Question

A company compiled the following information for the current year. (Assume that all raw materials used were direct materials.) Raw materials inventory, January 1

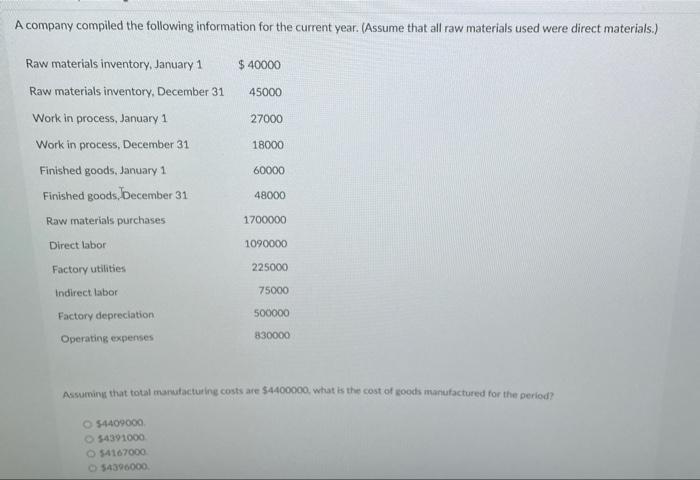

A company compiled the following information for the current year. (Assume that all raw materials used were direct materials.) Raw materials inventory, January 1 $ 40000 Raw materials inventory, December 31 45000 Work in process, January 1 27000 Work in process, December 31 18000 Finished goods, January 1 60000 Finished goods, December 31 48000 Raw materials purchases 1700000 Direct labor 1090000 Factory utilities 225000 Indirect labor 75000 Factory depreciation 500000 30000 Operating expenses Assuming that total manutacturing costs are $4400000, what is the cost of goods manufactured for the period? O S4409000. O $4391000 O S4167000. O$4396000.

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Cost of Goods Manufactured Beg...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Understanding Financial Accounting

Authors: Christopher Burnley, Robert Hoskin, Maureen Fizzell, Donald

1st Canadian Edition

1118849388, 9781119048572, 978-1118849385

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App