Question

A company has provided the following data for its two most recent years of operation: Selling price per unit Direct materials cost per unit

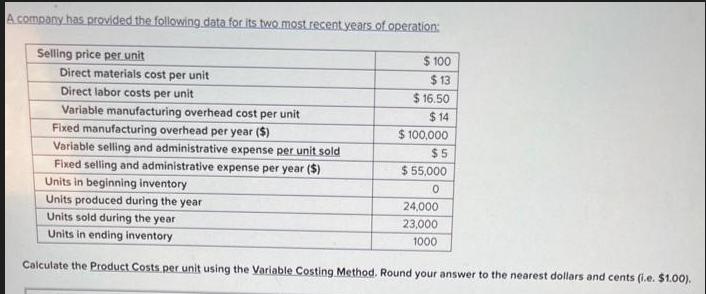

A company has provided the following data for its two most recent years of operation: Selling price per unit Direct materials cost per unit Direct labor costs per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead per year ($) Variable selling and administrative expense per unit sold Fixed selling and administrative expense per year ($) Units in beginning inventory Units produced during the year $100 $13 $16.50 $14 $ 100,000 $5 $ 55,000 0 24,000 23,000 1000 Units sold during the year Units in ending inventory Calculate the Product Costs per unit using the Variable Costing Method. Round your answer to the nearest dollars and cents (i.e. $1.00).

Step by Step Solution

3.44 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the product cost per unit using the Variabl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managerial Accounting

Authors: Ray Garrison, Eric Noreen, Peter Brewer

16th edition

1259307417, 978-1260153132, 1260153134, 978-1259307416

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App