Answered step by step

Verified Expert Solution

Question

1 Approved Answer

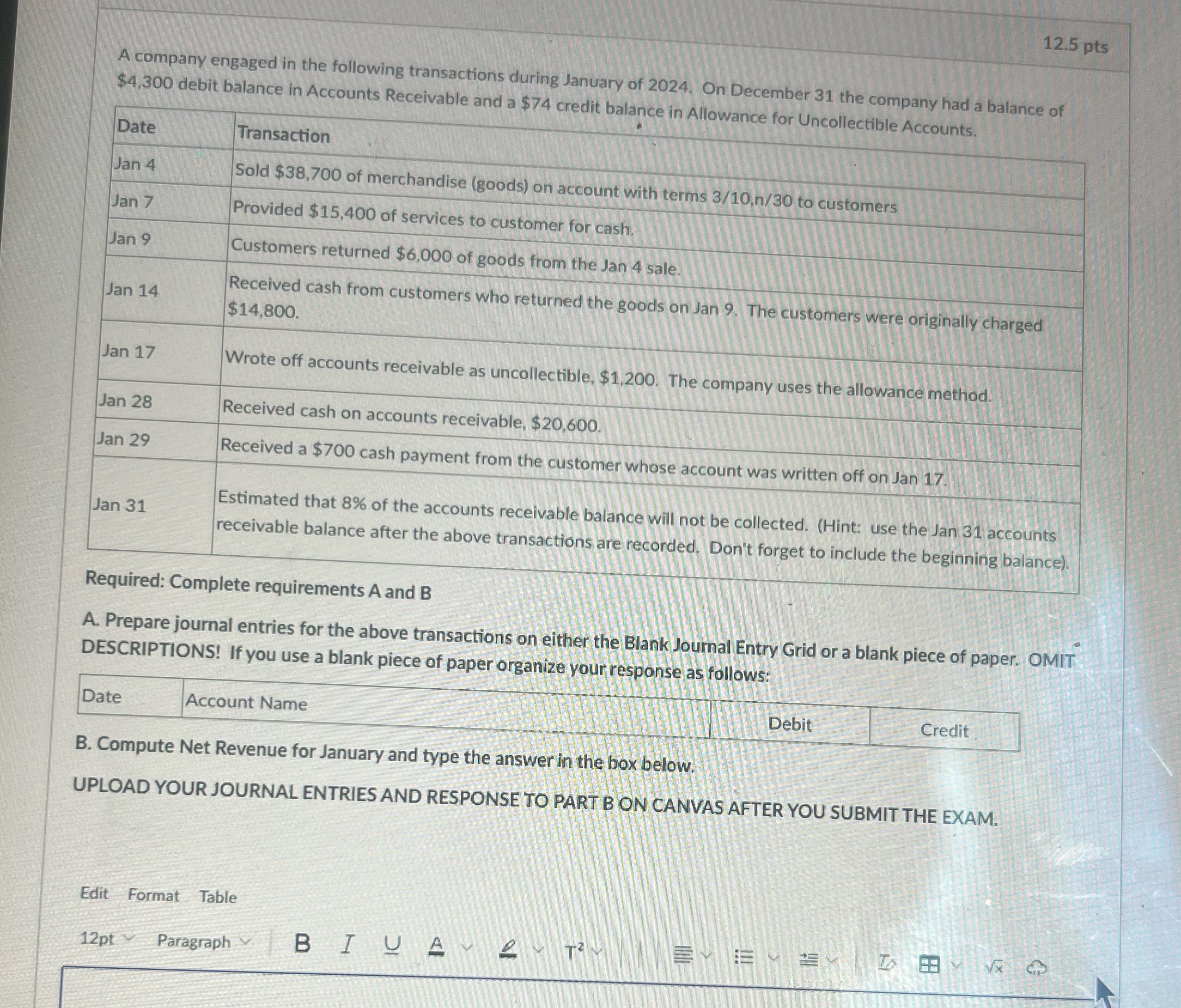

A company engaged in the following transactions during January of 2024. On December 31 the company had a balance of $4,300 debit balance in

A company engaged in the following transactions during January of 2024. On December 31 the company had a balance of $4,300 debit balance in Accounts Receivable and a $74 credit balance in Allowance for Uncollectible Accounts. Date Jan 4 Jan 7 Jan 9 Jan 14 Jan 17 Jan 28 Jan 29 Jan 31 Edit Date Transaction Sold $38,700 of merchandise (goods) on account with terms 3/10,n/30 to customers Provided $15,400 of services to customer for cash. Customers returned $6,000 of goods from the Jan 4 sale. Received cash from customers who returned the goods on Jan 9. The customers were originally charged $14,800. Wrote off accounts receivable as uncollectible, $1,200. The company uses the allowance method. Received cash on accounts receivable, $20,600. Received a $700 cash payment from the customer whose account was written off on Jan 17. Required: Complete requirements A and B A. Prepare journal entries for the above transactions on either the Blank Journal Entry Grid or a blank piece of paper. OMIT DESCRIPTIONS! If you use a blank piece of paper organize your response as follows: Estimated that 8% of the accounts receivable balance will not be collected. (Hint: use the Jan 31 accounts receivable balance after the above transactions are recorded. Don't forget to include the beginning balance). Account Name B. Compute Net Revenue for January and type the answer in the box below. UPLOAD YOUR JOURNAL ENTRIES AND RESPONSE TO PART B ON CANVAS AFTER YOU SUBMIT THE EXAM. Format Table Debit 12pt Paragraph BIUA 2- T- 12.5 pts Credit EVEM 9 To B x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Journal Entries Jan 4 Accounts Receivable 38700 Debit Sales Revenue 38700 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started