Question

A company has a P/E ratio of 18 with an earnings growth rate of 20%. The S&P 500's P/E is 15 with an earnings

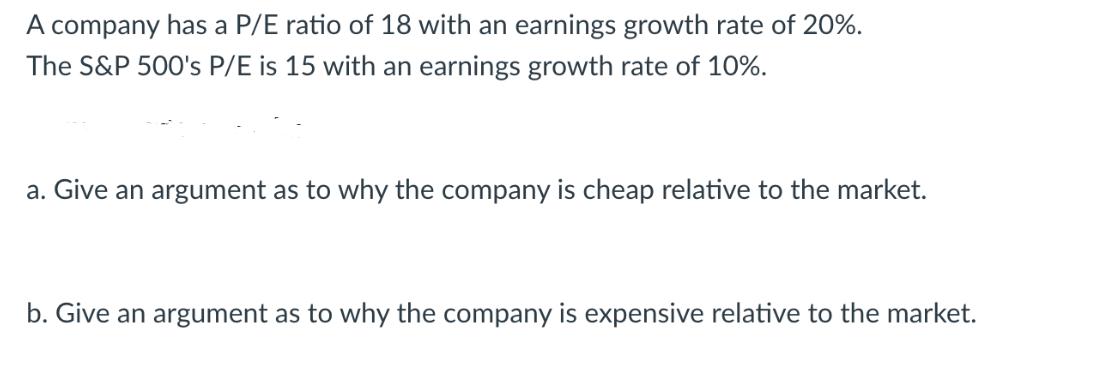

A company has a P/E ratio of 18 with an earnings growth rate of 20%. The S&P 500's P/E is 15 with an earnings growth rate of 10%. a. Give an argument as to why the company is cheap relative to the market. b. Give an argument as to why the company is expensive relative to the market.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Argument for the company being cheap relative to the market The companys PE ratio of 18 is higher than the markets PE ratio of 15 However when consi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals Of Management

Authors: Ricky Griffin

10th Edition

0357517342, 978-0357517345

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App