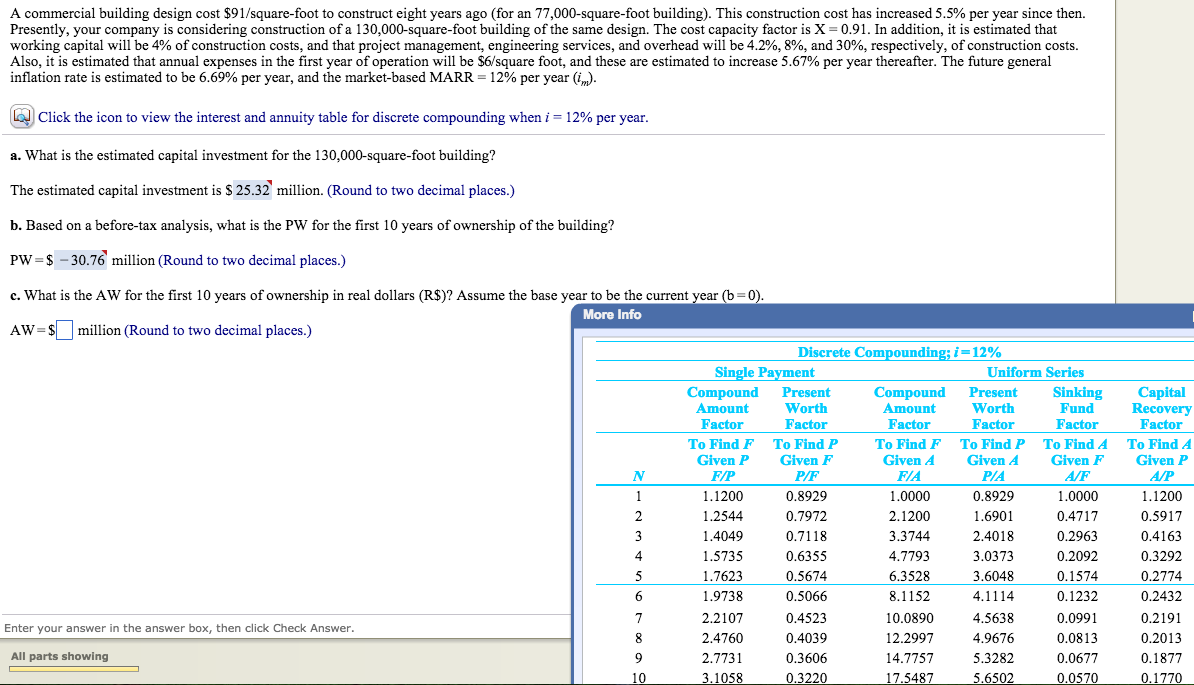

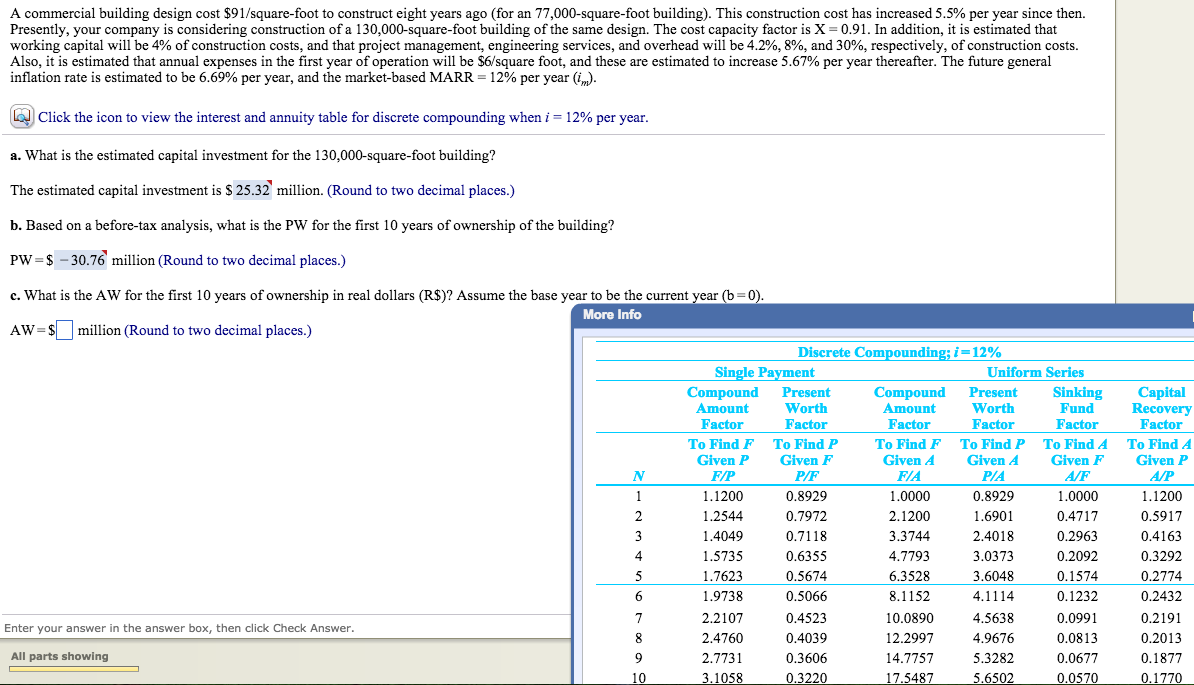

A commercial building design cost $91/square-foot to construct eight years ago (for an 77,000-square-foot building). This construction cost has increased 5.5% per year since then. Presently, your company is considering construction of a 130,000-square-foot building of the same design. The cost capacity factor is X 0.91. In addition, it is estimated that working capital will be 4% of construction costs, and that project management, engineering services, and overhead will be 4.2%, 8%, and 30%, respectively, of construction costs Also, it is estimated that annual expenses in the first year of operation will be $6/square foot, and these are estimated to increase 5.67% per year thereafter. The future general inflation rate is estimated to be 6.69% per year, and the market-based MARR 12% per year (im) Click the icon to view the interest and annuity table for discrete compounding when i 12% per year. a. What is the estimated capital investment for the 130,000-square-foot building? The estimated capital investment is s 25.32 million. (Round to two decimal places b. Based on a before-tax analysis, what is the PW for the first 10 years of ownership of the building? Pw $-30.76 million (Round to two decimal places.) c. What is the AW for the first 10 years of ownership in real dollars (R$)? Assume the base year to be the current year b 00 More Info AW SL lion (Round to two decimal places Discrete Compounding i 12% Uniform Series Single P ent Compound Present Compound Present Amount Worth Amount Worth Fund Factor Factor Factor Factor Factor To Find F To Find P To Find F To Find P To Find A Given P Given F Given A Given A Given F FIP P/F 1.1200 0.8929 1.0000 0.8929 1.0000 0.7972 2.1200 1.2544 1.6901 0.4717 0.2963 4049 0.7118 3.3744 2.4018 0.2092 1.5735 0.6355 4.7793 3.0373 1.7623 6.3528 0.5674 3.6048 0.1574 0.5066 0.1232 1.9738 8.1152 4.1114 2.2107 0.4523 10.0890 4.5638 0.0991 Enter your answer in the answer box, then click Check Answer 0.0813 2.4760 12.2997 4.9676 0.4039 All parts showing 0.3606 14.7757 5.3282 2.7731 0.0677 10 3,1058 0.3220 17.5487 5.6502 0.0570 Capital Recovery Factor To Find A Given P 1.1200 0.5917 0.4163 0.3292 0.2774 0.2432 0.2191 0.2013 0.1877 0.1770