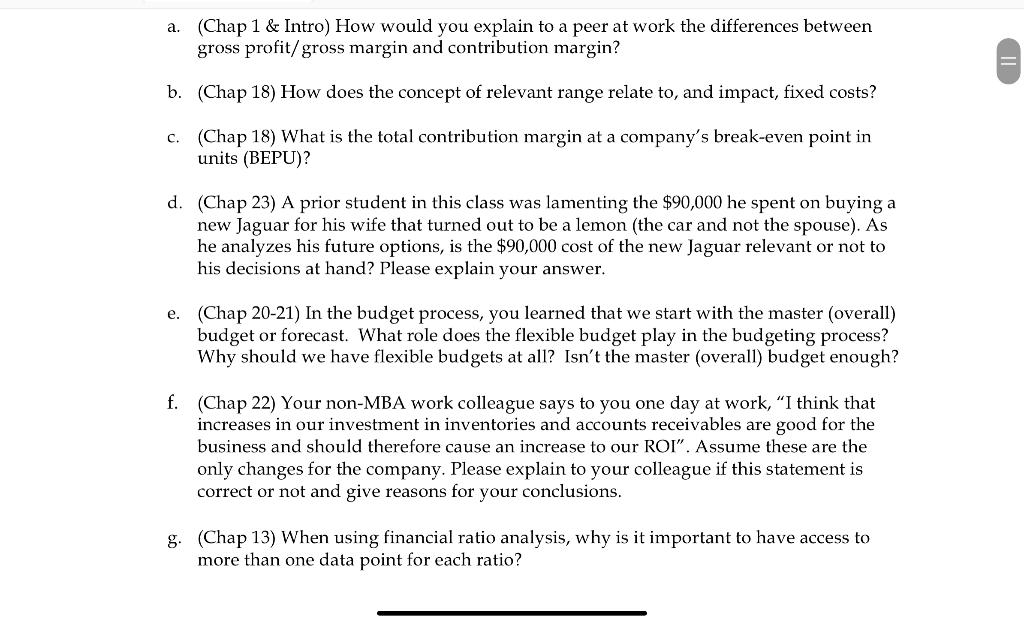

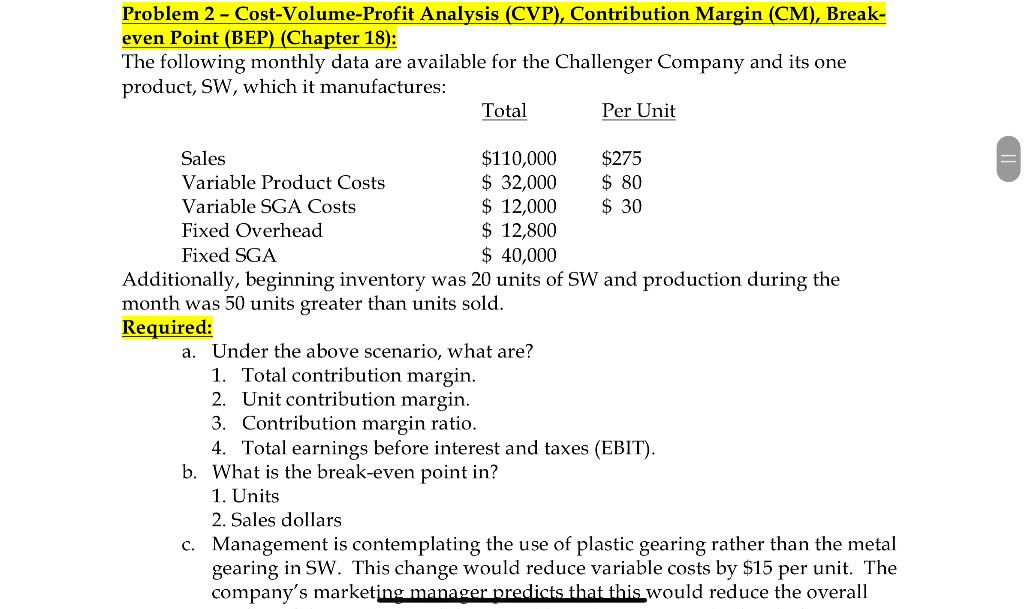

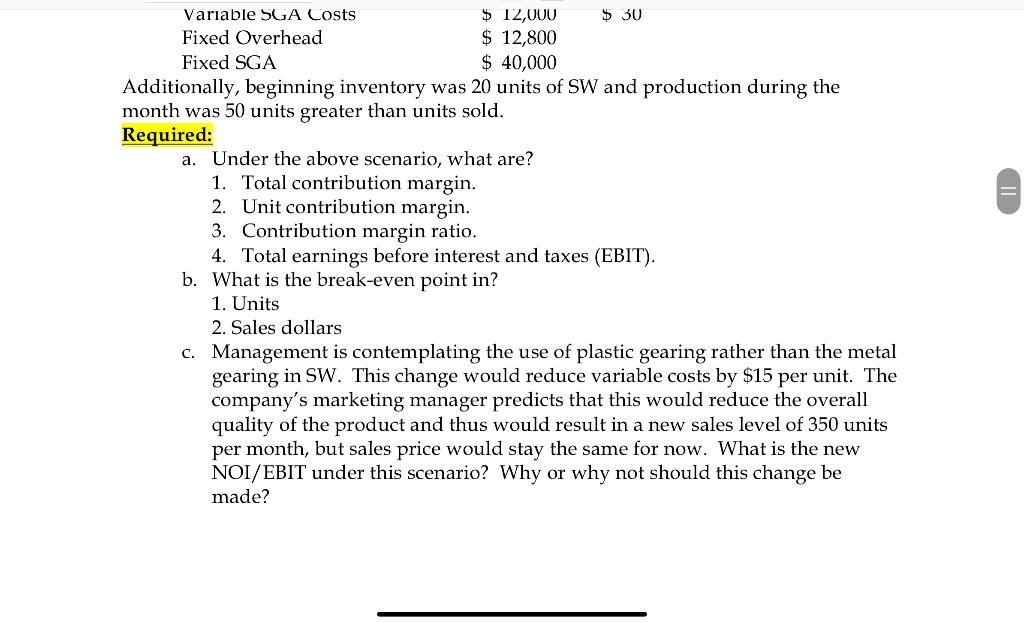

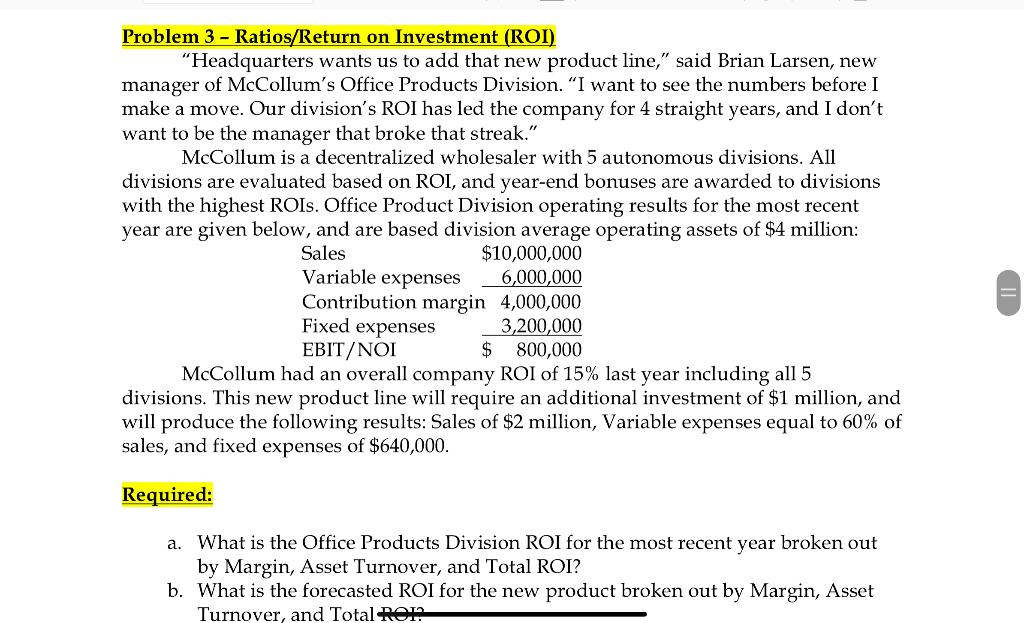

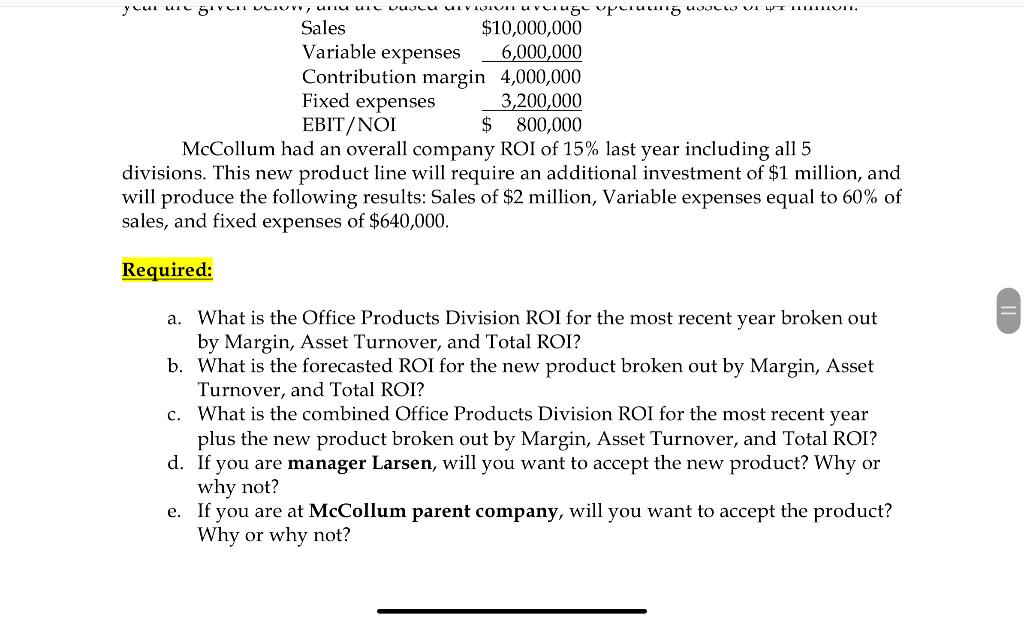

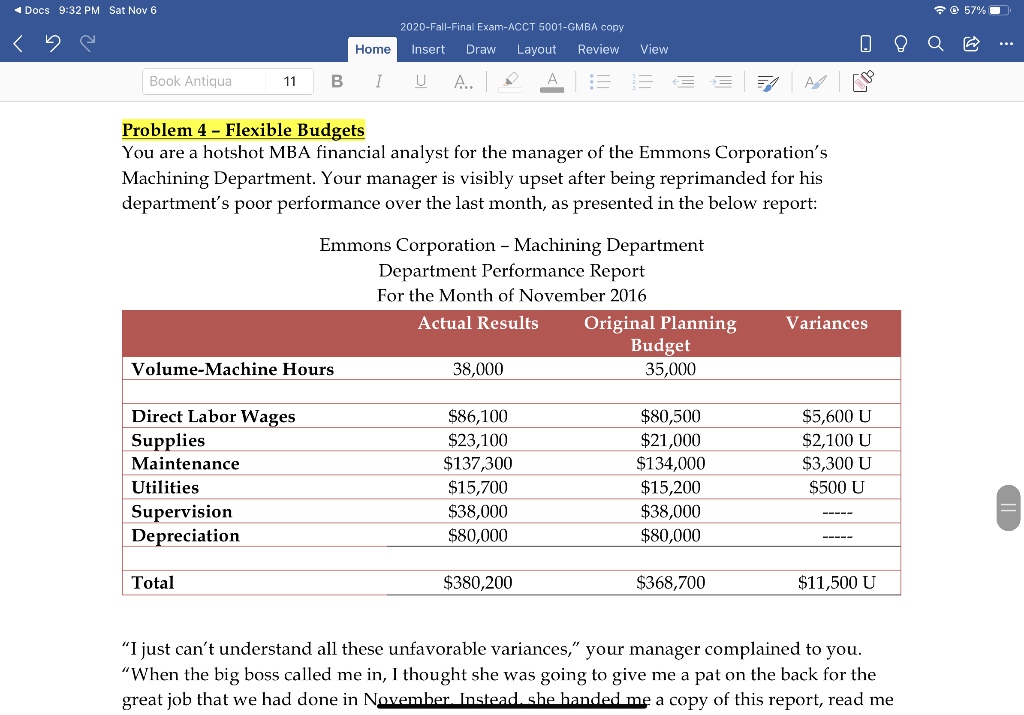

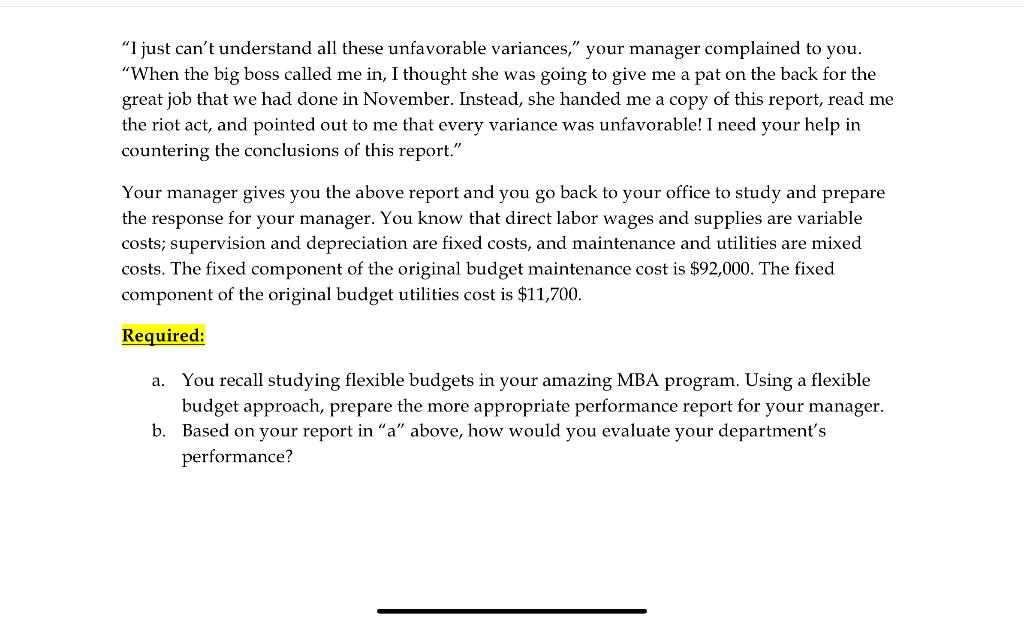

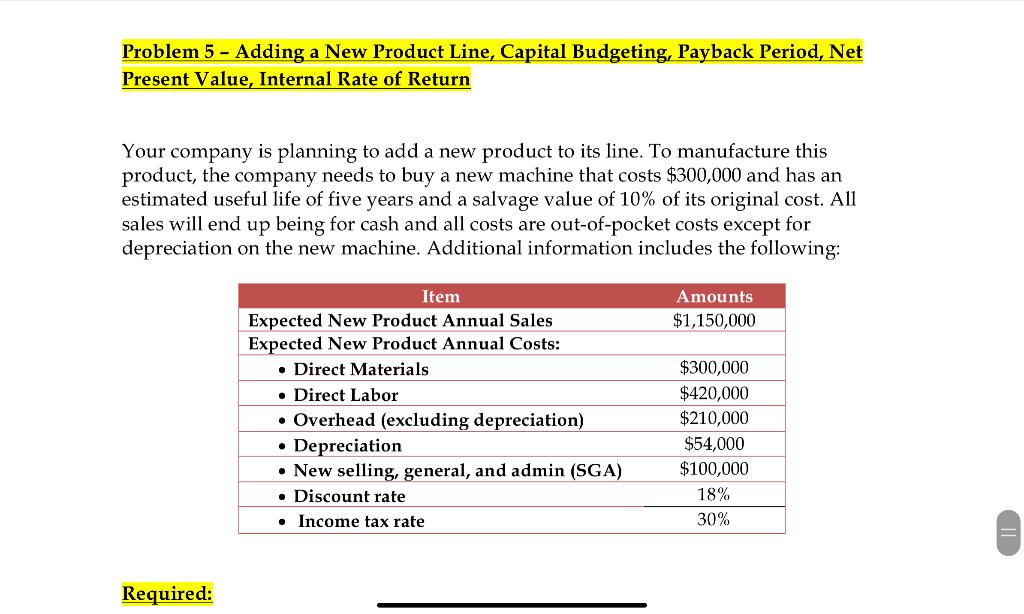

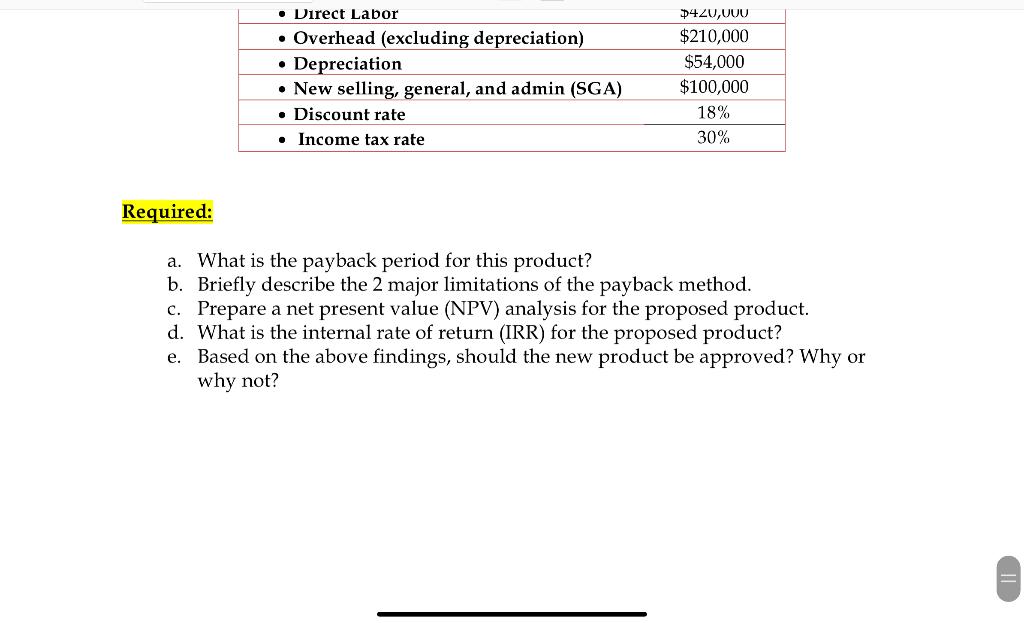

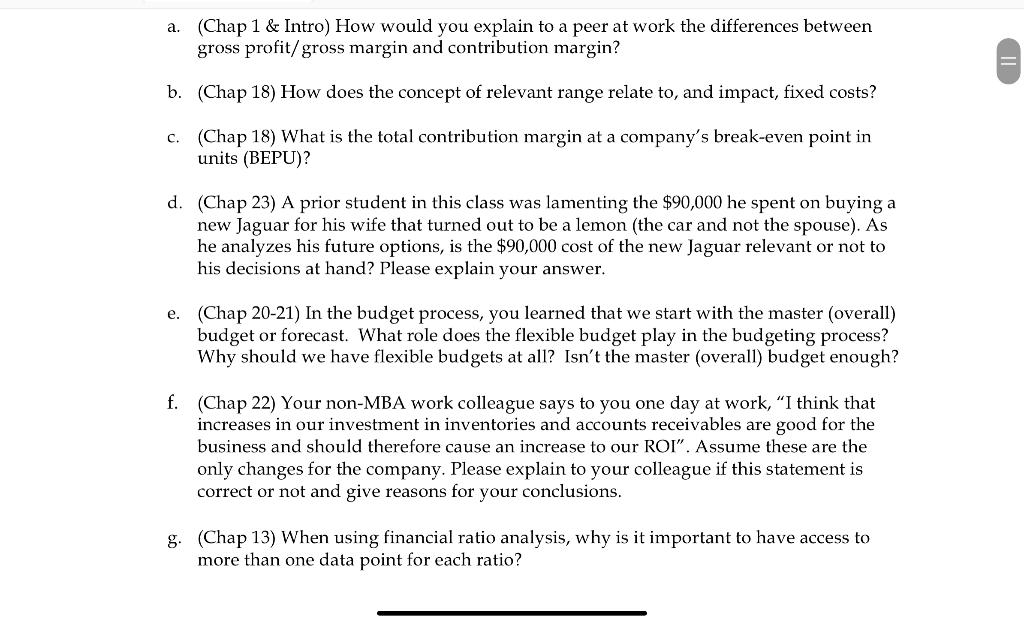

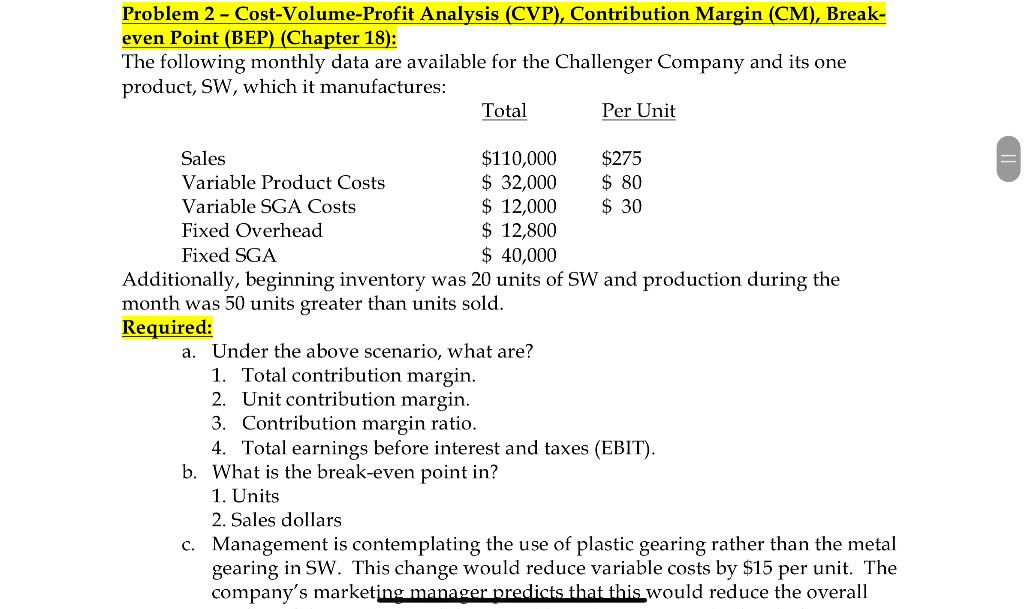

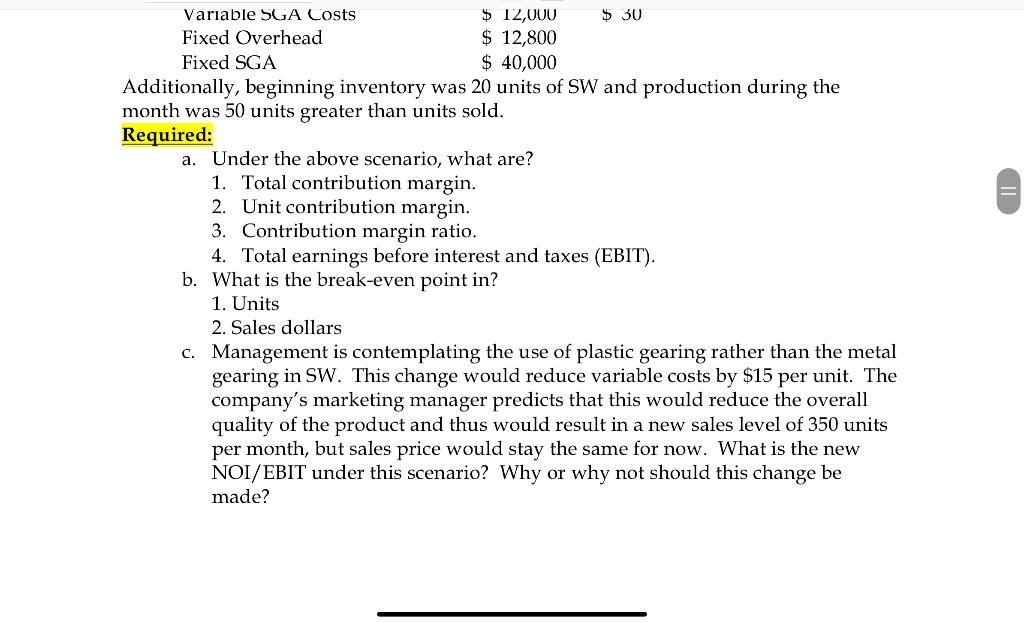

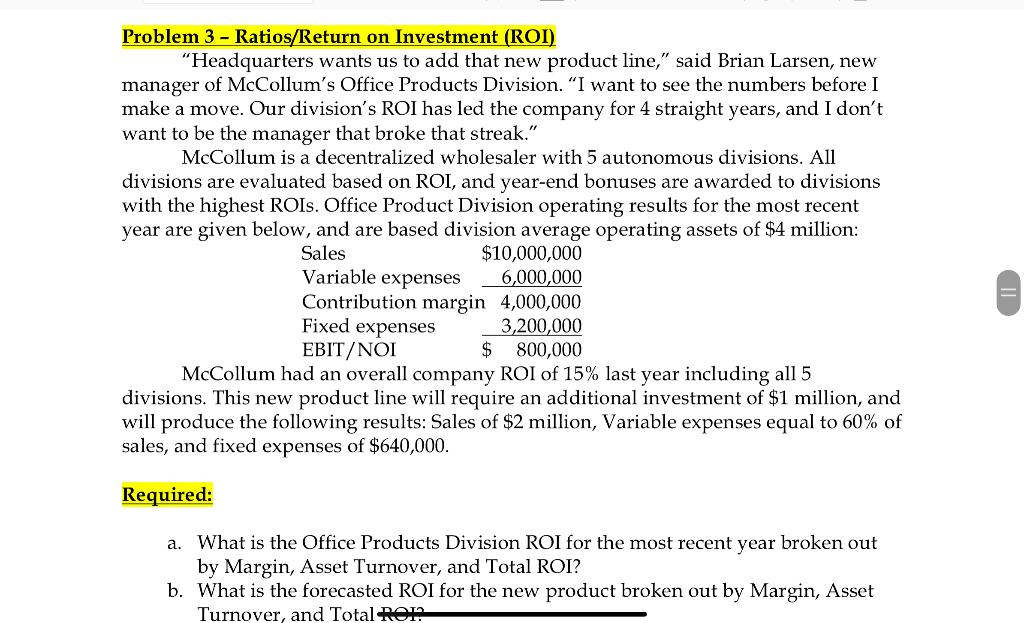

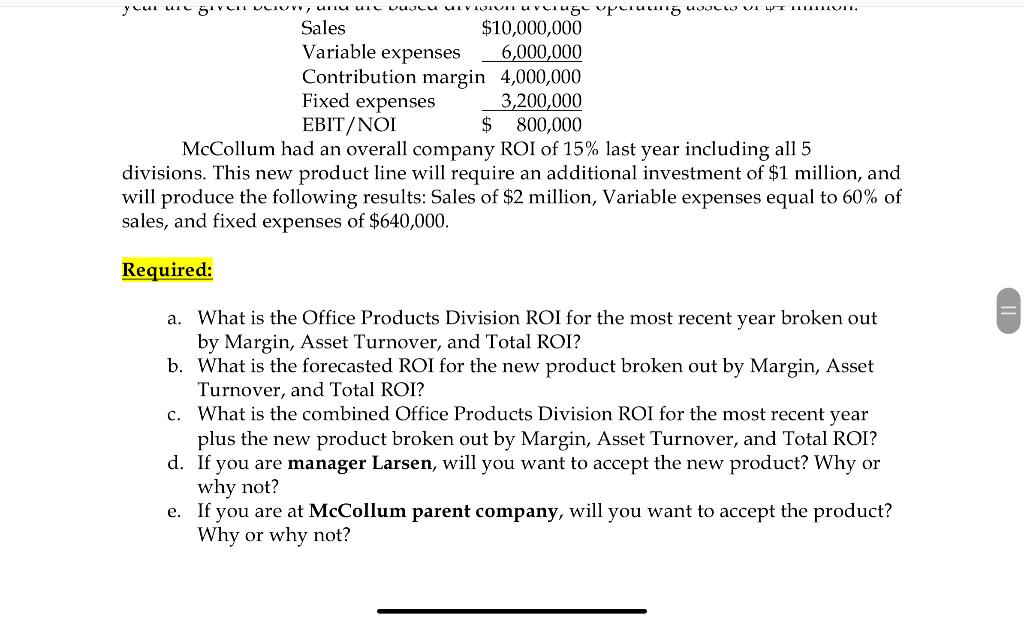

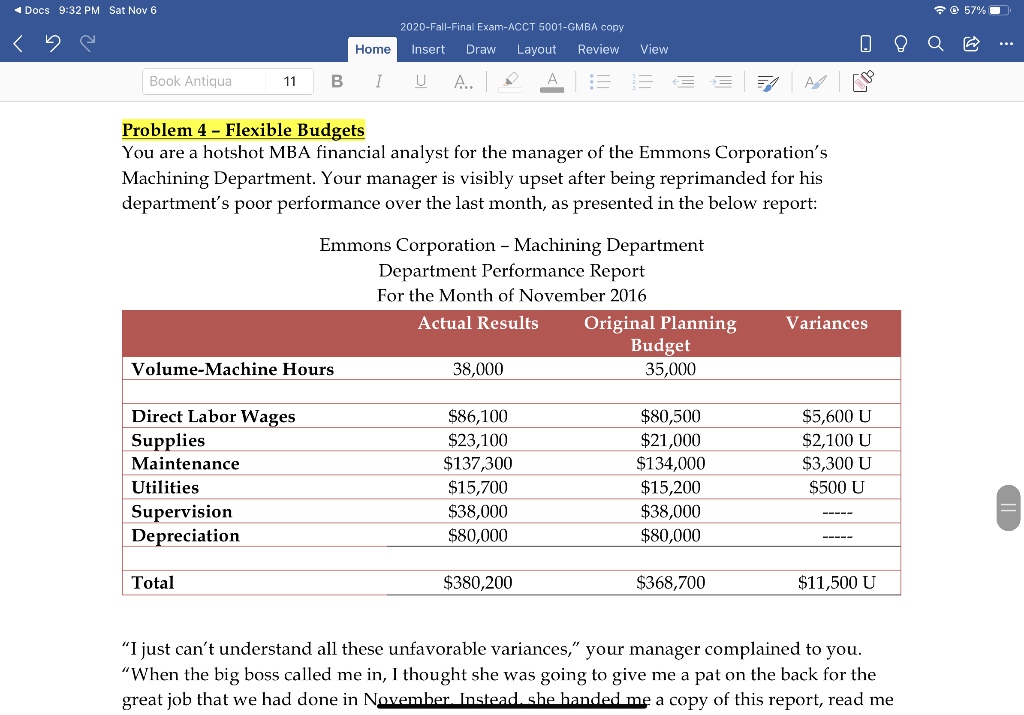

a. (Chap 1 & Intro) How would you explain to a peer at work the differences between gross profit/ gross margin and contribution margin? b. (Chap 18) How does the concept of relevant range relate to, and impact, fixed costs? c. (Chap 18) What is the total contribution margin at a company's break-even point in units (BEPU)? d. (Chap 23) A prior student in this class was lamenting the $90,000 he spent on buying a new Jaguar for his wife that turned out to be a lemon (the car and not the spouse). As he analyzes his future options, is the $90,000 cost of the new Jaguar relevant or not to his decisions at hand? Please explain your answer. e. (Chap 20-21) In the budget process, you learned that we start with the master (overall) budget or forecast. What role does the flexible budget play in the budgeting process? Why should we have flexible budgets at all? Isn't the master (overall) budget enough? f. (Chap 22) Your non-MBA work colleague says to you one day at work, I think that increases in our investment in inventories and accounts receivables are good for the business and should therefore cause an increase to our ROI". Assume these are the only changes for the company. Please explain to your colleague if this statement is correct or not and give reasons for your conclusions. g. (Chap 13) When using financial ratio analysis, why is it important to have access to more than one data point for each ratio? Problem 2 - Cost-Volume-Profit Analysis (CVP), Contribution Margin (CM), Break- even Point (BEP) (Chapter 18): The following monthly data are available for the Challenger Company and its one product, SW, which it manufactures: Total Per Unit Sales $110,000 $275 Variable Product Costs $ 32,000 $ 80 Variable SGA Costs $ 12,000 $ 30 Fixed Overhead $ 12,800 Fixed SGA $ 40,000 Additionally, beginning inventory was 20 units of SW and production during the month was 50 units greater than units sold. Required: a. Under the above scenario, what are? 1. Total contribution margin. 2. Unit contribution margin. 3. Contribution margin ratio. 4. Total earnings before interest and taxes (EBIT). b. What is the break-even point in? 1. Units 2. Sales dollars c. Management is contemplating the use of plastic gearing rather than the metal gearing in SW. This change would reduce variable costs by $15 per unit. The company's marketing manager predicts that this would reduce the overall $ 30 Variable SGA Costs $ 12,000 Fixed Overhead $ 12,800 Fixed SGA $ 40,000 Additionally, beginning inventory was 20 units of SW and production during the month was 50 units greater than units sold. Required: a. Under the above scenario, what are? 1. Total contribution margin. 2. Unit contribution margin. 3. Contribution margin ratio. 4. Total earnings before interest and taxes (EBIT). b. What is the break-even point in? 1. Units 2. Sales dollars c. Management is contemplating the use of plastic gearing rather than the metal gearing in SW. This change would reduce variable costs by $15 per unit. The company's marketing manager predicts that this would reduce the overall quality of the product and thus would result in a new sales level of 350 units per month, but sales price would stay the same for now. What is the new NOI/EBIT under this scenario? Why or why not should this change be made? Problem 3 - Ratios/Return on Investment (ROI) Headquarters wants us to add that new product line," said Brian Larsen, new manager of McCollum's Office Products Division. "I want to see the numbers before I make a move. Our division's ROI has led the company for 4 straight years, and I don't want to be the manager that broke that streak." McCollum is a decentralized wholesaler with 5 autonomous divisions. All divisions are evaluated based on ROI, and year-end bonuses are awarded to divisions with the highest ROIs. Office Product Division operating results for the most recent year are given below, and are based division average operating assets of $4 million: Sales $10,000,000 Variable expenses 6,000,000 Contribution margin 4,000,000 Fixed expenses 3,200,000 EBIT/NOI $ 800,000 McCollum had an overall company ROI of 15% last year including all 5 divisions. This new product line will require an additional investment of $1 million, and will produce the following results: Sales of $2 million, Variable expenses equal to 60% of sales, and fixed expenses of $640,000. Required: a. What is the Office Products Division ROI for the most recent year broken out by Margin, Asset Turnover, and Total ROI? b. What is the forecasted ROI for the new product broken out by Margin, Asset Turnover, and Total ROI y cu 5 VCI VLIVY 5 "% . Sales $10,000,000 Variable expenses 6,000,000 Contribution margin 4,000,000 Fixed expenses 3,200,000 EBIT/NOI $ 800,000 McCollum had an overall company ROI of 15% last year including all 5 divisions. This new product line will require an additional investment of $1 million, and will produce the following results: Sales of $2 million, Variable expenses equal to 60% of sales, and fixed expenses of $640,000. Required: a. What is the Office Products Division ROI for the most recent year broken out by Margin, Asset Turnover, and Total ROI? b. What is the forecasted ROI for the new product broken out by Margin, Asset Turnover, and Total ROI? c. What is the combined Office Products Division ROI for the most recent year plus the new product broken out by Margin, Asset Turnover, and Total ROI? d. you are manager Larsen, will you want to accept the new product? Why or why not? e. If you are at McCollum parent company, will you want to accept the product? Why or why not? - Docs 9:32 PM Sat Nov 6 57%