Answered step by step

Verified Expert Solution

Question

1 Approved Answer

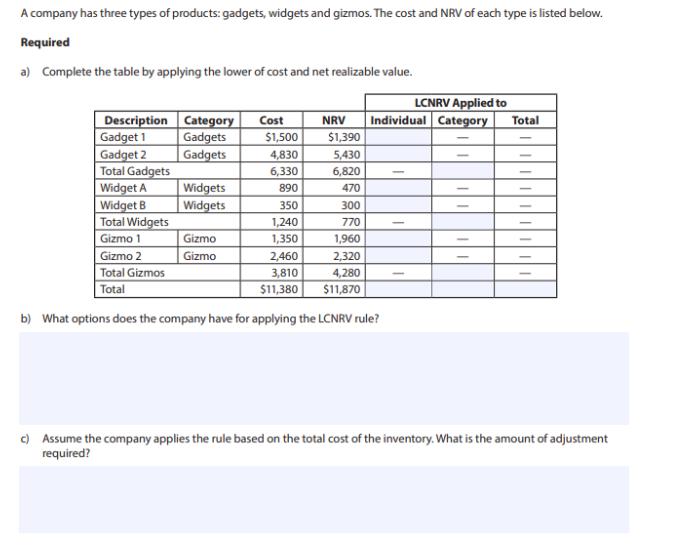

A company has three types of products: gadgets, widgets and gizmos. The cost and NRV of each type is listed below. Required a) Complete

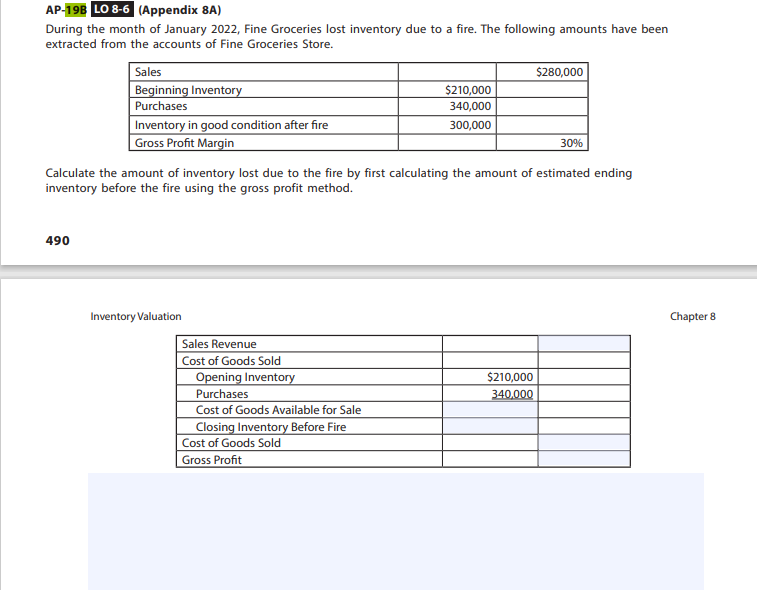

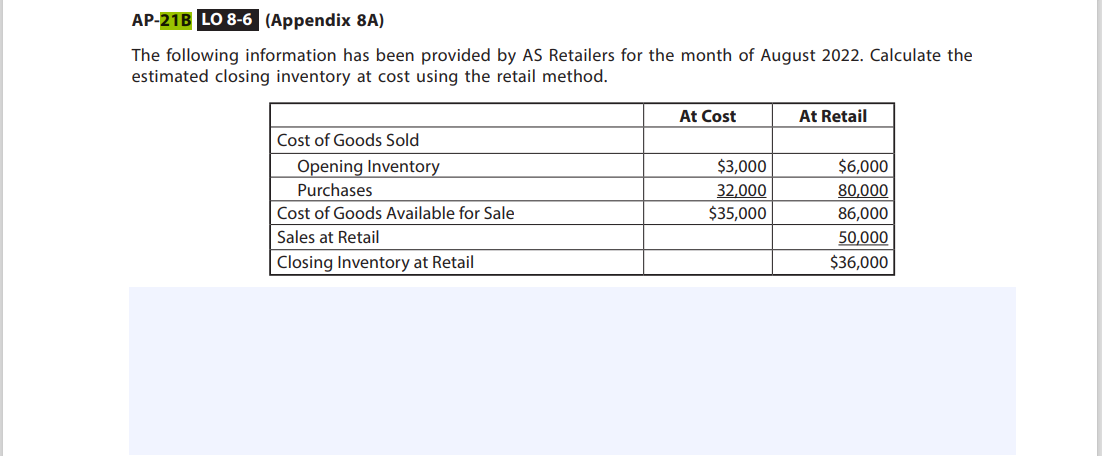

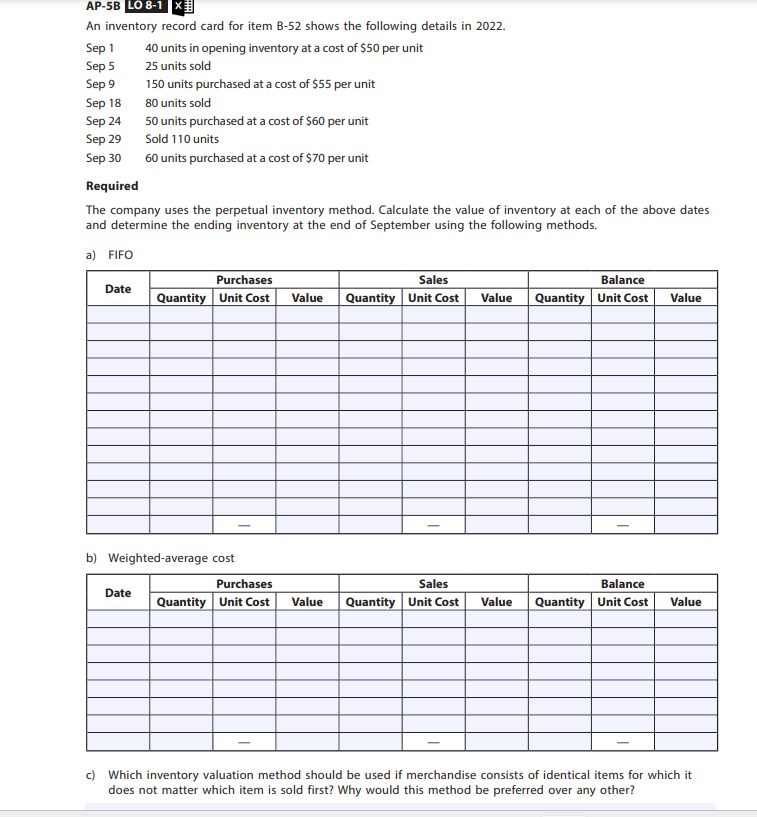

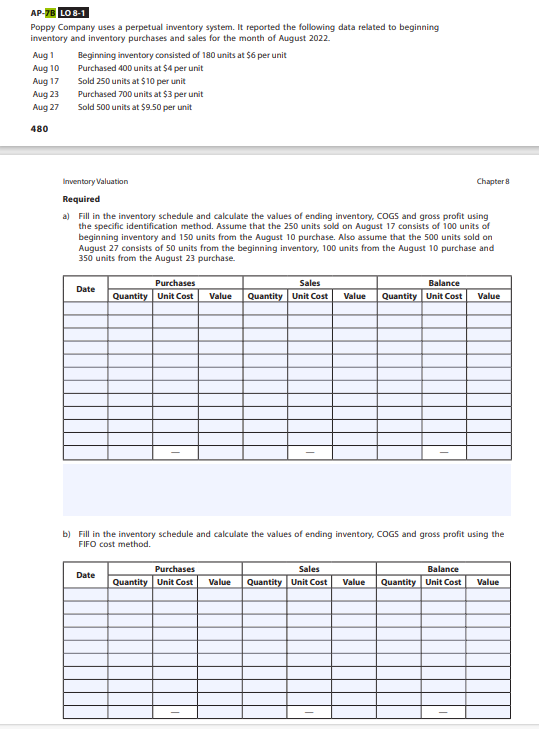

A company has three types of products: gadgets, widgets and gizmos. The cost and NRV of each type is listed below. Required a) Complete the table by applying the lower of cost and net realizable value. LCNRV Applied to Description Category Cost NRV Individual Category Total Gadget 1 Gadgets $1,500 $1,390 Gadget 2 Gadgets 4,830 5,430 - Total Gadgets 6,330 6,820 Widget A Widgets 890 470 Widget B Widgets 350 300 - Total Widgets 1,240 770 Gizmo 1 Gizmo 1,350 1,960 Gizmo 2 Gizmo 2,460 2,320 Total Gizmos 3,810 4,280 Total $11,380 $11,870 b) What options does the company have for applying the LCNRV rule? c) Assume the company applies the rule based on the total cost of the inventory. What is the amount of adjustment required? AP-19B LO 8-6 (Appendix 8A) During the month of January 2022, Fine Groceries lost inventory due to a fire. The following amounts have been extracted from the accounts of Fine Groceries Store. Sales Beginning Inventory Purchases Inventory in good condition after fire Gross Profit Margin $280,000 $210,000 340,000 300,000 30% Calculate the amount of inventory lost due to the fire by first calculating the amount of estimated ending inventory before the fire using the gross profit method. 490 Inventory Valuation Sales Revenue Cost of Goods Sold Opening Inventory $210,000 Purchases 340,000 Cost of Goods Available for Sale Closing Inventory Before Fire Cost of Goods Sold Gross Profit Chapter 8 AP-21B LO 8-6 (Appendix 8A) The following information has been provided by AS Retailers for the month of August 2022. Calculate the estimated closing inventory at cost using the retail method. At Cost At Retail Cost of Goods Sold Opening Inventory $3,000 $6,000 Purchases 32,000 80,000 Cost of Goods Available for Sale $35,000 86,000 Sales at Retail 50,000 Closing Inventory at Retail $36,000 AP-5B LO 8-1 An inventory record card for item B-52 shows the following details in 2022. Sep 1 40 units in opening inventory at a cost of $50 per unit Sep 5 25 units sold Sep 9 150 units purchased at a cost of $55 per unit Sep 18 80 units sold Sep 24 50 units purchased at a cost of $60 per unit Sep 29 Sold 110 units Sep 30 60 units purchased at a cost of $70 per unit Required The company uses the perpetual inventory method. Calculate the value of inventory at each of the above dates and determine the ending inventory at the end of September using the following methods. a) FIFO Purchases Sales Balance Date Quantity Unit Cost Value Quantity Unit Cost Value Quantity Unit Cost Value - b) Weighted-average cost Purchases Sales Balance Date Quantity Unit Cost Value Quantity Unit Cost Value Quantity Unit Cost Value c) Which inventory valuation method should be used if merchandise consists of identical items for which it does not matter which item is sold first? Why would this method be preferred over any other? AP-7B LO 8-1 Poppy Company uses a perpetual inventory system. It reported the following data related to beginning inventory and inventory purchases and sales for the month of August 2022. Beginning inventory consisted of 180 units at $6 per unit Purchased 400 units at $4 per unit Aug 1 Aug 10 Aug 17 Sold 250 units at $10 per unit Aug 23 Purchased 700 units at $3 per unit Aug 27 Sold 500 units at $9.50 per unit 480 Inventory Valuation Required Chapter 8 a) Fill in the inventory schedule and calculate the values of ending inventory, COGS and gross profit using the specific identification method. Assume that the 250 units sold on August 17 consists of 100 units of beginning inventory and 150 units from the August 10 purchase. Also assume that the 500 units sold on August 27 consists of 50 units from the beginning inventory, 100 units from the August 10 purchase and 350 units from the August 23 purchase. Purchases Sales Balance Date Quantity Unit Cost Value Quantity Unit Cost Value Quantity Unit Cost Value b) Fill in the inventory schedule and calculate the values of ending inventory, COGS and gross profit using the FIFO cost method. Purchases Sales Balance Date Quantity Unit Cost Value Quantity Unit Cost Value Quantity Unit Cost Value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started