A commercial real estate investment fund must report its quarterly investment performance to investors. A summary of its (1) beginning and end-of-quarter assets and

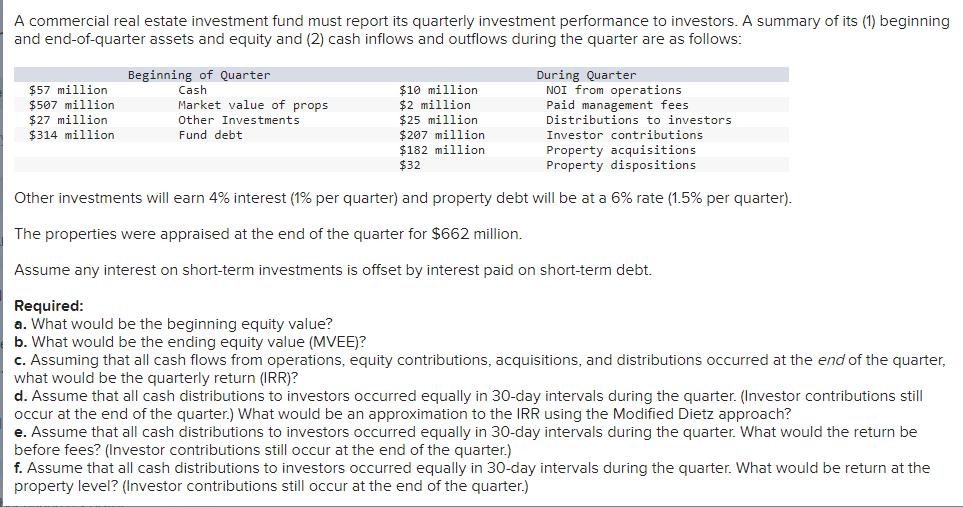

A commercial real estate investment fund must report its quarterly investment performance to investors. A summary of its (1) beginning and end-of-quarter assets and equity and (2) cash inflows and outflows during the quarter are as follows: Beginning of Quarter Cash $57 million $507 million $27 million. $10 million Market value of props $2 million $314 million Other Investments Fund debt $25 million $207 million $182 million $32 During Quarter NOI from operations Paid management fees Distributions to investors Investor contributions Property acquisitions Property dispositions Other investments will earn 4% interest (1% per quarter) and property debt will be at a 6% rate (1.5% per quarter). The properties were appraised at the end of the quarter for $662 million. Assume any interest on short-term investments is offset by interest paid on short-term debt. Required: a. What would be the beginning equity value? b. What would be the ending equity value (MVEE)? c. Assuming that all cash flows from operations, equity contributions, acquisitions, and distributions occurred at the end of the quarter, what would be the quarterly return (IRR)? d. Assume that all cash distributions to investors occurred equally in 30-day intervals during the quarter. (Investor contributions still occur at the end of the quarter.) What would be an approximation to the IRR using the Modified Dietz approach? e. Assume that all cash distributions to investors occurred equally in 30-day intervals during the quarter. What would the return be before fees? (Investor contributions still occur at the end of the quarter.) f. Assume that all cash distributions to investors occurred equally in 30-day intervals during the quarter. What would be return at the property level? (Investor contributions still occur at the end of the quarter.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the required values well go through each question step by step a Beginning Equity Value To calculate the beginning equity value we need to subtract the beginning cash from the beginning a...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started