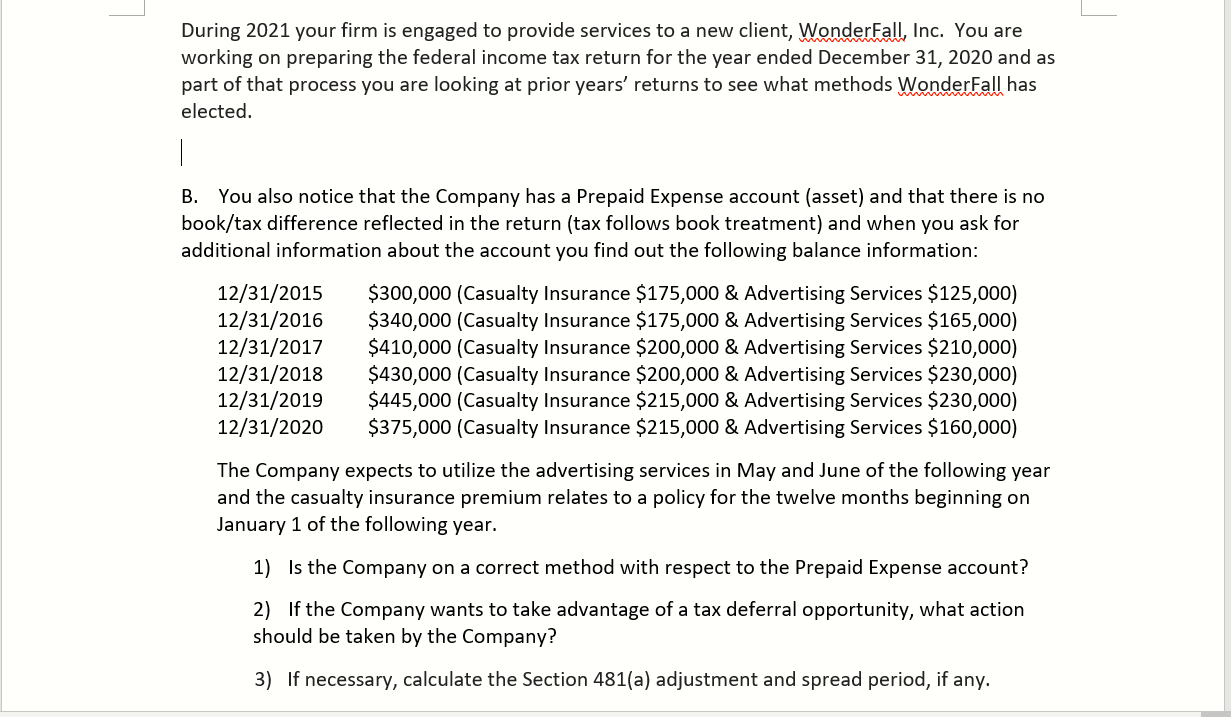

During 2021 your firm is engaged to provide services to a new client, WonderFall, Inc. You are working on preparing the federal income tax return for the year ended December 31, 2020 and as part of that process you are looking at prior years' returns to see what methods WonderFall has elected. B. You also notice that the Company has a Prepaid Expense account (asset) and that there is no book/tax difference reflected in the return (tax follows book treatment) and when you ask for additional information about the account you find out the following balance information: 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 12/31/2020 $300,000 (Casualty Insurance $175,000 & Advertising Services $125,000) $340,000 (Casualty Insurance $175,000 & Advertising Services $165,000) $410,000 (Casualty Insurance $200,000 & Advertising Services $210,000) $430,000 (Casualty Insurance $200,000 & Advertising Services $230,000) $445,000 (Casualty Insurance $215,000 & Advertising Services $230,000) $375,000 (Casualty Insurance $215,000 & Advertising Services $160,000) The Company expects to utilize the advertising services in May and June of the following year and the casualty insurance premium relates to a policy for the twelve months beginning on January 1 of the following year. 1) Is the Company on a correct method with respect to the Prepaid Expense account? 2) If the Company wants to take advantage of a tax deferral opportunity, what action should be taken by the Company? 3) If necessary, calculate the Section 481(a) adjustment and spread period, if any. During 2021 your firm is engaged to provide services to a new client, WonderFall, Inc. You are working on preparing the federal income tax return for the year ended December 31, 2020 and as part of that process you are looking at prior years' returns to see what methods WonderFall has elected. B. You also notice that the Company has a Prepaid Expense account (asset) and that there is no book/tax difference reflected in the return (tax follows book treatment) and when you ask for additional information about the account you find out the following balance information: 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 12/31/2020 $300,000 (Casualty Insurance $175,000 & Advertising Services $125,000) $340,000 (Casualty Insurance $175,000 & Advertising Services $165,000) $410,000 (Casualty Insurance $200,000 & Advertising Services $210,000) $430,000 (Casualty Insurance $200,000 & Advertising Services $230,000) $445,000 (Casualty Insurance $215,000 & Advertising Services $230,000) $375,000 (Casualty Insurance $215,000 & Advertising Services $160,000) The Company expects to utilize the advertising services in May and June of the following year and the casualty insurance premium relates to a policy for the twelve months beginning on January 1 of the following year. 1) Is the Company on a correct method with respect to the Prepaid Expense account? 2) If the Company wants to take advantage of a tax deferral opportunity, what action should be taken by the Company? 3) If necessary, calculate the Section 481(a) adjustment and spread period, if any

A change in method of accounting generally requires an adjustment under IRC 481(a) to prevent duplication or error in income or deductions when the taxpayer computes its taxable income under a method of accounting different from the method used to compute taxable income for the preceding year.

A change in method of accounting generally requires an adjustment under IRC 481(a) to prevent duplication or error in income or deductions when the taxpayer computes its taxable income under a method of accounting different from the method used to compute taxable income for the preceding year.