Question

A company agreed on December 26 to provide consulting services to a client for a fixed fee of $3,000 for 60 days. Step 1: On

A company agreed on December 26 to provide consulting services to a client for a fixed fee of $3,000 for 60 days.

Step 1: On December 26, the client paid the 60-day fee in advance, covering the period December 27 to February 24. The entry to record the cash received in advance is:

DR Cash 3000 CR Unearned Consulting Revenue 3000

This advance payment increases cash and creates an obligation to do consulting work over the next 60 days (5 days this year and 55 days next year)

Step 2: As time passes, FastForward earns this payment through consulting. By December 31, it has provided five days' service and earned 5/60 of the $3,000 unearned revenue.

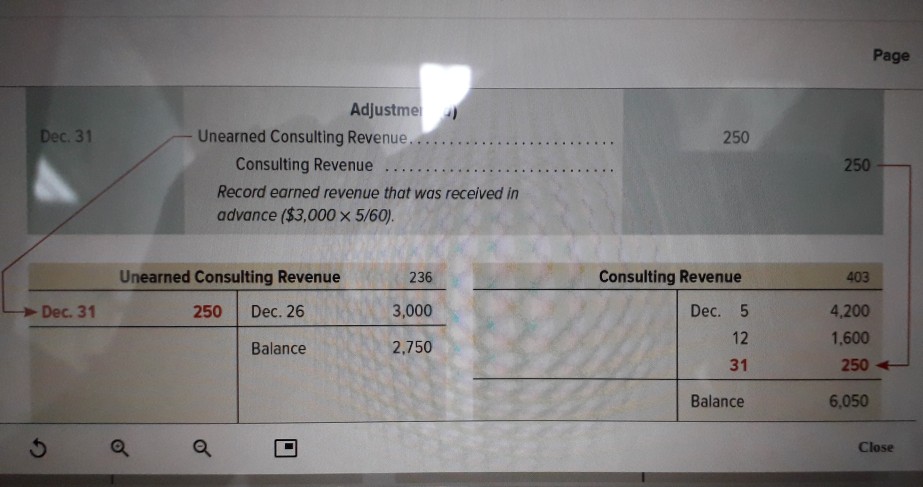

Step 3: The adjusting entry to reduce the liability account and recognize earned revenue, along with T-account postings, follows:

Question: How do we get this consulting balance $6,050 in the Consulting revenue account?

Page Adjustme Dec 31 250 Consulting Revenue Record earned revenue that was received in 250 advance ($3,000 x 5/60). Unearned Consulting Revenue 236 3,000 2,750 Consulting Revenue Dec. 5 12 31 Balance 403 4,.200 1,600 250 6,050 Dec. 31 250 Dec. 26 Balance 5 a a Close

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started