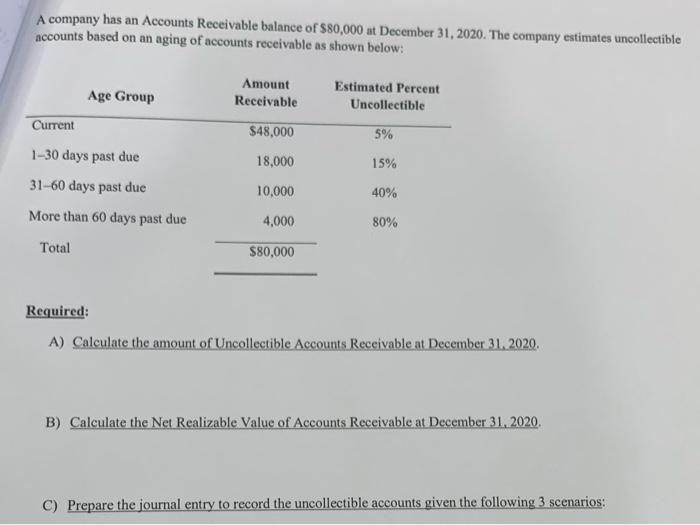

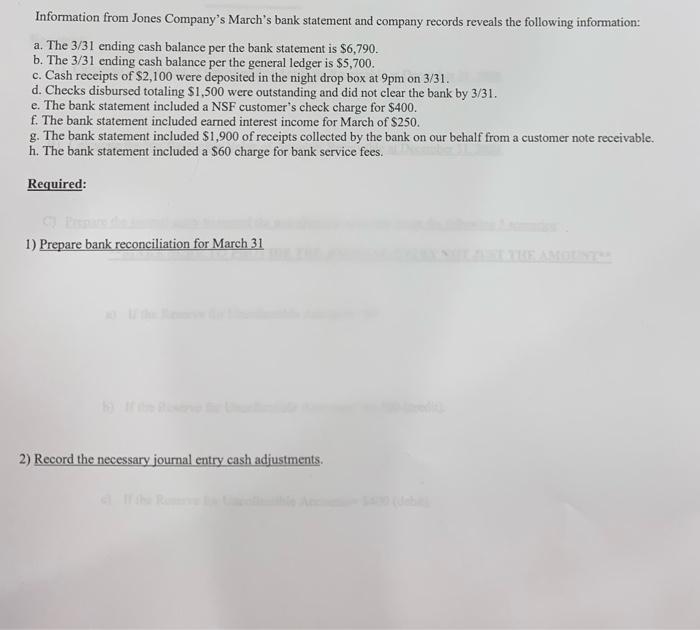

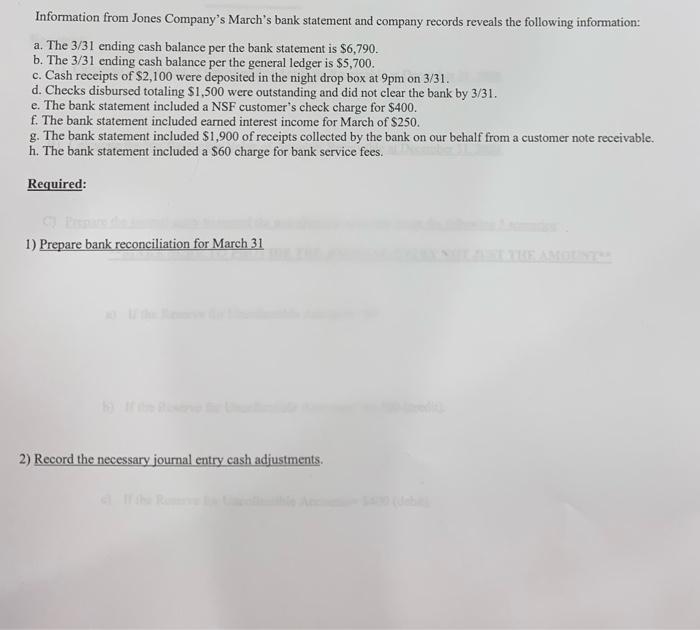

A company has an Accounts Receivable balance of $80,000 at December 31, 2020. The company estimates uncollectible accounts based on an aging of accounts receivable as shown below: Age Group Amount Receivable Estimated Percent Uncollectible Current $48,000 5% 18,000 15% 1-30 days past due 31-60 days past due More than 60 days past due 10,000 40% 4,000 80% Total $80,000 Required: A) Calculate the amount of Uncollectible Accounts Receivable at December 31, 2020. B) Calculate the Net Realizable Value of Accounts Receivable at December 31, 2020, C) Prepare the journal entry to record the uncollectible accounts given the following 3 scenarios: Information from Jones Company's March's bank statement and company records reveals the following information: a. The 3/31 ending cash balance per the bank statement is $6,790. b. The 3/31 ending cash balance per the general ledger is $5,700. c. Cash receipts of $2,100 were deposited in the night drop box at 9pm on 3/31. d. Checks disbursed totaling $1,500 were outstanding and did not clear the bank by 3/31. e. The bank statement included a NSF customer's check charge for $400. f. The bank statement included earned interest income for March of $250. g. The bank statement included $1,900 of receipts collected by the bank on our behalf from a customer note receivable. h. The bank statement included a $60 charge for bank service fees. Required: 1) Prepare bank reconciliation for March 31 2) Record the necessary journal entry cash adjustments. A company has an Accounts Receivable balance of $80,000 at December 31, 2020. The company estimates uncollectible accounts based on an aging of accounts receivable as shown below: Age Group Amount Receivable Estimated Percent Uncollectible Current $48,000 5% 18,000 15% 1-30 days past due 31-60 days past due More than 60 days past due 10,000 40% 4,000 80% Total $80,000 Required: A) Calculate the amount of Uncollectible Accounts Receivable at December 31, 2020. B) Calculate the Net Realizable Value of Accounts Receivable at December 31, 2020, C) Prepare the journal entry to record the uncollectible accounts given the following 3 scenarios: Information from Jones Company's March's bank statement and company records reveals the following information: a. The 3/31 ending cash balance per the bank statement is $6,790. b. The 3/31 ending cash balance per the general ledger is $5,700. c. Cash receipts of $2,100 were deposited in the night drop box at 9pm on 3/31. d. Checks disbursed totaling $1,500 were outstanding and did not clear the bank by 3/31. e. The bank statement included a NSF customer's check charge for $400. f. The bank statement included earned interest income for March of $250. g. The bank statement included $1,900 of receipts collected by the bank on our behalf from a customer note receivable. h. The bank statement included a $60 charge for bank service fees. Required: 1) Prepare bank reconciliation for March 31 2) Record the necessary journal entry cash adjustments