Question

A company had the following purchases and sales during its first year of operations: Purchases 22 units at $180 32 units at $185 27units

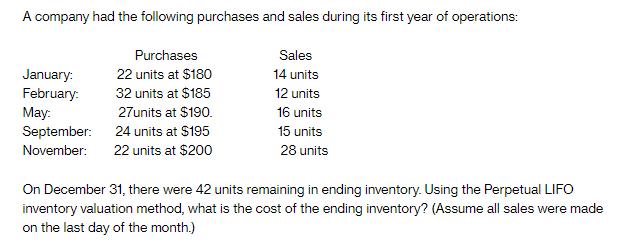

A company had the following purchases and sales during its first year of operations: Purchases 22 units at $180 32 units at $185 27units at $190. 24 units at $195 22 units at $200 January: February: May: September: November: Sales 14 units 12 units 16 units 15 units 28 units On December 31, there were 42 units remaining in ending inventory. Using the Perpetual LIFO inventory valuation method, what is the cost of the ending inventory? (Assume all sales were made on the last day of the month.)

Step by Step Solution

3.51 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the cost of the ending inventory using the perpetual LIFO Last In First Out method we need to determine the cost of the units sold and th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App