Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company called Blaze Wines Limited has been given 3,000,000 excise stamps which were used as follows: 50% of stamps brand 40 (product at

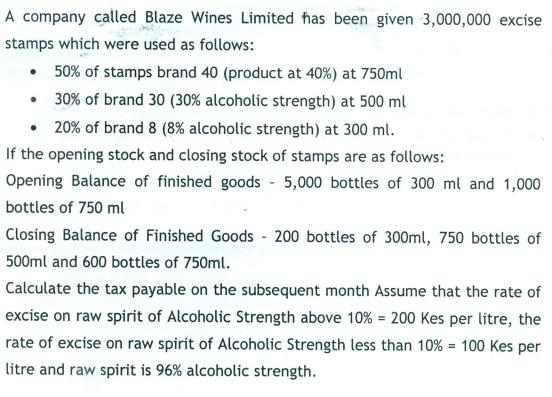

A company called Blaze Wines Limited has been given 3,000,000 excise stamps which were used as follows: 50% of stamps brand 40 (product at 40%) at 750ml 30% of brand 30 (30% alcoholic strength) at 500 ml 20% of brand 8 (8 % alcoholic strength) at 300 ml. If the opening stock and closing stock of stamps are as follows: Opening Balance of finished goods 5,000 bottles of 300 ml and 1,000 bottles of 750 ml Closing Balance of Finished Goods 200 bottles of 300ml, 750 bottles of 500ml and 600 bottles of 750ml. Calculate the tax payable on the subsequent month Assume that the rate of excise on raw spirit of Alcoholic Strength above 10% = 200 Kes per litre, the rate of excise on raw spirit of Alcoholic Strength less than 10% = 100 Kes per litre and raw spirit is 96% alcoholic strength.

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the tax payable on the subsequent month we first need to determine the quantity of raw ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started