Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company has three employers Journal Entries required: 1. Record the remittance of payroll liabilities to the Receiver General for Canada. 2. Record the payroll

A company has three employers

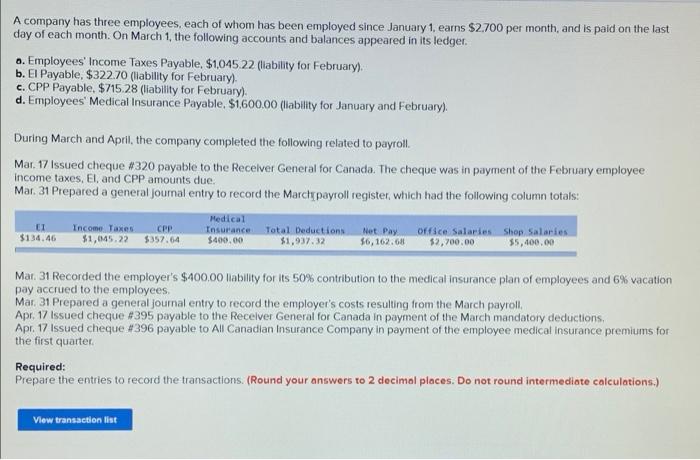

A company has three employees, each of whom has been employed since January 1, earns $2,700 per month, and is paid on the last day of each month. On March 1, the following accounts and balances appeared in its ledger .. Employees' Income Taxes Payable. $1,045 22 (liability for February) b. El Payable, $322.70 (liability for February) C. CPP Payable, $715.28 (liability for February). d. Employees' Medical Insurance Payable, $1,600.00 (lability for January and February). During March and April, the company completed the following related to payroll. Mar. 17 Issued cheque #320 payable to the Receiver General for Canada. The cheque was in payment of the February employee income taxes, El. and CPP amounts due: Mar. 31 Prepared a general Journal entry to record the Marche payroll register, which had the following column totals: EL $134.46 Income Taxes $1,045.22 CPP $357.64 Medical Insurance $400.00 Total Deductions $1,937.32 Net Pay 56,162.68 Office Salaries Shop Salaries $2,700,00 $5,400.00 Mar. 31 Recorded the employer's $100.00 Mobility for its 50% contribution to the medical insurance plan of employees and 6% vacation pay accrued to the employees Mar. 31 Prepared a general journal entry to record the employer's costs resulting from the March payroll, Apr. 17 Issued cheque #395 payable to the Receiver General for Canada in payment of the March mandatory deductions, Apr 17 issued cheque #396 payable to All Canadian Insurance Company in payment of the employee medical insurance premiums for the first quarter Required: Prepare the entries to record the transactions. (Round your answers to 2 decimal places. Do not round intermediate calculations.) View transaction list

Journal Entries required:

1. Record the remittance of payroll liabilities to the Receiver General for Canada.

2. Record the payroll register for the pay period ending Mar 31.

3. Record employee benefits.

4. Record the employer's payroll expenses.

5. Record the remittance of payroll liabilities to the Receiver General for Canada.

6. Record the remittance of payroll liabilities to the Receiver General for Canada.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started