Answered step by step

Verified Expert Solution

Question

1 Approved Answer

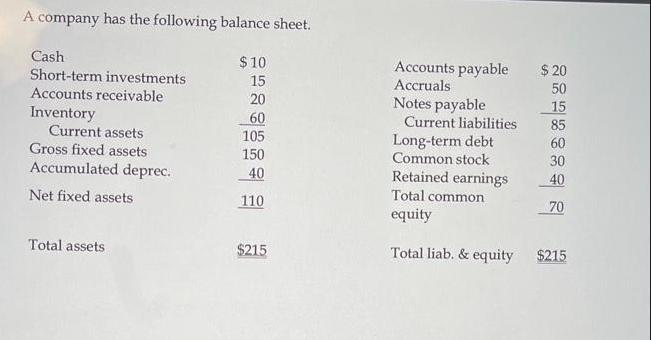

A company has the following balance sheet. Cash Short-term investments Accounts receivable Inventory Current assets Gross fixed assets Accumulated deprec. Net fixed assets Total

A company has the following balance sheet. Cash Short-term investments Accounts receivable Inventory Current assets Gross fixed assets Accumulated deprec. Net fixed assets Total assets $10 15 20 60 105 150 40 110 $215 Accounts payable Accruals Notes payable Current liabilities Long-term debt Common stock Retained earnings Total common equity Total liab. & equity $ 20 50 15 85 60 30 40 70 $215 a. What is its current ratio? b. What is its quick ratio? c. What is its debt-to-equity ratio? Assume debt includes all liabilities d. What is its net working capital? e. What is its net operating working capital? Assume that all cash is excess cash and not needed for operations. f. What is its total operating capital?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the financial ratios and working capital figures well use the given information from the balance sheet a Current Ratio The current ratio ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started