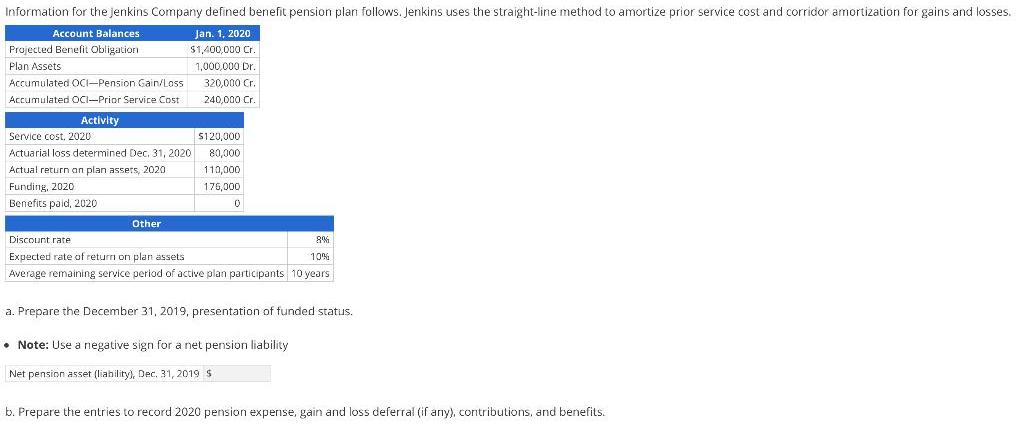

Question: Information for the jenkins Company defined benefit pension plan follows. Jenkins uses the straight-line method to amortize prior service cost and corridor amortization for

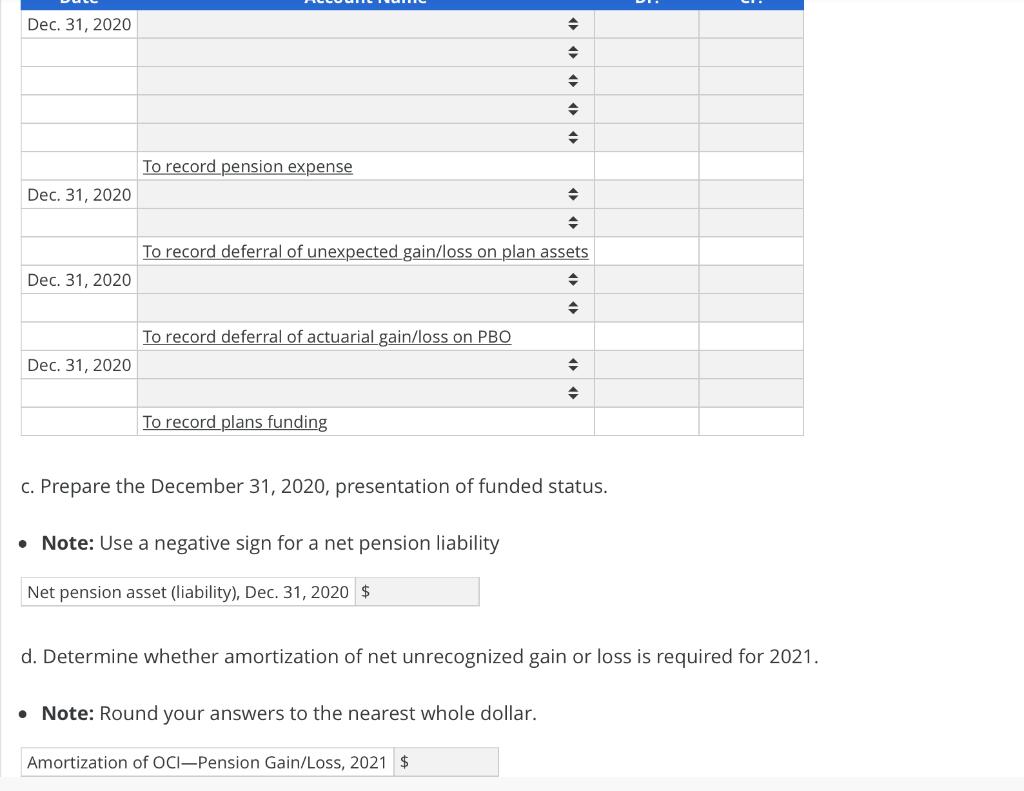

Information for the jenkins Company defined benefit pension plan follows. Jenkins uses the straight-line method to amortize prior service cost and corridor amortization for gains and losses. Account Balances Jan. 1, 2020 Projected Benefit Obligation S1,400,000 Cr. Plan Assets 1,000,000 Dr. Accumulated OCI-Pension Gain/Loss 320,000 Cr. Accumulated OCI-Prior Service Cost 240.000 Cr. Activity Service cost, 2020 5120,000 Actuarial loss determined Dec, 31, 2020 80,000 Actual return an plan assets, 2020 110,000 Funding, 2020 176,000 Benefits paid, 2020 Other Discount rate 8% Expected rate of returri on plan assets 10% Average remaining service period of active plan participants 10 years a. Prepare the December 31, 2019, presentation of funded status. Note: Use a negative sign for a net pension liability Net pension asset (liahility), Dec. 31, 2019 S b. Prepare the entries to record 2020 pension expense, gain and loss deferral (if any), contributions, and benefits. Dec. 31, 2020 To record pension expense Dec. 31, 2020 To record deferral of unexpected gain/loss on plan assets Dec. 31, 2020 To record deferral of actuarial gain/loss on PBO Dec. 31, 2020 To record plans funding c. Prepare the December 31, 2020, presentation of funded status. Note: Use a negative sign for a net pension liability Net pension asset (liability), Dec. 31, 2020 $ d. Determine whether amortization of net unrecognized gain or loss is required for 2021. Note: Round your answers to the nearest whole dollar. Amortization of OCI-Pension Gain/Loss, 2021 $

Step by Step Solution

3.55 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts