Answered step by step

Verified Expert Solution

Question

1 Approved Answer

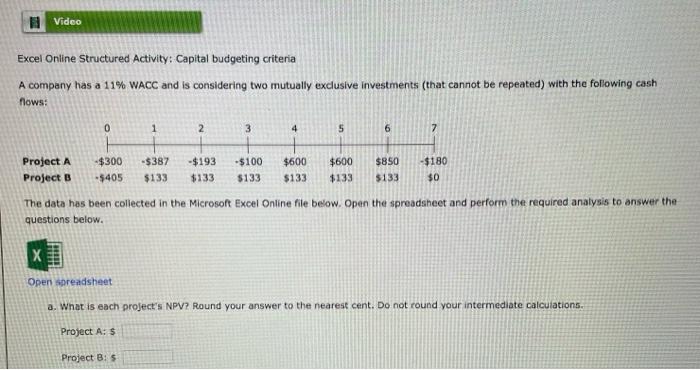

A company had a 11% WACC and is considering two mutually exclusive investments (that can not be repeated) with the following cash flows: please answer

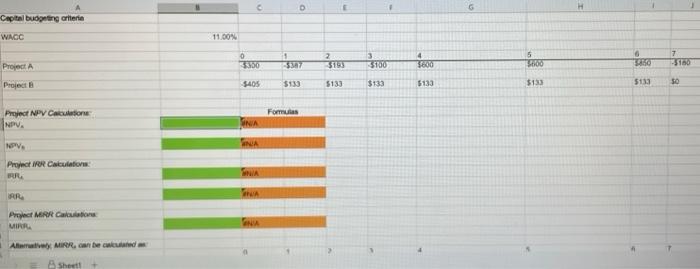

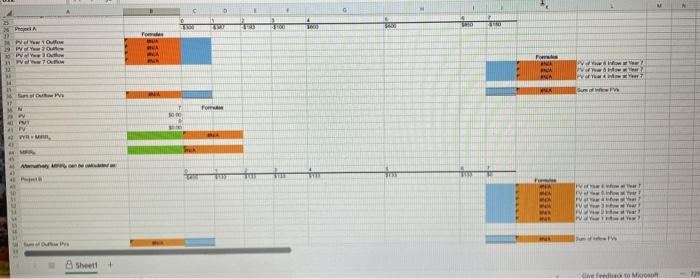

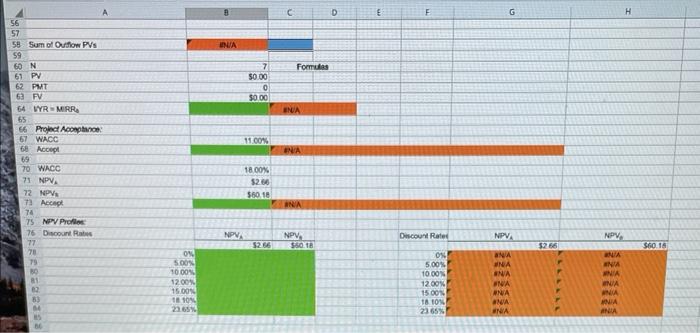

A company had a 11% WACC and is considering two mutually exclusive investments (that can not be repeated) with the following cash flows:

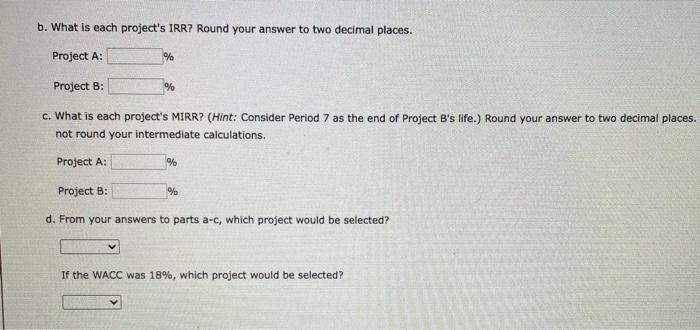

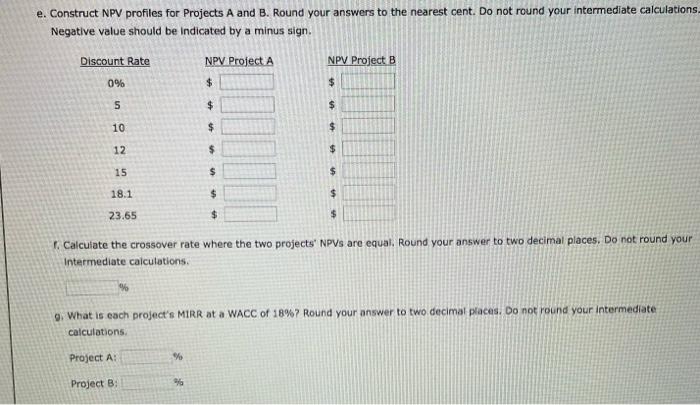

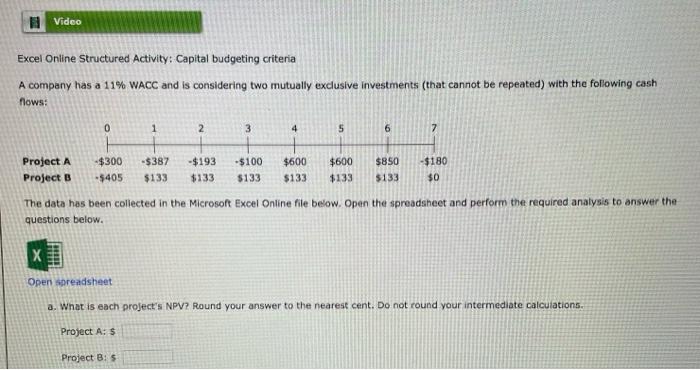

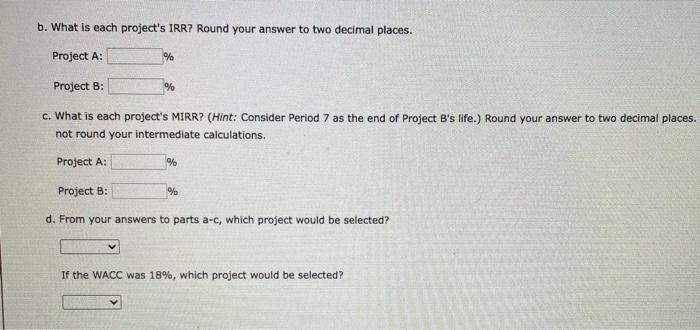

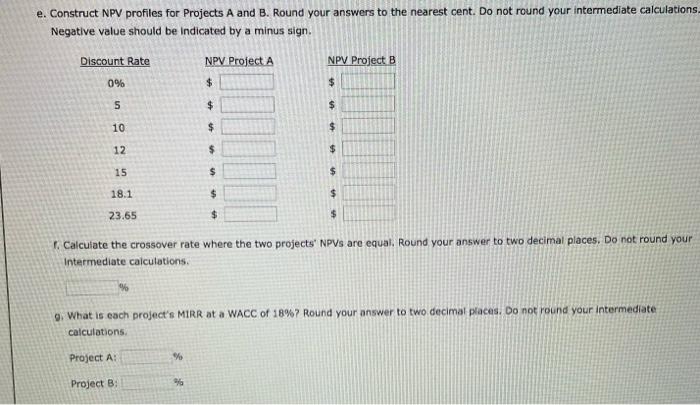

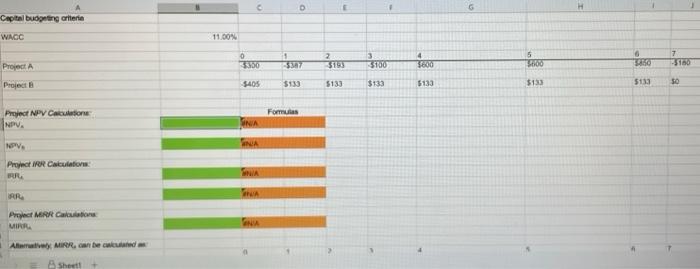

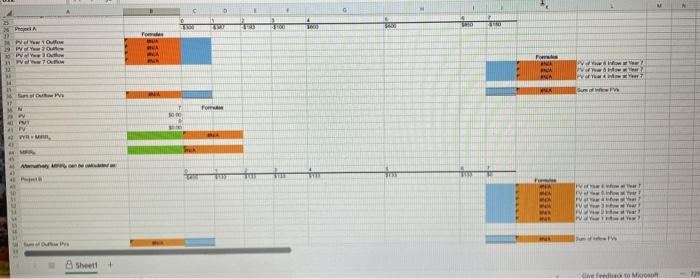

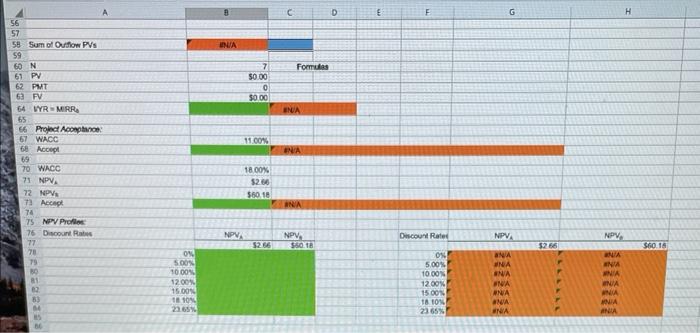

Excel Online Structured Activity: Capital budgeting criteria A company has a 11\% WACC and is considering two mutually exclusive investments (that cannot be repeated) with the following cash flows: The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open sprendsheet a. What is each project's NPV? Round your answer to the nearest cent. Do not round vour intermediate calculations. Project A:5 Project B: 5 b. What is each project's IRR? Round your answer to two decimal places. Project A: % Project B: c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Round your answer to two decimal places. not round your intermediate calculations. Project A: Project B: % % Construct NPV profiles for Projects A and B. Round your answers to the nearest cent. Do not round your intermediate calculation Negative value should be indicated by a minus sign. f. Calculate the crossover rate where the two projects' NPVs are equal, Round your answer to two decimal places. Do not round your intermediate caiculations. 9. What is each projects MIRR at a WACC of 18% ? Round your answer to two decimal places. Do not round your intermediate calculations. Project A : Project B: Captal buspeste crierit WMEC Project A Pripect NPV Caculasone: Fomalas Ginin finit Propet ier Cakulatons: BEL. Fina iar Prin Prquet mepf cabalabions. Minds. Ahenatseby Mises car te cakcuand a E . is NeVProlles: 76 Dicourl Ratins A please answer A through G in excel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started