Question

A company is considering a new project. The project costs $295,000 and has a 5-year life. During the Year 1, it will produce a cash

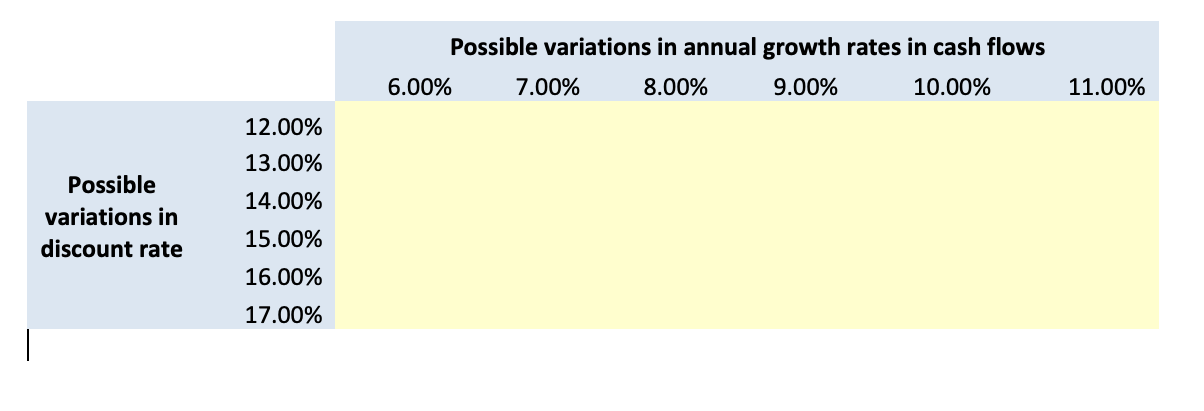

A company is considering a new project. The project costs $295,000 and has a 5-year life. During the Year 1, it will produce a cash flow of $73,000, which is expected to grow at 8% per annum from Year 2 to 5. The appropriate discount rate is 15% per annum. Please answer the following questions: (a) Work out the Year 2 to 5 cash flows from this investment (with no added terminal value) (1 mark). (b) Use a financial function to work out the Net Present Value (NPV) and the Internal Rate of Return (IRR) of the project (c) Use a logical function to indicate whether the NPV and IRR suggest that this project should proceed (1 mark). (d) Add a Data Table that displays how the net present value changes as the discount rate and growth rate varies between 12%-17% and 6%-11% respectively, as shown in the table below (2 marks - no marks for entering individual formulae into the table). ( use excel. And display the formula and calculation process)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started