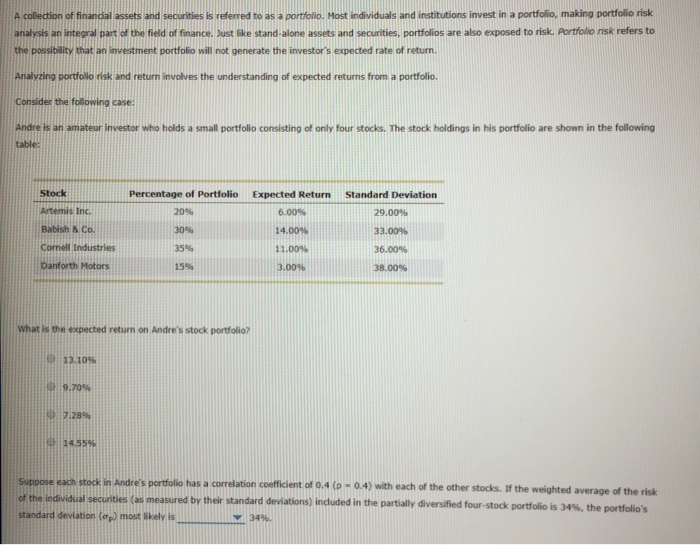

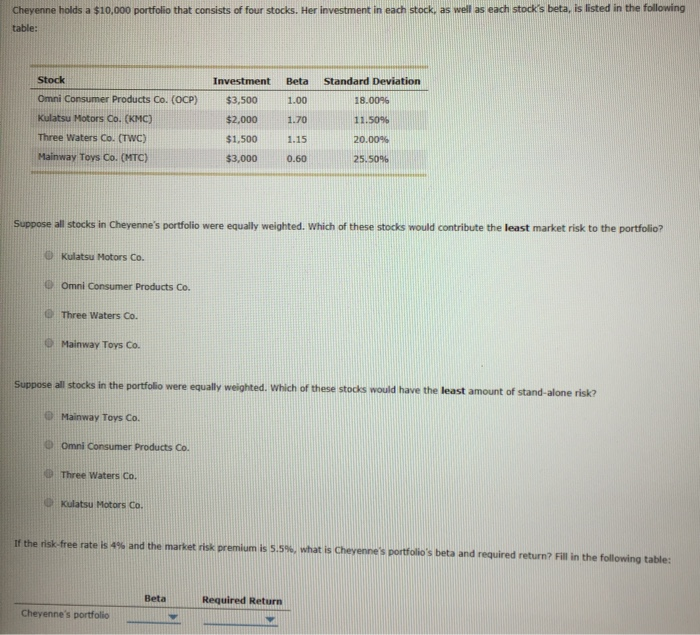

A collection of financial assets and securities is referred to as a portfolio. Most individuals and institutions invest in a portfolio, making portfolio risk analysis an integral part of the field of finance, Dust like stand-alone assets and securities. portfolios are also exposed to risk. Portfolio risk refers to the possibility that an investment portfolio will not generate the investor's expected rate of return Analyzing portfolio risk and return involves the understanding of expected returns from a portfolio. Consider the following case: Andre is an amateur investor who holds a small portfolio consisting of only four stocks. The stock holdings in his portfolio are shown in the following Stock Percentage of Portfolio Expected Return Standard Deviation 29.00% Babish & CO 3094 14.009 32.0096 11.009 35% 15% 36.00% 38.00% Danforth Motors what is the expected return on Andre's stock portfolio? 114 5596 Suppose each stock in Andre's portfolio has a correlation coefficient of 0.4 (0 - 0.4) with each of the other stocks. If the weighted average of the risk of the individual securities (as measured by their standard deviations) included in the partially diversified four-stock portfolio is 34%, the portfolio's standard deviation () most heyenne holds a $10,000 portfolio that consists of four stocks. Her investment in each stock, as well as each stock's beta, is listed in the following table: Stock Omni Consumer Products Co. (OCP) Kulatsu Motors Co. (KMC) Three Waters Co. (TWC) Mainway Toys Co. (MTC) Investment $3,500 $2,000 $1,500 $3,000 Beta 1.00 1.70 1.15 0.60 Standard Deviation 18.0096 11.50% 20.00% 25.5096 Suppose all stocks in Cheyenne's portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Kulatsu Motors Co. Omni Consumer Products Co. Three Waters Co. Mainway Toys Co. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Mainway Toys Co. Omni Consumer Products Co. Three Waters Co. Kulatsu Motors Co. If the risk-free rate is 4% and the market risk premium is 5.5%, what is Cheyenne's portfolio's beta and required return? Fill in the following table: Required Return Cheyenne's portfolio