Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company had sales of $600 and costs of $300. Depreciation was an additional $150, and interest paid was $30. Taxes were 40% of

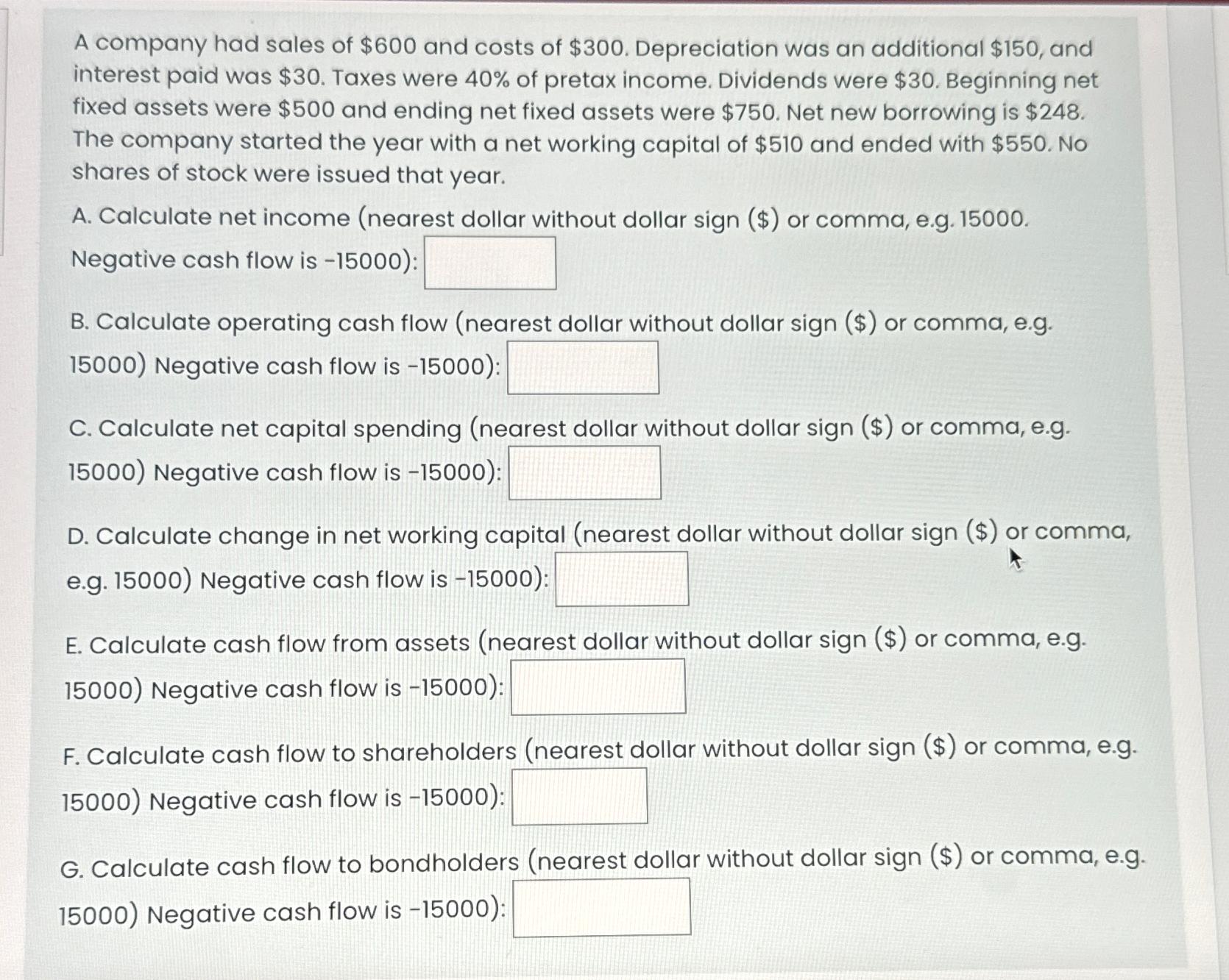

A company had sales of $600 and costs of $300. Depreciation was an additional $150, and interest paid was $30. Taxes were 40% of pretax income. Dividends were $30. Beginning net fixed assets were $500 and ending net fixed assets were $750. Net new borrowing is $248. The company started the year with a net working capital of $510 and ended with $550. No shares of stock were issued that year. A. Calculate net income (nearest dollar without dollar sign ($) or comma, e.g. 15000. Negative cash flow is -15000): B. Calculate operating cash flow (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): C. Calculate net capital spending (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): D. Calculate change in net working capital (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): E. Calculate cash flow from assets (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): F. Calculate cash flow to shareholders (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000): G. Calculate cash flow to bondholders (nearest dollar without dollar sign ($) or comma, e.g. 15000) Negative cash flow is -15000):

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Given the information provided let us work through each of the financial calculations requested A Net Income Calculation Net income is calculated by t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started