Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A company is considering a 2-year project that requires paying $5,000,000 for a cutting-edge production equipment. This equipment falls into the 3 year MACRS class

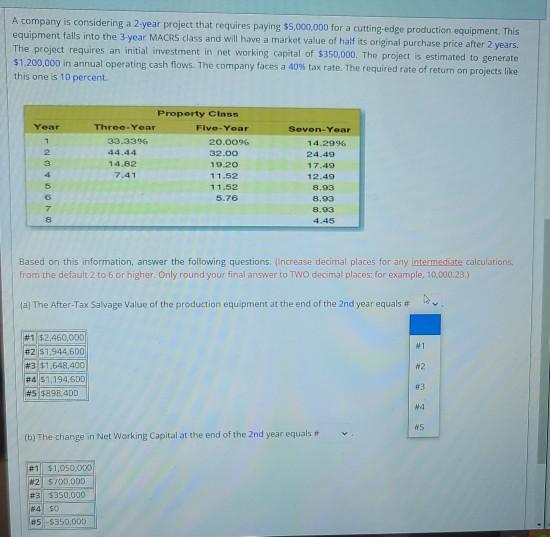

A company is considering a 2-year project that requires paying $5,000,000 for a cutting-edge production equipment. This equipment falls into the 3 year MACRS class and will have a market value of half its original purchase price after 2 years. The project requires an initial investment in net working capital of $350,000. The project is estimated to generate $1.200,000 in annual operating cash flows. The company faces a 40% tax rate. The required rate of return on projects like this one is 10 percent Year Property Class Three-Year Five-Year 33.3396 20.0096 32.00 14.82 19.20 7.41 11.52 11.52 5.76 3 4 Seven-Year 14.29% 24.40 17.49 12.49 8.03 8.93 8.93 7 8 Based on this information, answer the following questions. Increase decimal places for any intermediate calculation, from the default 2 to b or higher Only round your final answer to TWO decimal places for example, 10.000:28) tal The After-Tax Salvage Value of the production equipment at the end of the 2nd year equals # N1 #1 $2.460,000 211.944,500 #3 11,648,400 #451,194,60D #5 $898 400 #2 NA 85 (b) The change in Net Working Capital at the end of the 2nd year equals #1 $1,050.000 W2 5700.000 #3 5350.000 #4 $0 85 -5350,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started