Question

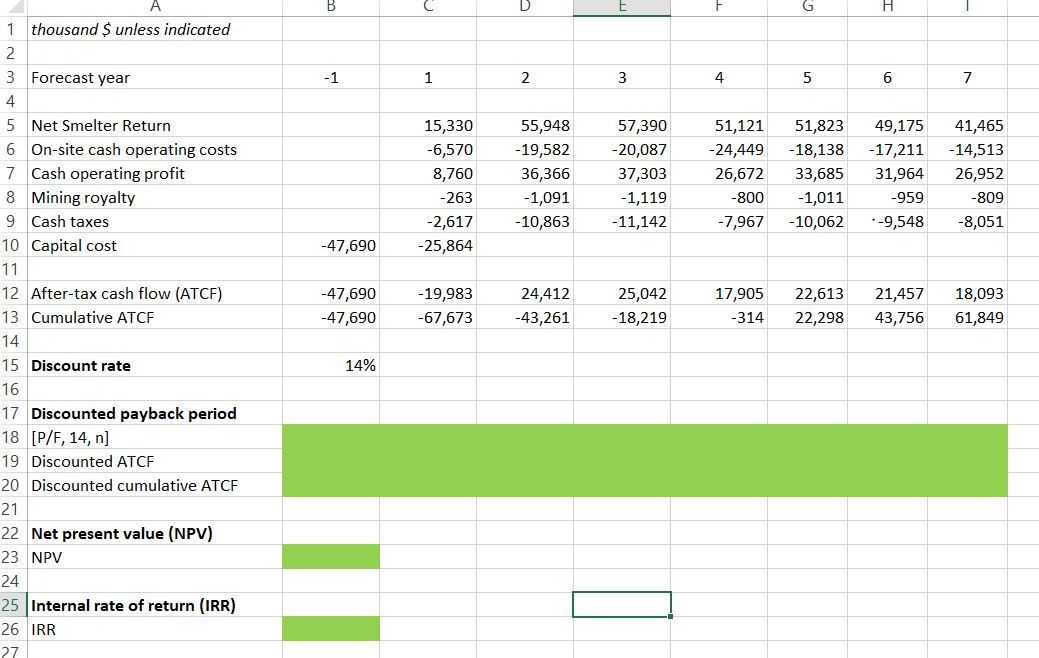

A colleague has been working to prepare a summary presentation in Excel of projected after-tax cash flows for a potential project. The discount rate to

A colleague has been working to prepare a summary presentation in Excel of projected after-tax cash flows for a potential project. The discount rate to be used is 14%. You may assume that the figures in this summary are calculated correctly, based on information available at this time. Your colleague has asked you to help with ensuring the summary is properly prepared to allow the calculation of the discounted payback period, the net present value, and the internal rate of return for the potential project

Part 1 -

(a) Your colleague says "Because the project produces revenue in column C, I entered the following values for the project year in row 3: -2, -1, 1,.. 6, because the first year in which revenue is generated should be project year -1" Is this correct or not, and why?

(b) Your colleague also says "The forecast includes $4 million for sustaining capital costs. I put that figure in row 10 as it is a type of capital cost, but I did not include it in calculating ATCF for that year? Is this correct or not, and why?

(c) Write the generic form of time value factor that needs to be input in cells B18 through I18

Part 2

Most of the cells in this spreadsheet are protected and cannot be altered. The following cells are not protected, and you may enter values and functions in them: B18..I18; B19..I19; B20..I20; B23; B26. You will be asked for a password the first time you try to input a value, formula or function in one or more of these cells -the password (case sensitive) is open; after entering the password you should be able to input into any/all of these cells

(a)Input all values and formulae needed to complete rows 18, 19 and 20 in the spreadsheet, and determine the approximate discounted payback period of this project (precise interpolation is not required)

(b)Calculate the net present value (NPV) of this project using a discount rate of 14%

(c)Calculate the internal rate of return (IRR) of this projec

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started