Answered step by step

Verified Expert Solution

Question

1 Approved Answer

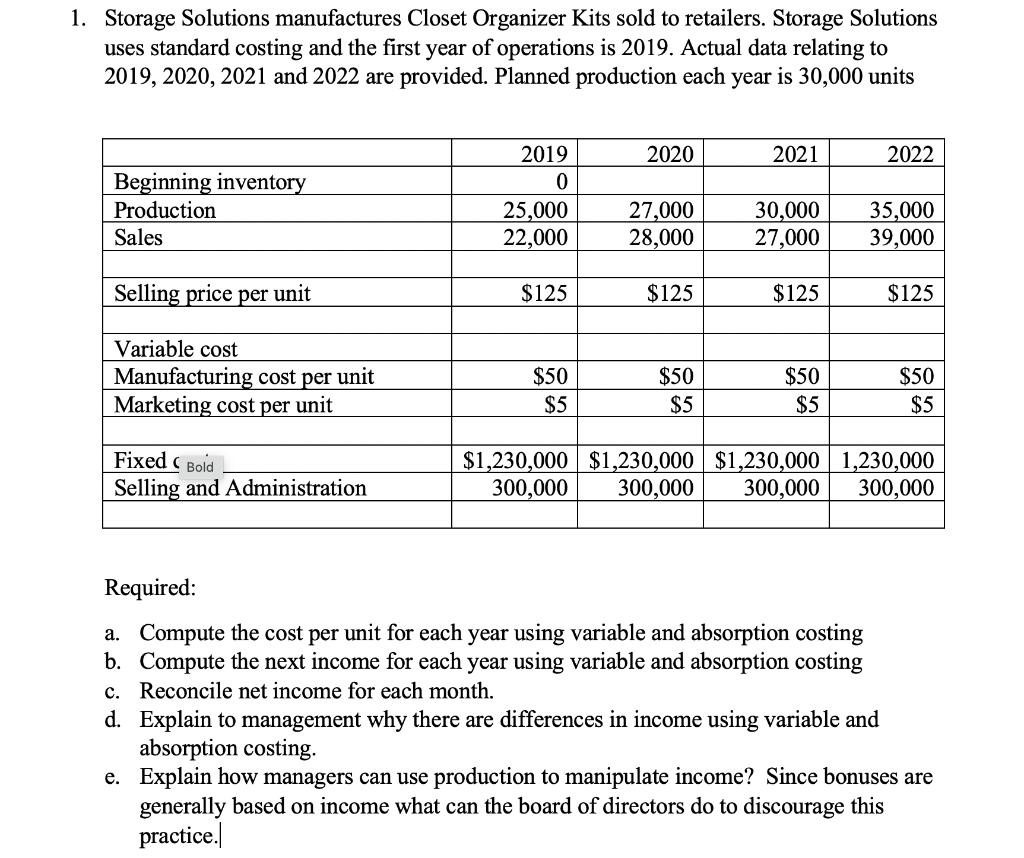

1. Storage Solutions manufactures Closet Organizer Kits sold to retailers. Storage Solutions uses standard costing and the first year of operations is 2019. Actual

1. Storage Solutions manufactures Closet Organizer Kits sold to retailers. Storage Solutions uses standard costing and the first year of operations is 2019. Actual data relating to 2019, 2020, 2021 and 2022 are provided. Planned production each year is 30,000 units Beginning inventory Production Sales Selling price per unit Variable cost Manufacturing cost per unit Marketing cost per unit Fixed Bold Selling and Administration 2019 0 25,000 22,000 $125 $50 $5 2020 27,000 28,000 $125 $50 $5 2021 30,000 35,000 27,000 39,000 $125 $50 $5 2022 Required: a. Compute the cost per unit for each year using variable and absorption costing b. Compute the next income for each year using variable and absorption costing c. Reconcile net income for each month. $125 $50 $5 $1,230,000 $1,230,000 $1,230,000 1,230,000 300,000 300,000 300,000 300,000 d. Explain to management why there are differences in income using variable and absorption costing. e. Explain how managers can use production to manipulate income? Since bonuses are generally based on income what can the board of directors do to discourage this practice.

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Cost per unit for each year using variable and absorption costing Variable Costing 2019 50 5 55 per unit 2020 50 5 55 per unit 2021 50 5 55 per unit 2022 50 5 55 per unit Absorption Costing 2019 50 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started