Question

A company has a liability with a present value of 100 million and a duration of 12 years. It wants to invest it in

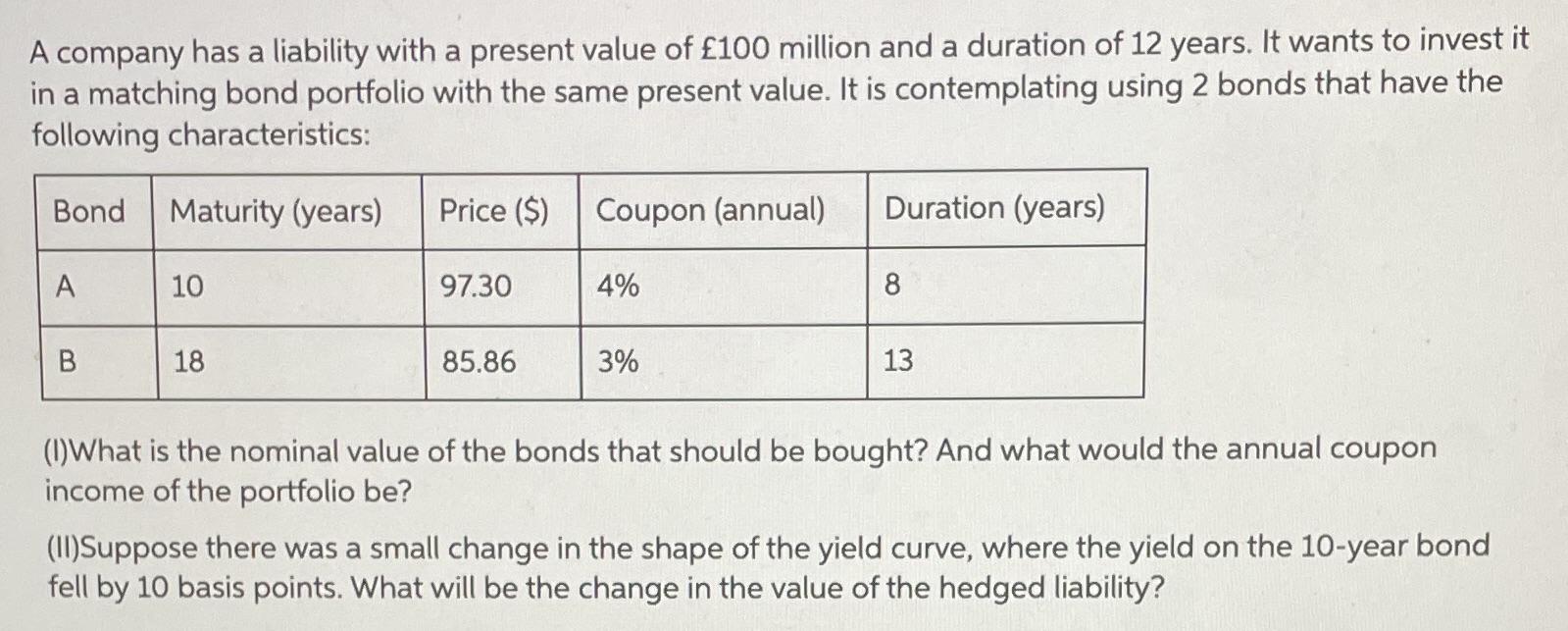

A company has a liability with a present value of 100 million and a duration of 12 years. It wants to invest it in a matching bond portfolio with the same present value. It is contemplating using 2 bonds that have the following characteristics: Bond Maturity (years) A B 10 18 Price ($) 97.30 85.86 Coupon (annual) 4% 3% Duration (years) 8 13 (1)What is the nominal value of the bonds that should be bought? And what would the annual coupon income of the portfolio be? (II)Suppose there was a small change in the shape of the yield curve, where the yield on the 10-year bond fell by 10 basis points. What will be the change in the value of the hedged liability?

Step by Step Solution

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 To match the liability the company needs to purchase a combination of Bonds A and B with a total p...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Finite Mathematics and Its Applications

Authors: Larry J. Goldstein, David I. Schneider, Martha J. Siegel, Steven Hair

12th edition

978-0134768588, 9780134437767, 134768582, 134437764, 978-0134768632

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App