Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A chocolate company (ticker: CHOC) announces a surprise acquisition of a peanut butter company (PB). By securing a steady supply of peanut butter, CHOC hopes

A chocolate company (ticker: CHOC) announces a surprise acquisition of a peanut butter company (PB). By securing a steady supply of peanut butter, CHOC hopes to produce chocolate peanut butter cups more cheaply.

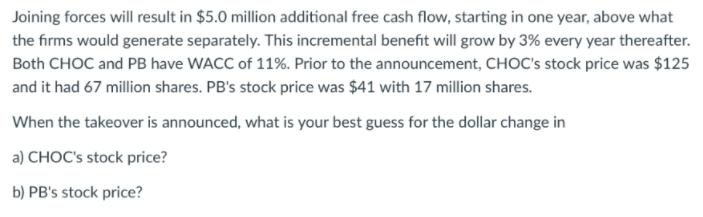

Joining forces will result in $5.0 million additional free cash flow, starting in one year, above what the firms would generate separately. This incremental benefit will grow by 3% every year thereafter. Both CHOC and PB have WACC of 11%. Prior to the announcement, CHOC s stock price was $125 and it had 67 million shares. PB s stock price was $41 with 17 million shares. When the takeover is announced, what is your best guess for the dollar change in a) CHOC s stock price? b) PB s stock price?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Value of Synergy from the takeover constant growth model 5 million 011 003 625 million CHOCs market ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started