Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A closed-end fund that has 400 shares outstanding consists of the following: Assets: 200 shares of Shake Shak Inc (SHAK) common stock @ $40/share

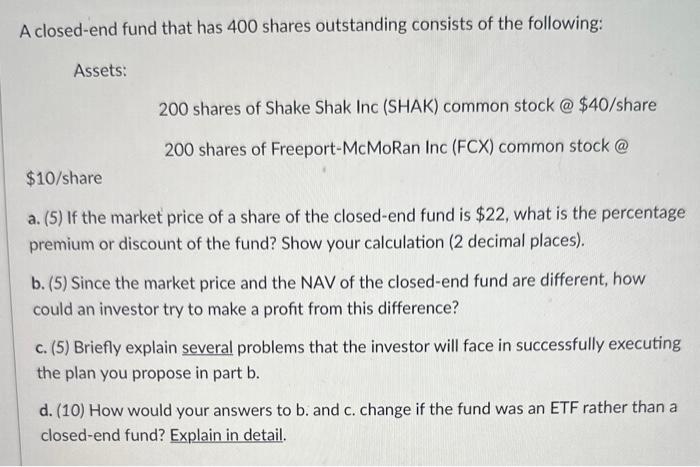

A closed-end fund that has 400 shares outstanding consists of the following: Assets: 200 shares of Shake Shak Inc (SHAK) common stock @ $40/share 200 shares of Freeport-McMoRan Inc (FCX) common stock @ $10/share a. (5) If the market price of a share of the closed-end fund is $22, what is the percentage premium or discount of the fund? Show your calculation (2 decimal places). b. (5) Since the market price and the NAV of the closed-end fund are different, how could an investor try to make a profit from this difference? c. (5) Briefly explain several problems that the investor will face in successfully executing the plan you propose in part b. d. (10) How would your answers to b. and c. change if the fund was an ETF rather than a closed-end fund? Explain in detail.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the percentage premium or discount of the closedend fund we need to compare the market price per share to the Net Asset Value NAV per share The NAV per share is calculated by dividing t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started