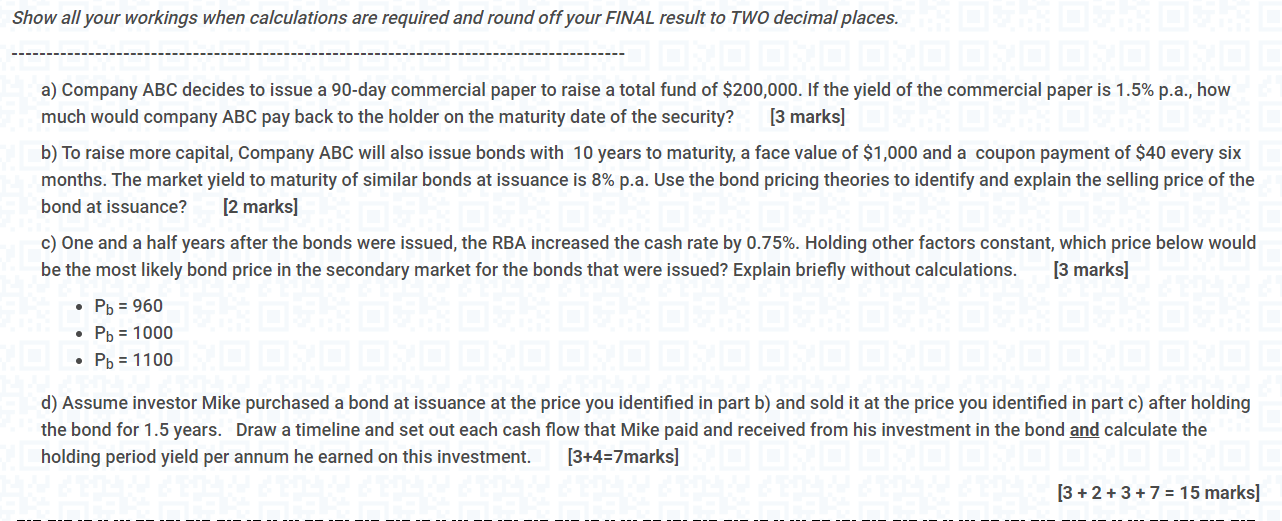

a) Company ABC decides to issue a 90 -day commercial paper to raise a total fund of $200,000. If the yield of the commercial paper is 1.5% p.a., how much would company ABC pay back to the holder on the maturity date of the security? [3 marks] b) To raise more capital, Company ABC will also issue bonds with 10 years to maturity, a face value of $1,000 and a coupon payment of $40 every six months. The market yield to maturity of similar bonds at issuance is 8% p.a. Use the bond pricing theories to identify and explain the selling price of the bond at issuance? [2 marks] c) One and a half years after the bonds were issued, the RBA increased the cash rate by 0.75%. Holding other factors constant, which price below would be the most likely bond price in the secondary market for the bonds that were issued? Explain briefly without calculations. [3 marks] - Pb=960 - Pb=1000 - Pb=1100 d) Assume investor Mike purchased a bond at issuance at the price you identified in part b) and sold it at the price you identified in part c) after holding the bond for 1.5 years. Draw a timeline and set out each cash flow that Mike paid and received from his investment in the bond and calculate the holding period yield per annum he earned on this investment. [3+4=7marks] [3+2+3+7=15marks] a) Company ABC decides to issue a 90 -day commercial paper to raise a total fund of $200,000. If the yield of the commercial paper is 1.5% p.a., how much would company ABC pay back to the holder on the maturity date of the security? [3 marks] b) To raise more capital, Company ABC will also issue bonds with 10 years to maturity, a face value of $1,000 and a coupon payment of $40 every six months. The market yield to maturity of similar bonds at issuance is 8% p.a. Use the bond pricing theories to identify and explain the selling price of the bond at issuance? [2 marks] c) One and a half years after the bonds were issued, the RBA increased the cash rate by 0.75%. Holding other factors constant, which price below would be the most likely bond price in the secondary market for the bonds that were issued? Explain briefly without calculations. [3 marks] - Pb=960 - Pb=1000 - Pb=1100 d) Assume investor Mike purchased a bond at issuance at the price you identified in part b) and sold it at the price you identified in part c) after holding the bond for 1.5 years. Draw a timeline and set out each cash flow that Mike paid and received from his investment in the bond and calculate the holding period yield per annum he earned on this investment. [3+4=7marks] [3+2+3+7=15marks]