Answered step by step

Verified Expert Solution

Question

1 Approved Answer

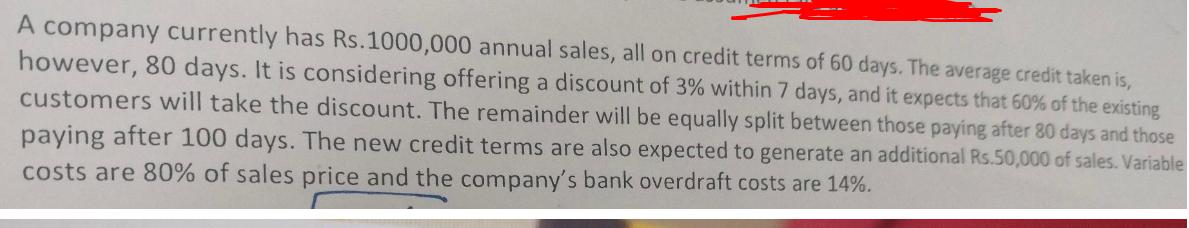

A company currently has Rs.1000,000 annual sales, all on credit terms of 60 days. The average credit taken is, however, 80 days. It is

A company currently has Rs.1000,000 annual sales, all on credit terms of 60 days. The average credit taken is, however, 80 days. It is considering offering a discount of 3% within 7 days, and it expects that 60% of the existing customers will take the discount. The remainder will be equally split between those paying after 80 days and those paying after 100 days. The new credit terms are also expected to generate an additional Rs.50,000 of sales. Variable costs are 80% of sales price and the company's bank overdraft costs are 14%. The company wishes to know whether offering the discount is worth-while if: a. No new sales are obtained b. New sales are obtained as described above (year may be taken consisting of 365 days) 2.000.000 Variabla

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Analyzing the Discount Offer for the Company Scenario a No new sales obtained Heres the analysis for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started