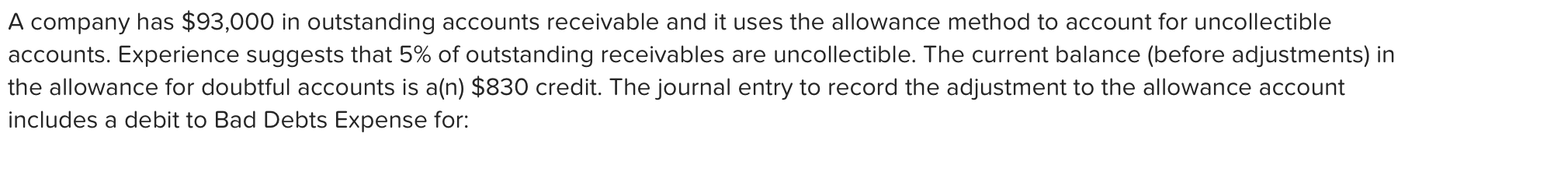

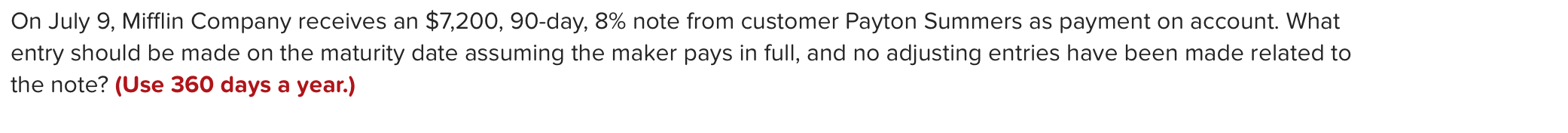

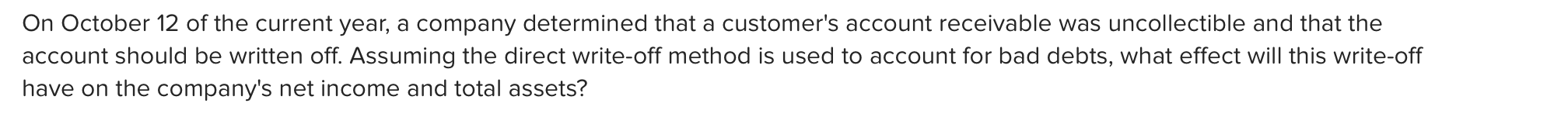

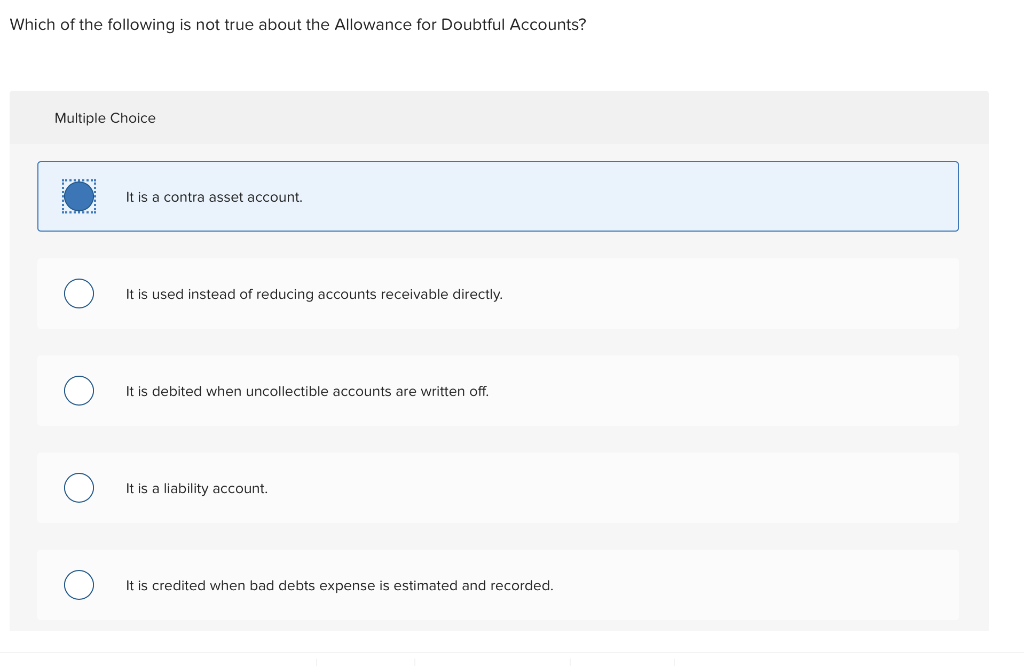

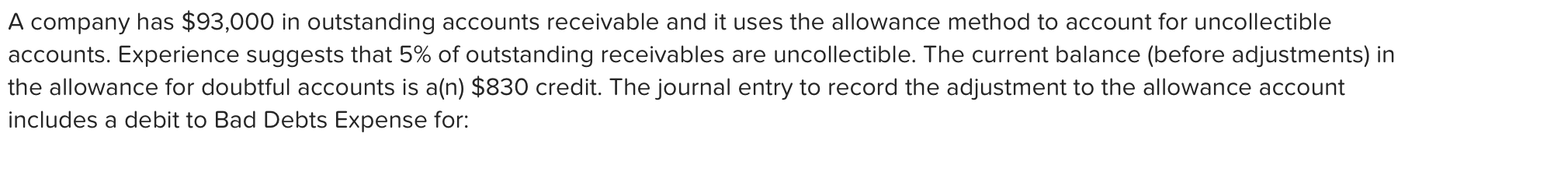

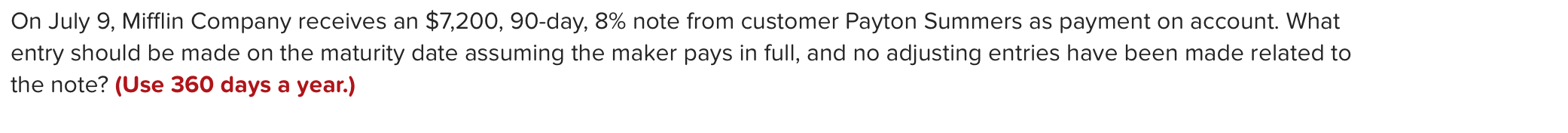

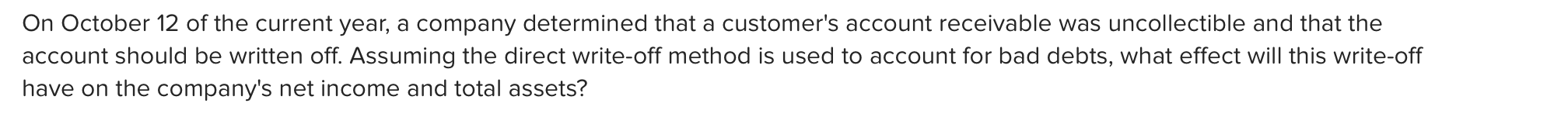

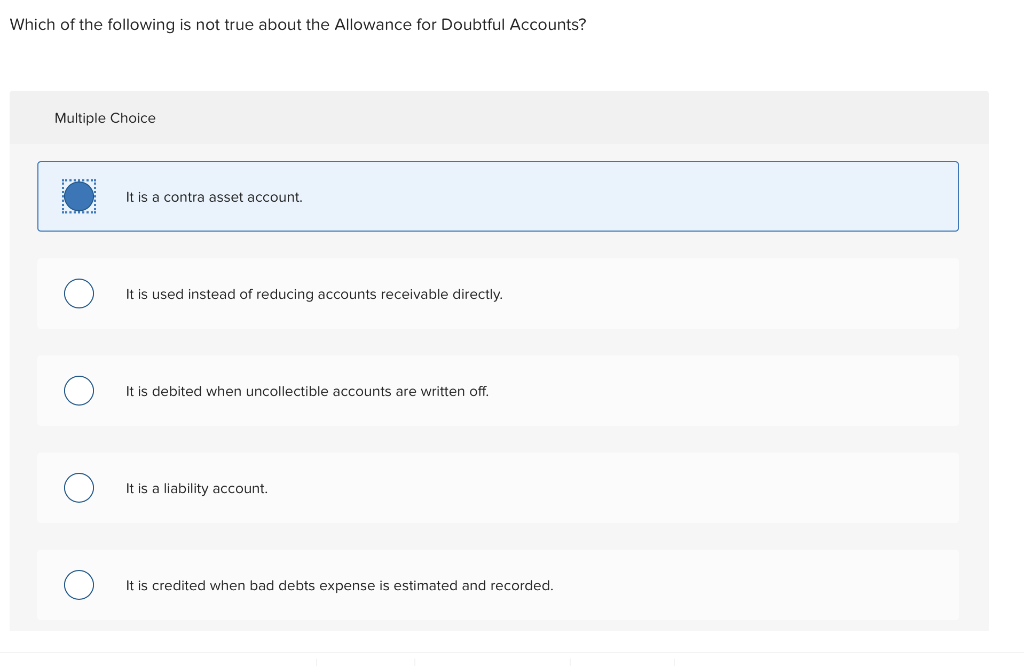

A company has $93,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts. Experience suggests that 5% of outstanding receivables are uncollectible. The current balance (before adjustments) in the allowance for doubtful accounts is a(n) $830 credit. The journal entry to record the adjustment to the allowance account includes a debit to Bad Debts Expense for: On July 9, Mifflin Company receives an $7,200, 90-day, 8% note from customer Payton Summers as payment on account. What entry should be made on the maturity date assuming the maker pays in full, and no adjusting entries have been made related to the note? (Use 360 days a year.) On October 12 of the current year, a company determined that a customer's account receivable was uncollectible and that the account should be written off. Assuming the direct write-off method is used to account for bad debts, what effect will this write-off have on the company's net income and total assets? Which of the following is not true about the Allowance for Doubtful Accounts? Multiple Choice It is a contra asset account. It is used instead of reducing accounts receivable directly It is debited when uncollectible accounts are written off. It is a liability account. o o It is credited when bad debts expense is estimated and recorded. A company has $93,000 in outstanding accounts receivable and it uses the allowance method to account for uncollectible accounts. Experience suggests that 5% of outstanding receivables are uncollectible. The current balance (before adjustments) in the allowance for doubtful accounts is a(n) $830 credit. The journal entry to record the adjustment to the allowance account includes a debit to Bad Debts Expense for: On July 9, Mifflin Company receives an $7,200, 90-day, 8% note from customer Payton Summers as payment on account. What entry should be made on the maturity date assuming the maker pays in full, and no adjusting entries have been made related to the note? (Use 360 days a year.) On October 12 of the current year, a company determined that a customer's account receivable was uncollectible and that the account should be written off. Assuming the direct write-off method is used to account for bad debts, what effect will this write-off have on the company's net income and total assets? Which of the following is not true about the Allowance for Doubtful Accounts? Multiple Choice It is a contra asset account. It is used instead of reducing accounts receivable directly It is debited when uncollectible accounts are written off. It is a liability account. o o It is credited when bad debts expense is estimated and recorded