Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company commenced business on 1 January 2021. On 31 December 2021, an extract of the balance sheet prepared for internal purposes, but excluding

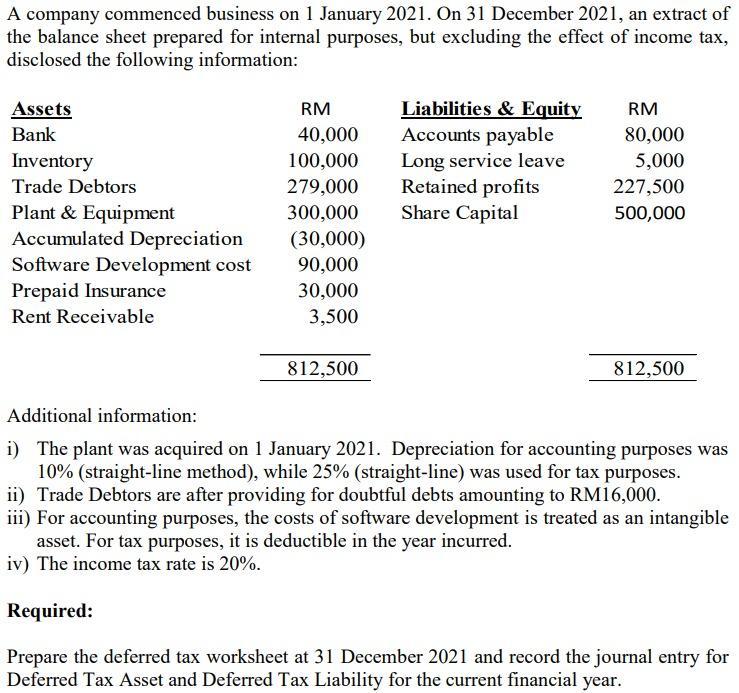

A company commenced business on 1 January 2021. On 31 December 2021, an extract of the balance sheet prepared for internal purposes, but excluding the effect of income tax, disclosed the following information: Assets Bank Inventory Trade Debtors Plant & Equipment Accumulated Depreciation Software Development cost Prepaid Insurance Rent Receivable RM 40,000 100,000 279,000 300,000 (30,000) 90,000 30,000 3,500 812,500 Liabilities & Equity Accounts payable Long service leave Retained profits Share Capital RM 80,000 5,000 227,500 500,000 812,500 Additional information: i) The plant was acquired on 1 January 2021. Depreciation for accounting purposes was 10% (straight-line method), while 25% (straight-line) was used for tax purposes. ii) Trade Debtors are after providing for doubtful debts amounting to RM16,000. iii) For accounting purposes, the costs of software development is treated as an intangible asset. For tax purposes, it is deductible in the year incurred. iv) The income tax rate is 20%. Required: Prepare the deferred tax worksheet at 31 December 2021 and record the journal entry for Deferred Tax Asset and Deferred Tax Liability for the current financial year.

Step by Step Solution

★★★★★

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Deferred Tax Worksheet as at 31 December 2021 Tax Base Accou...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started