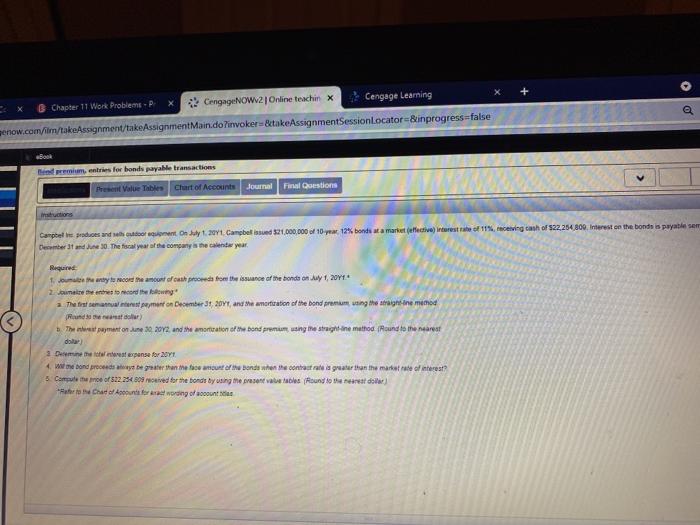

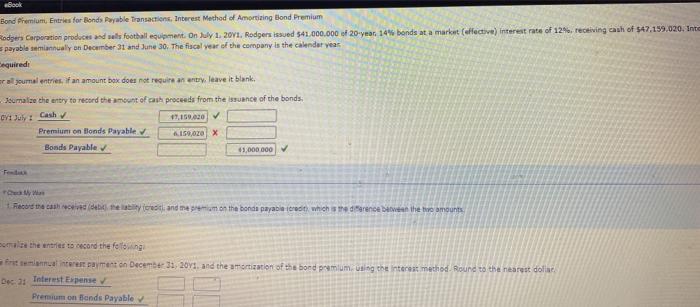

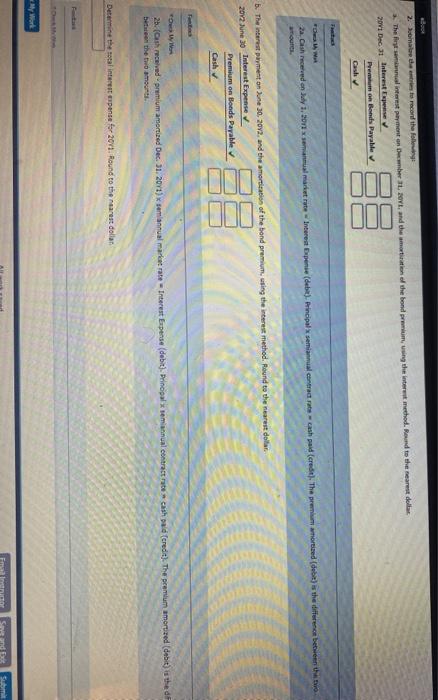

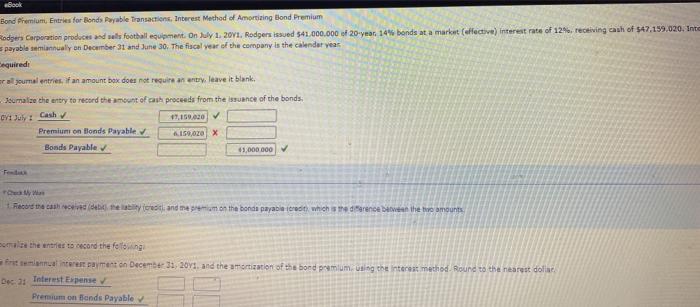

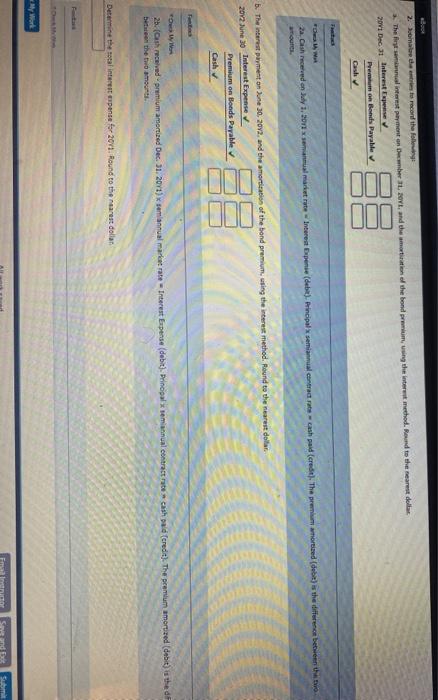

a Chapter 11 Work Problems -P x CengageNOW2 Online teachinx Cengage Learning enow.com/ilm/takeAssignment/takeAssignmentMain.doFinvoker=&takeAssignmentSessionLocator=&inprogress=false tool premium, et for bonds payable transactions Present Value Tables Chart of Accounts Journal Final Questions actions Campbell Prades and hot only 1.201 Campbell issued 321,000,000 of 10-12% bonds ata mare efective interest rate of 11%, receiving cash of $22.254.800. Interest on the bonds is payable ser Deer and 30. The fiscal year of the company is the calendar year Required 1 Jouets e tytuache ancort d'un proceeds from the source of the bonds on May 1, 2014 2 were the rest or the following a. The first seamna s pamer on December 3, 2014, and the amorturation of the bond premium using the magnetne memed Rand) The last payment on une 30 2012 and the amortization of the bons premum ung strapatine method iPound to the nearest 2 Dewane for 20Y wine bond proceeds to be pater than the face out of the Bondsten the contrast rate a greater than the market rate of interest Compuluhu 22.234.00 ved for the bonds by using the presenevale fabled (Round to be reset dolor] e to Chat counter wording of sont le Book Bond Premium, Entries for Bonds Payable Transactions Interest Method of Amortizing blond Premium Rodgers Corporation produces and selfootball equipment. On July 1. 2011. Rodgers issued $41.000.000 of 20-year 10% bends at a market (effective) interest rate of 129. Teceiving ash of 547,159,020. Inte s payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year equired rol joumal entries. If an amount box does not require an entry leave it blank Joomalize the entry to record the amount of cash proceeds from the issuance of the bonds cv1 July Cash Premium on Blonds Payable 150,00 X Bonds Payable 43.000000 Recortable and on the bonds payable credit which is the dance between the teamounts Bore the entries to record the following freemaal nerer payment on December 31, 201, and the amortization of the bond premium. Uting the interest method Round to the nearest do Dec 3: Interest Expense Premium on Bonds Payable Som record the folle The first ainst payment on December, and the motion of the band premium, sing the interest method. Round to the nearest dollar 2011 Dec si interest Pre on Bands Payable Cash 2a Cash recevedonly 1, 2011 maart rate Interest Expense (debit) Principal semana contra as cash pad (cedit). The premium amorized (debit) is the difference between the Toutes B. The interest payment on June 30, 2012, and the amortization of the bond premium, using the interest method. Round to the nearest dollar 2012 June Interest Expense Premium on Bonds Payable Cash 100 dll 2. (Ch received-premium amortized Dec. 31. 2011) X semiannual market rate - Interest Expense (debit). Principals semiannual contract rate cash bald (credit). The premium amorized (debit) lethed between the two amous Determine the total interest Expense for 2011. Round to the nearest dolla My Work FO Sed Sub a Chapter 11 Work Problems -P x CengageNOW2 Online teachinx Cengage Learning enow.com/ilm/takeAssignment/takeAssignmentMain.doFinvoker=&takeAssignmentSessionLocator=&inprogress=false tool premium, et for bonds payable transactions Present Value Tables Chart of Accounts Journal Final Questions actions Campbell Prades and hot only 1.201 Campbell issued 321,000,000 of 10-12% bonds ata mare efective interest rate of 11%, receiving cash of $22.254.800. Interest on the bonds is payable ser Deer and 30. The fiscal year of the company is the calendar year Required 1 Jouets e tytuache ancort d'un proceeds from the source of the bonds on May 1, 2014 2 were the rest or the following a. The first seamna s pamer on December 3, 2014, and the amorturation of the bond premium using the magnetne memed Rand) The last payment on une 30 2012 and the amortization of the bons premum ung strapatine method iPound to the nearest 2 Dewane for 20Y wine bond proceeds to be pater than the face out of the Bondsten the contrast rate a greater than the market rate of interest Compuluhu 22.234.00 ved for the bonds by using the presenevale fabled (Round to be reset dolor] e to Chat counter wording of sont le Book Bond Premium, Entries for Bonds Payable Transactions Interest Method of Amortizing blond Premium Rodgers Corporation produces and selfootball equipment. On July 1. 2011. Rodgers issued $41.000.000 of 20-year 10% bends at a market (effective) interest rate of 129. Teceiving ash of 547,159,020. Inte s payable semiannually on December 31 and June 30. The fiscal year of the company is the calendar year equired rol joumal entries. If an amount box does not require an entry leave it blank Joomalize the entry to record the amount of cash proceeds from the issuance of the bonds cv1 July Cash Premium on Blonds Payable 150,00 X Bonds Payable 43.000000 Recortable and on the bonds payable credit which is the dance between the teamounts Bore the entries to record the following freemaal nerer payment on December 31, 201, and the amortization of the bond premium. Uting the interest method Round to the nearest do Dec 3: Interest Expense Premium on Bonds Payable Som record the folle The first ainst payment on December, and the motion of the band premium, sing the interest method. Round to the nearest dollar 2011 Dec si interest Pre on Bands Payable Cash 2a Cash recevedonly 1, 2011 maart rate Interest Expense (debit) Principal semana contra as cash pad (cedit). The premium amorized (debit) is the difference between the Toutes B. The interest payment on June 30, 2012, and the amortization of the bond premium, using the interest method. Round to the nearest dollar 2012 June Interest Expense Premium on Bonds Payable Cash 100 dll 2. (Ch received-premium amortized Dec. 31. 2011) X semiannual market rate - Interest Expense (debit). Principals semiannual contract rate cash bald (credit). The premium amorized (debit) lethed between the two amous Determine the total interest Expense for 2011. Round to the nearest dolla My Work FO Sed Sub