Question

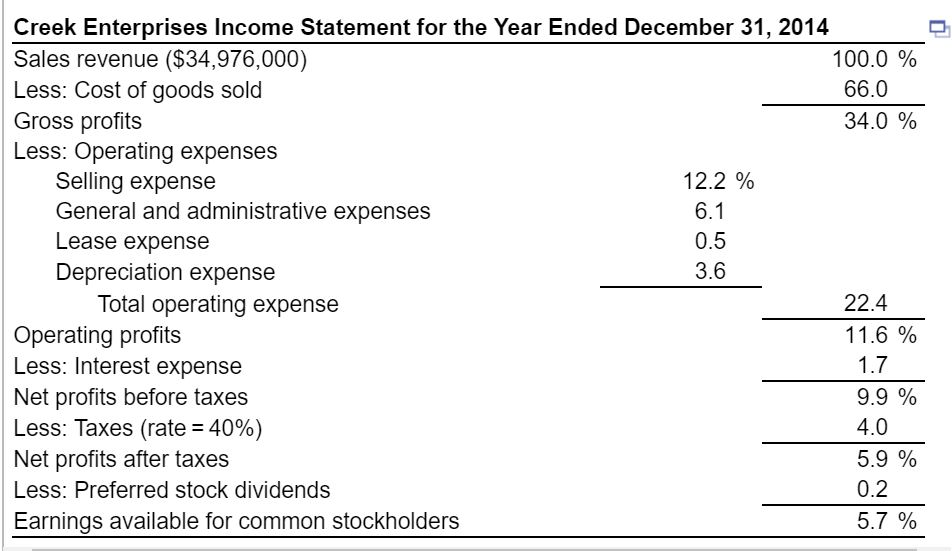

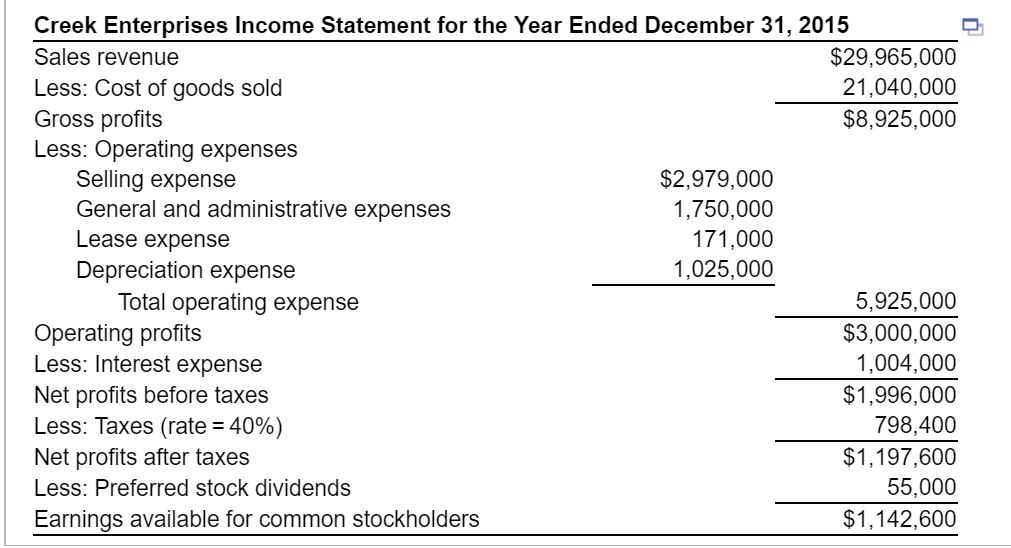

A common-size income statement for Creek Enterprises' 2014 operations follows AA picture Using the firm's 2015 income statement BB picture develop the 2015 common-size income

A common-size income statement for Creek Enterprises' 2014 operations follows AA picture Using the firm's 2015 income statement BB picture develop the 2015 common-size income statement and compare it to the 2014 statement. Which areas require further analysis and investigation?

Complete the common-size income statement for the year ending December 31, 2015 and compare it to the common-size income statement for the year ending December 2014: (Round to one decimalplace.)

| Creek Enterprises | ||||||||

| Common-Size Income Statement | ||||||||

| for the Years Ended December 31, 2014 and December 2015 | ||||||||

|

| 2015 | 2014 | ||||||

| Sales revenue |

| % | 100.0 | % | ||||

| Less: Cost of goods sold |

|

| 66.0 |

| ||||

| Gross profits |

| % | 34.0 | % | ||||

| Less: Operating expenses |

|

| ||||||

| Selling expense |

| % |

| 12.2 | % |

| ||

| General and administrative expenses |

|

| 6.1 |

| ||||

| Lease expense |

|

| 0.5 |

| ||||

| Depreciation expense |

|

|

| 3.6 |

|

| ||

| Total operating expense |

|

| 22.4 |

| ||||

| Operating profits |

| % | 11.6 | % | ||||

| Less: Interest expense |

|

| 1.7 |

| ||||

| Net profits before taxes |

| % | 9.9 | % | ||||

| Less: Taxes (rate = 40%) |

|

| 4.0 |

| ||||

| Net profits after taxes |

| % | 5.9 | % | ||||

| Less: Preferred stock dividends |

|

| 0.2 |

| ||||

| Earnings available for common stockholders |

| % | 5.7 | % | ||||

Enter any number in the edit fields and then click Check Answer.

Creek Enterprises Income Statement for the Year Ended December 31, 2014 Sales revenue ($34,976,000) Less: Cost of goods sold Gross profits Less: Operating expenses 100.0 % 66.0 34.0 % 12.2 % Selling expense General and administrative expenses Lease expense Depreciation expense 0.5 3.6 lotal operating expense 22.4 Operating profits Less: Interest expense Net profits before taxes Less: Taxes (rate = 40%) Net profits after taxes Less: Preferred stock dividends Earnings available for common stockholders 11.6 % 9.9 % 4.0 5.9% 0.2 57 %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started