Question

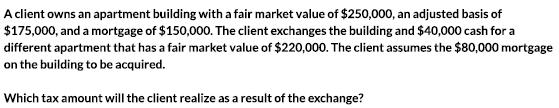

A client owns an apartment building with a fair market value of $250,000, an adjusted basis of $175,000, and a mortgage of $150,000. The

A client owns an apartment building with a fair market value of $250,000, an adjusted basis of $175,000, and a mortgage of $150,000. The client exchanges the building and $40,000 cash for a different apartment that has a fair market value of $220,000. The client assumes the $80,000 mortgage on the building to be acquired. Which tax amount will the client realize as a result of the exchange?

Step by Step Solution

3.36 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

The client will realize a capital gain of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Taxation For Decision Makers 2017

Authors: Shirley Dennis Escoffier, Karen Fortin

7th Edition

1119330416, 978-1119330417

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App