Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company has stock options written on its common stock, with the following characteristics: Per - share stock = $ 6 8 price Exercise price

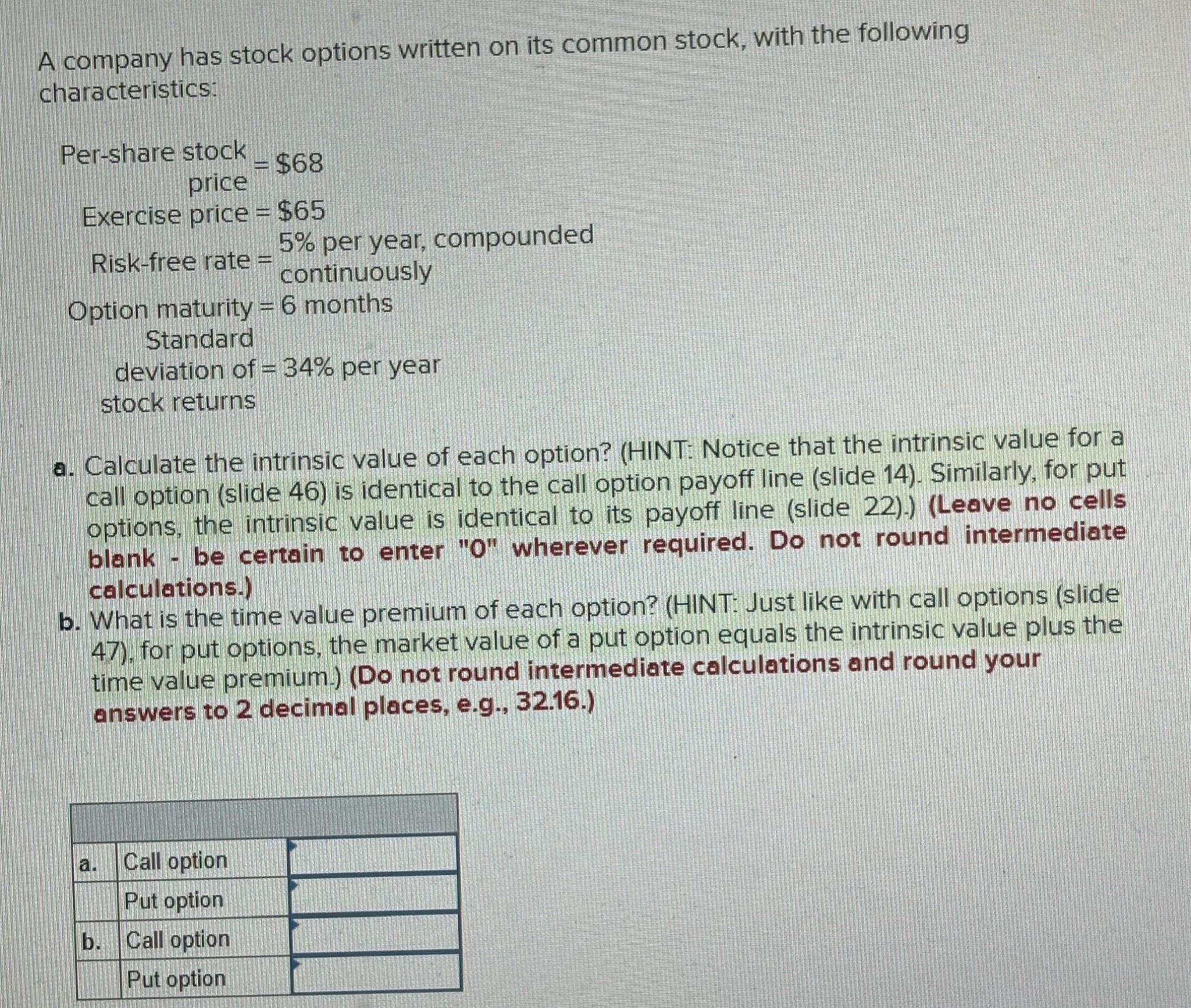

A company has stock options written on its common stock, with the following characteristics:

Pershare stock $

price

Exercise price $

Riskfree rate per year, compounded

continuously

Option maturity months

Standard

deviation of per year

stock returns

a Calculate the intrinsic value of each option? HINT: Notice that the intrinsic value for a call option slide is identical to the call option payoff line slide Similarly, for put options, the intrinsic value is identical to its payoff line slide Leave no cells blank be certain to enter wherever required. Do not round intermediate calculations.

b What is the time value premium of each option? HINT: Just like with call options slide for put options, the market value of a put option equals the intrinsic value plus the time value premium.Do not round intermediate calculations and round your answers to decimal places, eg

tableaCall option,Put option,bCall option,Put option,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started