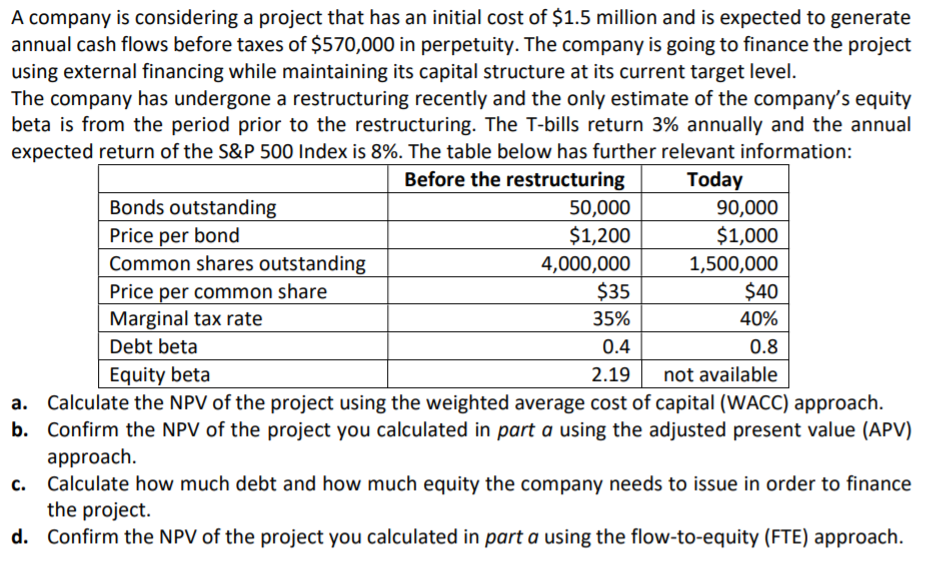

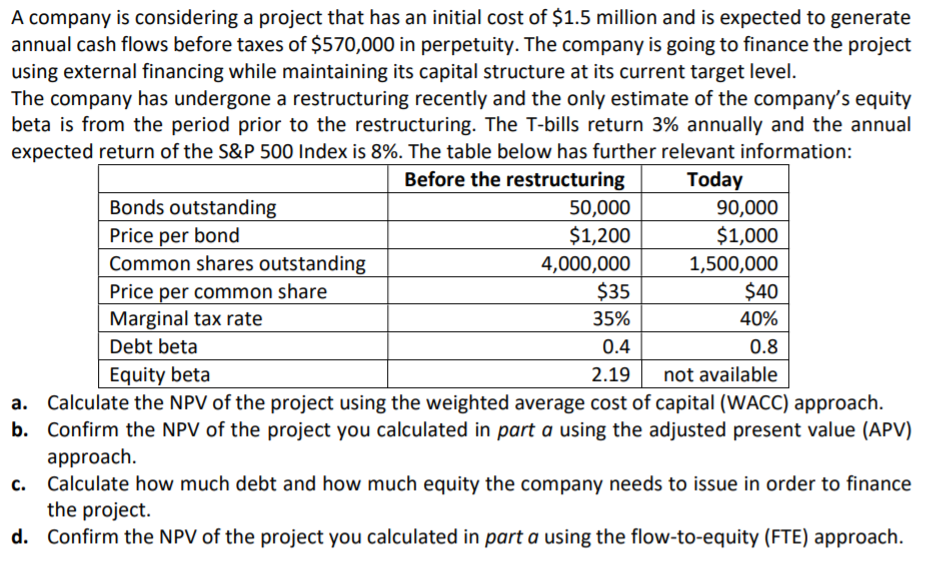

A company is considering a project that has an initial cost of $1.5 million and is expected to generate annual cash flows before taxes of $570,000 in perpetuity. The company is going to finance the project using external financing while maintaining its capital structure at its current target level. The company has undergone a restructuring recently and the only estimate of the company's equity beta is from the period prior to the restructuring. The T-bills return 3% annually and the annual expected return of the S&P 500 Index is 8%. The table below has further relevant information: Before the restructuring Today Bonds outstanding 50,000 90,000 Price per bond $1,200 $1,000 Common shares outstanding 4,000,000 1,500,000 Price per common share $35 $40 Marginal tax rate 35% 40% Debt beta 0.4 0.8 Equity beta 2.19 not available a. Calculate the NPV of the project using the weighted average cost of capital (WACC) approach. b. Confirm the NPV of the project you calculated in part a using the adjusted present value (APV) approach. Calculate how much debt and how much equity the company needs to issue in order to finance the project. d. Confirm the NPV of the project you calculated in part a using the flow-to-equity (FTE) approach. A company is considering a project that has an initial cost of $1.5 million and is expected to generate annual cash flows before taxes of $570,000 in perpetuity. The company is going to finance the project using external financing while maintaining its capital structure at its current target level. The company has undergone a restructuring recently and the only estimate of the company's equity beta is from the period prior to the restructuring. The T-bills return 3% annually and the annual expected return of the S&P 500 Index is 8%. The table below has further relevant information: Before the restructuring Today Bonds outstanding 50,000 90,000 Price per bond $1,200 $1,000 Common shares outstanding 4,000,000 1,500,000 Price per common share $35 $40 Marginal tax rate 35% 40% Debt beta 0.4 0.8 Equity beta 2.19 not available a. Calculate the NPV of the project using the weighted average cost of capital (WACC) approach. b. Confirm the NPV of the project you calculated in part a using the adjusted present value (APV) approach. Calculate how much debt and how much equity the company needs to issue in order to finance the project. d. Confirm the NPV of the project you calculated in part a using the flow-to-equity (FTE) approach