Answered step by step

Verified Expert Solution

Question

1 Approved Answer

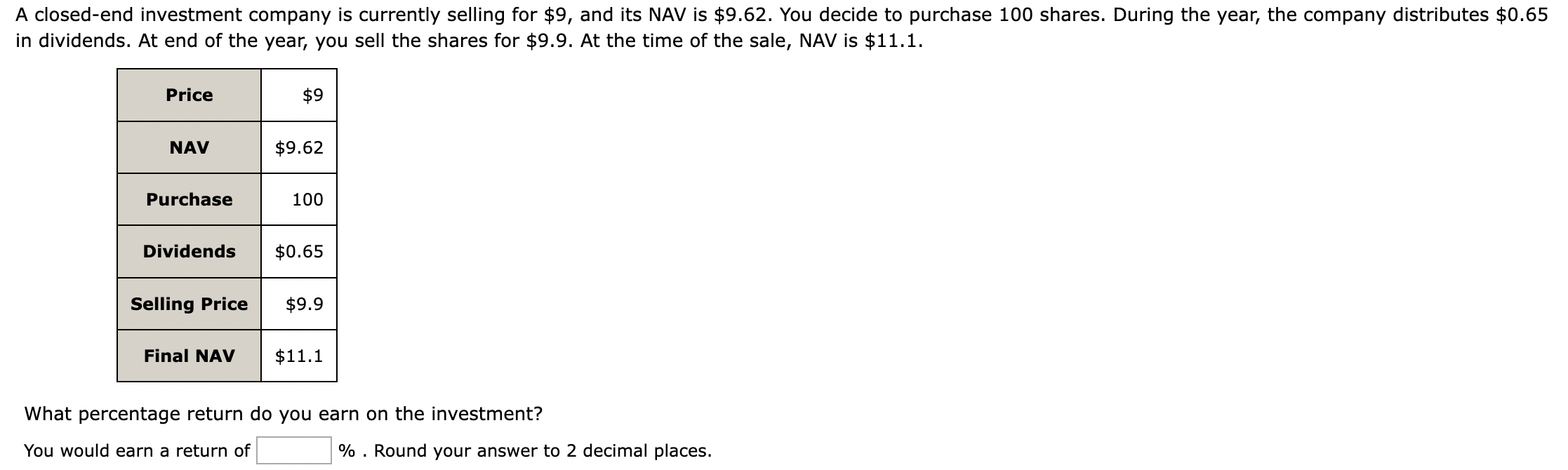

A closed-end investment company is currently selling for $9, and its NAV is $9.62. You decide to purchase 100 shares. During the year, the company

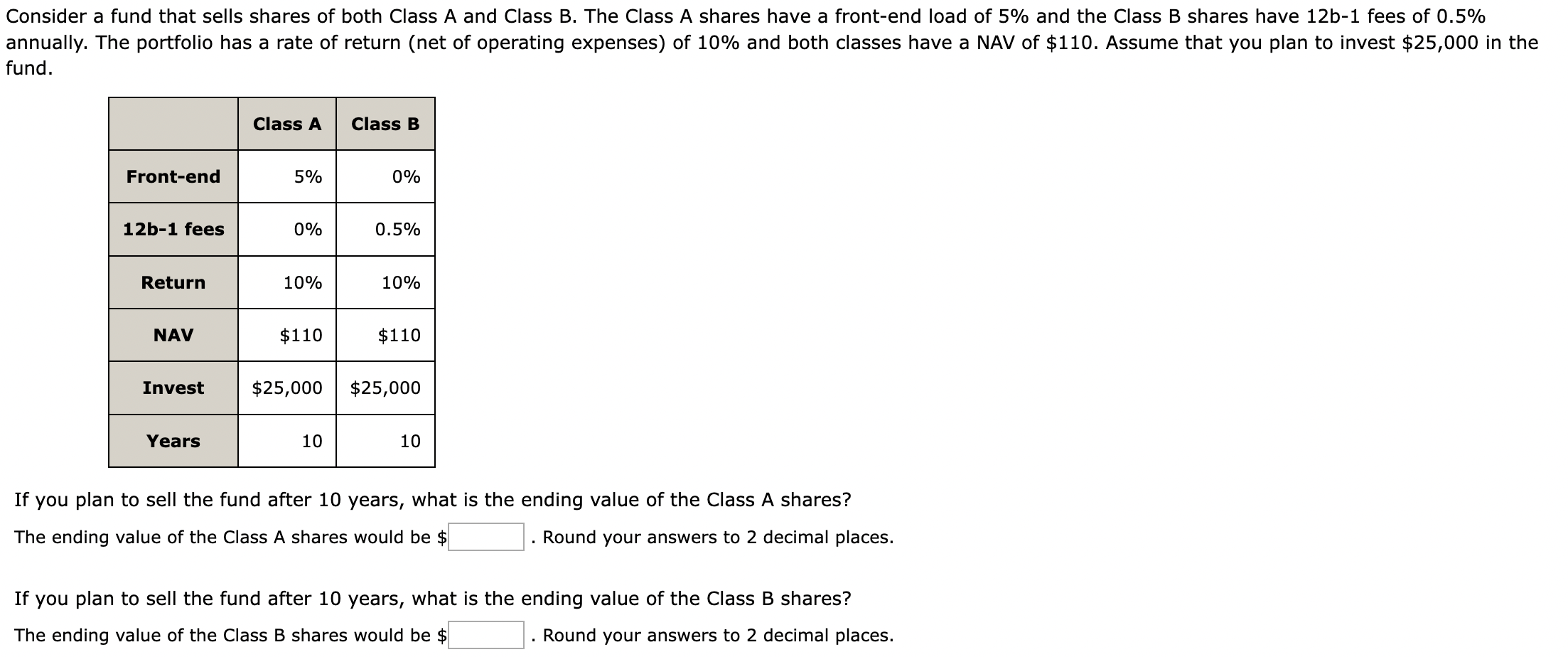

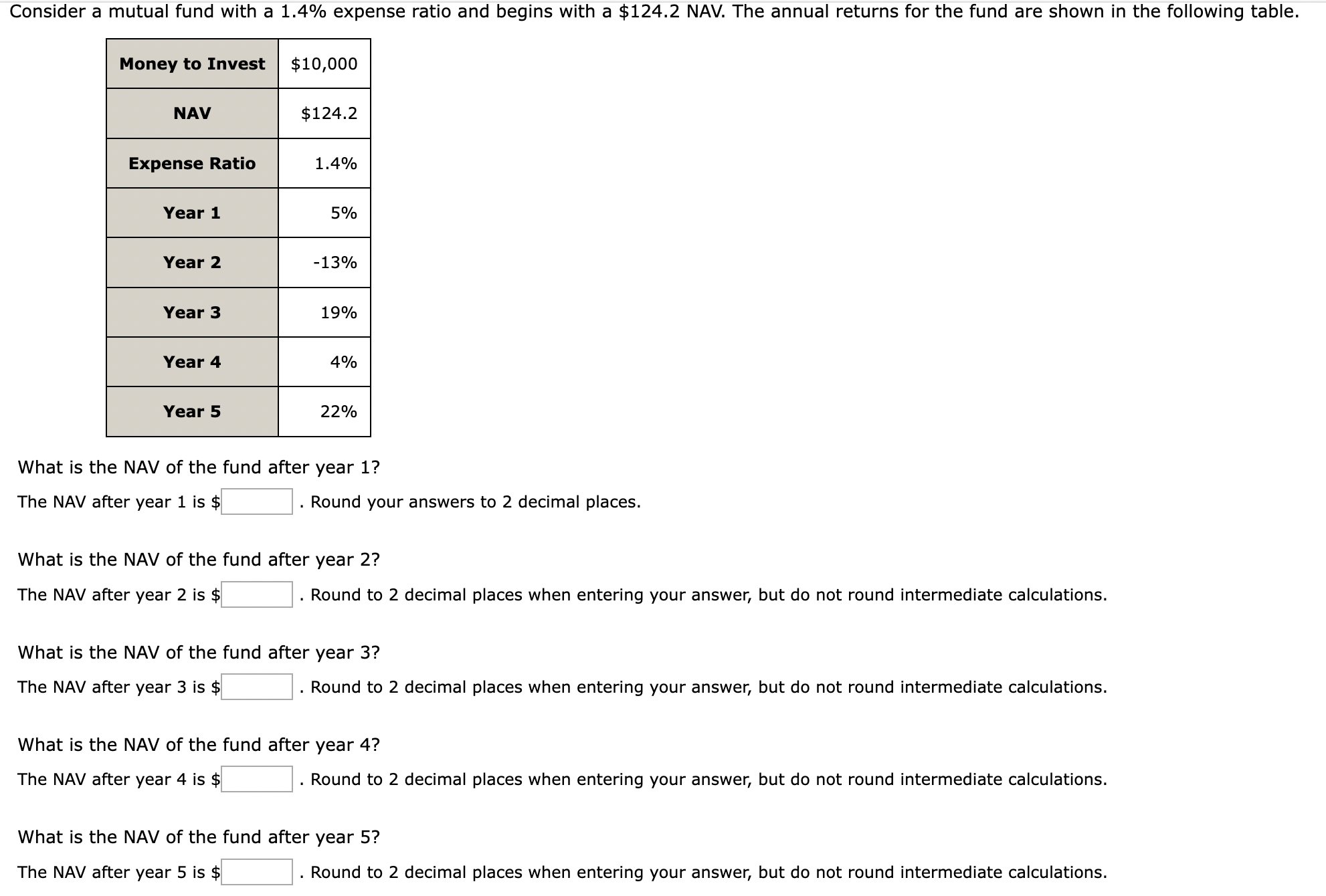

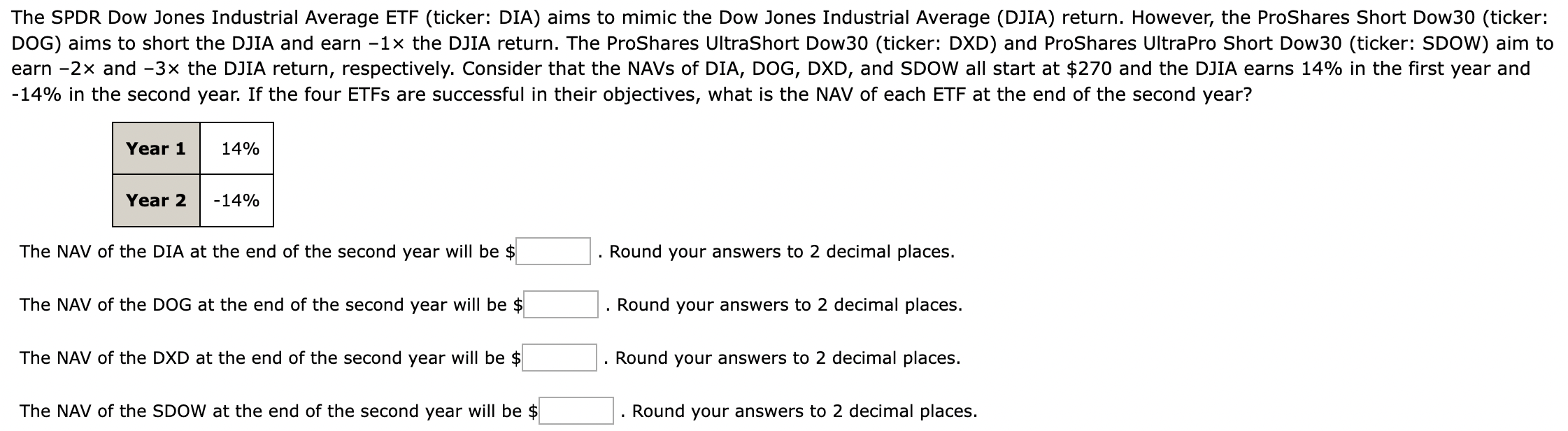

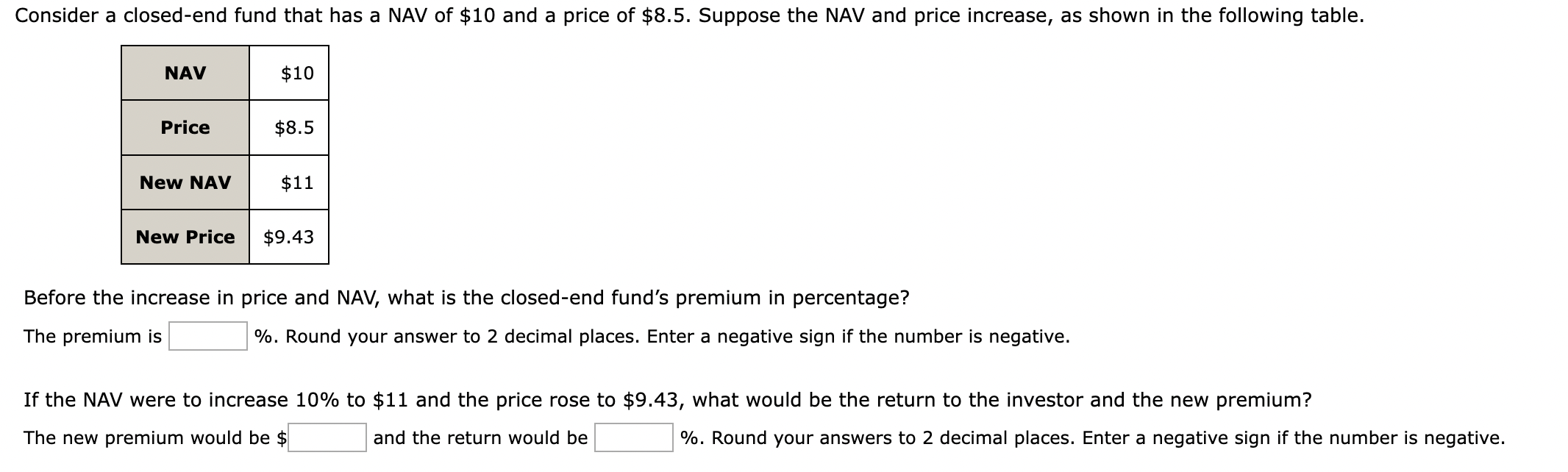

A closed-end investment company is currently selling for $9, and its NAV is $9.62. You decide to purchase 100 shares. During the year, the company distributes $0.65 in dividends. At end of the year, you sell the shares for $9.9. At the time of the sale, NAV is $11.1. What percentage return do you earn on the investment? You would earn a return of %. Round your answer to 2 decimal places. Consider a fund that sells shares of both Class A and Class B. The Class A shares have a front-end load of 5% and the Class B shares have 12b1 fees of 0.5% annually. The portfolio has a rate of return (net of operating expenses) of 10% and both classes have a NAV of $110. Assume that you plan to invest $25,000 in the fund. If you plan to sell the fund after 10 years, what is the ending value of the Class A shares? The ending value of the Class A shares would be : . Round your answers to 2 decimal places. If you plan to sell the fund after 10 years, what is the ending value of the Class B shares? The ending value of the Class B shares would be s . Round your answers to 2 decimal places. The SPDR Dow Jones Industrial Average ETF (ticker: DIA) aims to mimic the Dow Jones Industrial Average (DJIA) return. However, the ProShares Short Dow30 (ticker: DOG) aims to short the DJIA and earn 1 the DJIA return. The ProShares UltraShort Dow30 (ticker: DXD) and ProShares UltraPro Short Dow30 (ticker: SDOW) aim to earn 2x and 3 the DJIA return, respectively. Consider that the NAVs of DIA, DOG, DXD, and SDOW all start at $270 and the DJIA earns 14% in the first year and 14% in the second year. If the four ETFs are successful in their objectives, what is the NAV of each ETF at the end of the second year? The NAV of the DIA at the end of the second year will be \$ The NAV of the DOG at the end of the second year will be \$ The NAV of the DXD at the end of the second year will be \$ The NAV of the SDOW at the end of the second year will be $ . Round your answers to 2 decimal places. . Round your answers to 2 decimal places. . Round your answers to 2 decimal places. . Round your answers to 2 decimal places. What is the NAV of the fund after year 1 ? The NAV after year 1 is $ . Round your answers to 2 decimal places. What is the NAV of the fund after year 2 ? The NAV after year 2 is $ . Round to 2 decimal places when entering your answer, but do not round intermediate calculations. What is the NAV of the fund after year 3 ? The NAV after year 3 is $ . Round to 2 decimal places when entering your answer, but do not round intermediate calculations. What is the NAV of the fund after year 4 ? The NAV after year 4 is $ . Round to 2 decimal places when entering your answer, but do not round intermediate calculations. What is the NAV of the fund after year 5 ? The NAV after year 5 is $ . Round to 2 decimal places when entering your answer, but do not round intermediate calculations. Consider a closed-end fund that has a NAV of $10 and a price of $8.5. Suppose the NAV and price increase, as shown in the following table. Before the increase in price and NAV, what is the closed-end fund's premium in percentage? The premium is %. Round your answer to 2 decimal places. Enter a negative sign if the number is negative. If the NAV were to increase 10% to $11 and the price rose to $9.43, what would be the return to the investor and the new premium? The new premium would be \$ and the return would be \%. Round your answers to 2 decimal places. Enter a negative sign if the number is negativ

A closed-end investment company is currently selling for $9, and its NAV is $9.62. You decide to purchase 100 shares. During the year, the company distributes $0.65 in dividends. At end of the year, you sell the shares for $9.9. At the time of the sale, NAV is $11.1. What percentage return do you earn on the investment? You would earn a return of %. Round your answer to 2 decimal places. Consider a fund that sells shares of both Class A and Class B. The Class A shares have a front-end load of 5% and the Class B shares have 12b1 fees of 0.5% annually. The portfolio has a rate of return (net of operating expenses) of 10% and both classes have a NAV of $110. Assume that you plan to invest $25,000 in the fund. If you plan to sell the fund after 10 years, what is the ending value of the Class A shares? The ending value of the Class A shares would be : . Round your answers to 2 decimal places. If you plan to sell the fund after 10 years, what is the ending value of the Class B shares? The ending value of the Class B shares would be s . Round your answers to 2 decimal places. The SPDR Dow Jones Industrial Average ETF (ticker: DIA) aims to mimic the Dow Jones Industrial Average (DJIA) return. However, the ProShares Short Dow30 (ticker: DOG) aims to short the DJIA and earn 1 the DJIA return. The ProShares UltraShort Dow30 (ticker: DXD) and ProShares UltraPro Short Dow30 (ticker: SDOW) aim to earn 2x and 3 the DJIA return, respectively. Consider that the NAVs of DIA, DOG, DXD, and SDOW all start at $270 and the DJIA earns 14% in the first year and 14% in the second year. If the four ETFs are successful in their objectives, what is the NAV of each ETF at the end of the second year? The NAV of the DIA at the end of the second year will be \$ The NAV of the DOG at the end of the second year will be \$ The NAV of the DXD at the end of the second year will be \$ The NAV of the SDOW at the end of the second year will be $ . Round your answers to 2 decimal places. . Round your answers to 2 decimal places. . Round your answers to 2 decimal places. . Round your answers to 2 decimal places. What is the NAV of the fund after year 1 ? The NAV after year 1 is $ . Round your answers to 2 decimal places. What is the NAV of the fund after year 2 ? The NAV after year 2 is $ . Round to 2 decimal places when entering your answer, but do not round intermediate calculations. What is the NAV of the fund after year 3 ? The NAV after year 3 is $ . Round to 2 decimal places when entering your answer, but do not round intermediate calculations. What is the NAV of the fund after year 4 ? The NAV after year 4 is $ . Round to 2 decimal places when entering your answer, but do not round intermediate calculations. What is the NAV of the fund after year 5 ? The NAV after year 5 is $ . Round to 2 decimal places when entering your answer, but do not round intermediate calculations. Consider a closed-end fund that has a NAV of $10 and a price of $8.5. Suppose the NAV and price increase, as shown in the following table. Before the increase in price and NAV, what is the closed-end fund's premium in percentage? The premium is %. Round your answer to 2 decimal places. Enter a negative sign if the number is negative. If the NAV were to increase 10% to $11 and the price rose to $9.43, what would be the return to the investor and the new premium? The new premium would be \$ and the return would be \%. Round your answers to 2 decimal places. Enter a negative sign if the number is negativ Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started