Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Chinese-owned ice-cream parlour located in the U.S. has the following accounting record related to its business during 2019: Total sales revenue Total costs

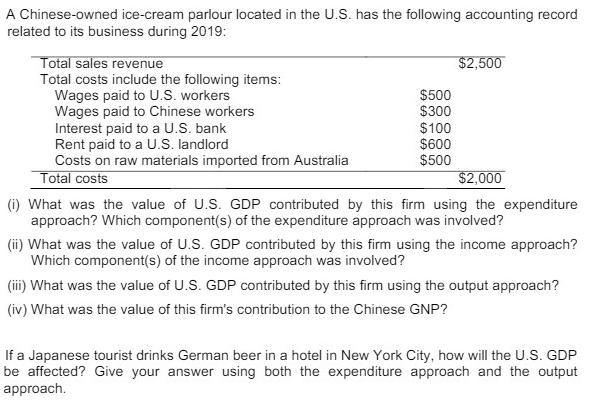

A Chinese-owned ice-cream parlour located in the U.S. has the following accounting record related to its business during 2019: Total sales revenue Total costs include the following items: Wages paid to U.S. workers Wages paid to Chinese workers Interest paid to a U.S. bank Rent paid to a U.S. landlord Costs on raw materials imported from Australia Total costs $500 $300 $100 $600 $500 $2,500 $2,000 (i) What was the value of U.S. GDP contributed by this firm using the expenditure approach? Which component(s) of the expenditure approach was involved? (ii) What was the value of U.S. GDP contributed by this firm using the income approach? Which component(s) of the income approach was involved? (iii) What was the value of U.S. GDP contributed by this firm using the output approach? (iv) What was the value of this firm's contribution to the Chinese GNP? If a Japanese tourist drinks German beer in a hotel in New York City, how will the U.S. GDP be affected? Give your answer using both the expenditure approach and the output approach.

Step by Step Solution

★★★★★

3.59 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

i The value of US GDP contributed by this firm using the expenditure approach can be calculated as follows GDP C I G NX whereC consumption spendingI investment spendingG government spendingNX net expo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started