Question

A company is considering adding leverage to its capital structure. The company's managers believe they can add as much as $35 million in debt

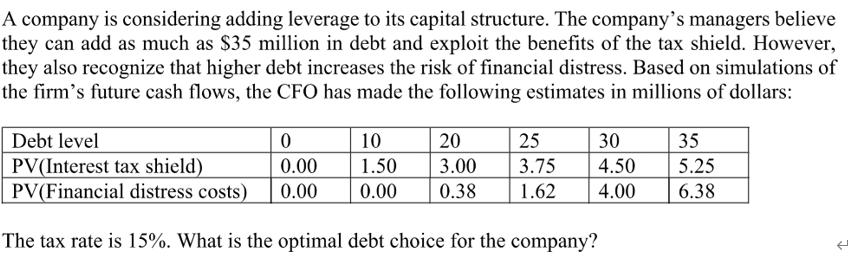

A company is considering adding leverage to its capital structure. The company's managers believe they can add as much as $35 million in debt and exploit the benefits of the tax shield. However, they also recognize that higher debt increases the risk of financial distress. Based on simulations of the firm's future cash flows, the CFO has made the following estimates in millions of dollars: Debt level 0 10 PV(Interest tax shield) 0.00 1.50 PV(Financial distress costs) 0.00 0.00 The tax rate is 15%. What is the optimal debt choice for the company? 20 3.00 0.38 25 30 3.75 4.50 1.62 4.00 35 5.25 6.38

Step by Step Solution

3.52 Rating (169 Votes )

There are 3 Steps involved in it

Step: 1

To determine the optimal debt level for the company we need to find the debt level that maximizes th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Operations Management Creating Value Along the Supply Chain

Authors: Roberta S. Russell, Bernard W. Taylor

7th Edition

9781118139523, 0470525908, 1118139526, 978-0470525906

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App